Senate Finance Begins To Explore Digital Assets Taxation; DOJ Unveils DEX Fraud Arrest

digital assets taxation

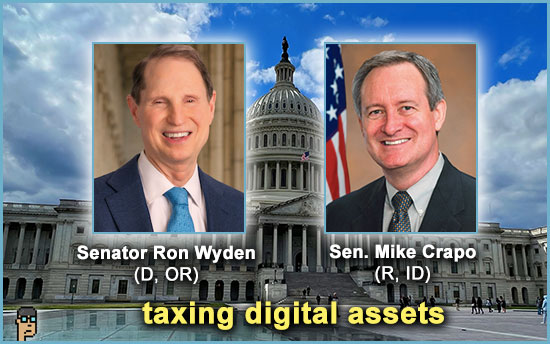

“In Letter to Stakeholders and Experts, Finance Leaders Seek Input to Address Uncertain Tax Treatment of Digital Assets” … so begins a press release from Senate Finance Committee Chairman Sen. Ron Wyden (D, OR) and Ranking Member Sen. Mike Crapo, (R, ID), who are attempting to address the need for proper taxation of digital assets beginning with feedback from the digital assets community and anyone else who cares to share. As evidenced by the detail of the release, this will be no small undertaking – just like most things in digital assets. Read it.

To breakdown where digital assets tax stands today, the Committee’s leaders asked the Joint Committee on Taxation (JCT) to compile a report on the taxation of digital assets – get the 24-page PDF here.

Jason Schwartz, a tax partner & digital assets co-head at law firm Fried-Frank, who also calls himself “Crypto Tax Guy,” quickly offered an analysis via a tweet thread examining each section of the Senators’ outline.

On wash sales, for example, Schwartz opined, “If you sell stock or bonds at a loss and buy back within 30 days, the tax loss is disallowed. The same rule doesn’t generally apply to crypto. Sound tax policy probably dictates that the wash sales apply to crypto in the same way they apply to stock & bonds.” Read the thread. Continue reading “Senate Finance Begins To Explore Digital Assets Taxation; DOJ Unveils DEX Fraud Arrest”

Republicans Request Prometheum Investigation; Bipartisan Support Grows?

Prometheum – investigation

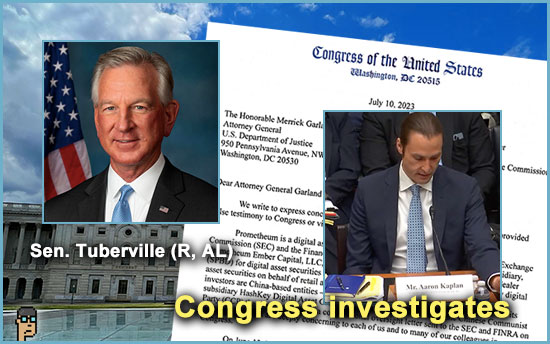

Senator Tommy Tuberville (R, AL) and 5 Republican members of the U.S. House of Representatives alleged yesterday that Prometheum co-founder and CEO Aaron Kaplan may have “provided false testimony” in front of a House Financial Services (HFS) Committee hearing on digital assets on June 13.

In a Congressional letter (see it here – PDF) addressed to U.S. Attorney General Merrick Garland and Securities and Exchange Commission (SEC) Chair Gary Gensler, the Congressional group asks for an investigation into whether or not a China-based investor named Shanghai Wangxiang Blockchain, Inc., was still supporting Prometheum well beyond the end of the 2019 time period Kaplan had suggested in written HFS testimony on June 13. “Wangxiang” as it is known is believed to have connections to the Chinese Communist Party (CCP). The Congressional Members point to Prometheum’s SEC filings which admit to Wangxiang’s continued involvement with the company’s platform beyond 2019.

CoinDesk notes that Wangxiang has a 20% stake in Prometheum today which Kaplan has admitted previously to the SEC.

FINRA, The FBI and the Director of National Intelligence are all cc’d on yesterday’s letter.

more tips:

(Opinion) U.S. Sen. Tommy Tuberville: It’s past time for the DOJ and the SEC to investigate Prometheum’s ties to China – 1819 News

Continue reading “Republicans Request Prometheum Investigation; Bipartisan Support Grows?”

Former SEC And CFTC Chairs On Digital Assets; How Big Is The Crypto Industry?

getting swallowed

In another story inspired by recent Bitcoin Spot ETF filings such as BlackRock’s, traditional finance is stepping up its interest in crypto. Matthew Sigel, a digital assets researcher at fund manager VanEck, tells The Washington Post, “Assets often move from weak hands to strong hands during bear markets. We think that’s what is happening in crypto. A lot of losses last year were taken by retail or immature players, and now here come the big boys” of traditional finance. Crypto pledged to dethrone Wall Street. It’s getting swallowed instead.” Read more.

Little hope is given to companies like Coinbase in the article.

former Chairs framework

In an op-ed on Friday hopefully titled, “A Path Forward for Regulating Crypto Markets,” former Republican Securities and Exchange Commission (SEC) Chair Jay Clayton, a Republican, and former Commodity Futures Trading Commission (CFTC) Chair Timothy Massad, a Democrat, combine forces to provide their own solution for a digital assets regulatory framework. Continue reading “Former SEC And CFTC Chairs On Digital Assets; How Big Is The Crypto Industry?”

Regulated Liability Network Meets Blockchain; July 19 Is HFS Markup For Crypto Bills

distributed ledger finance

A new report is out from a group of U.S. financial services companies – such as Citigroup Inc., HSBC, BNY Mellon and others regarding a “regulated liability network” (RLN) based on distributed ledger technology.

CoinDesk’s Jesse Hamilton distills the news, “Fitting somewhere in the middle of the debate between central bank digital currencies (CBDCs) and private stablecoins, the Federal Reserve Bank of New York’s New York Innovation Center (NYIC), which has collaborated on the project since last year, concluded that “the network has the potential to deliver improvements in the processing of wholesale payments due to its ability to synchronize U.S. dollar-denominated payments and facilitate settlement on a near-real time, 24 hours a day, 7 days a week basis.” Read more from CoinDesk.

more tips:

Regulated Liability Network U.S. Proof of Concept Findings – rlnuspoc.org

Research Study Examines Feasibility of Theoretical Payments System Designed to Facilitate and Settle Digital Asset Transactions – Federal Reserve Bank of New York Continue reading “Regulated Liability Network Meets Blockchain; July 19 Is HFS Markup For Crypto Bills”

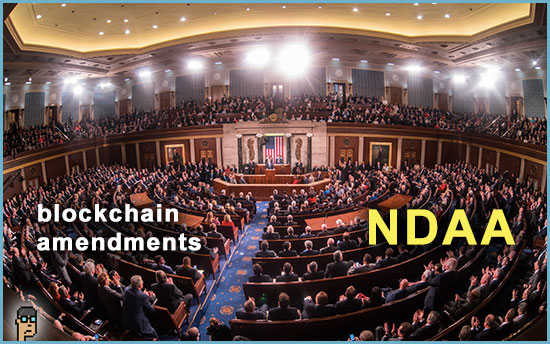

Blockchain Technology Makes NDAA Amendments; Cyber CODEL

cyber CODEL

According to Politico, the most recent Congressional recess provided an opportunity for a trip to Europe by a CODEL of the House’s Cybersecurity and Infrastructure Protection Subcommittee. Members who participated included Chair Andrew Garbarino (R, NY), Ranking Member Eric Swalwell (D, CA), Rep. Dave Joyce (R, OH) and Rep. Rob Menendez (D, NJ) who said that “there are definitely lessons to be learned” from cyber officials in the European Union. The Congressmen were tight-lipped on specifics, but told Politico: “One concept, in particular, that struck a chord with some of the lawmakers in their meeting with Estonia’s Secret Service was a proposal to provide the agency with additional authority to investigate crimes related to digital currency.” Read a bit more.

more tips:

The lore of CODELs – Politico Continue reading “Blockchain Technology Makes NDAA Amendments; Cyber CODEL”

Senate Banking Democrats Tout FedNow; Crypto Exchanges Attract Most Scrutiny

FedNow this month

FedNow, the Federal Reserve’s real-time payment system is expected to launch later this month. Last week, 57 companies were “certified as ready” for the new service with “41 financial institutions participating as senders, receivers and/or correspondents supporting settlement, 15 service providers processing on behalf of participants, and the U.S. Department of the Treasury.” Read the release.

The Democrats’ Senate Banking Committee Twitter account touted the FedNow news on Monday tweeting, “Our banking system is one step closer to real-time payments, which will help consumers and small businesses send and receive money instantly and safely. And the more banks that sign on, the more Americans that will have access to instant payments.”

Meanwhile, back in April, the Federal Reserve was already trying to debunk the idea that FedNow will replace cash and/or provide an on-ramp to a Central Bank Digital Currency (CBDC). See “Is FedNow replacing cash? Is it a central bank digital currency?”

And in early June, Bitwise crypto research analyst Ryan Rasmussen explained to Blockworks 5 important ways that stablecoins remain relevant in spite of FedNow’s launch of an always-on payment service including stablecoins’ global reach. Read them all. Continue reading “Senate Banking Democrats Tout FedNow; Crypto Exchanges Attract Most Scrutiny”

Bitcoin ETFs Boomerang Refilings; OTC Framework For Tokens?

Bitcoin ETF – refilings

On Friday, the Securities and Exchange Commission (SEC) informed NASDAQ and Cboe that their applications were “inadequate” due to a dearth of information on their surveillance sharing arrangements for a Bitcoin Spot ETF. The Wall Street Journal reported that the two firms “filed the applications on behalf of asset managers including BlackRock and Fidelity Investments.” Read it. ”

By late Friday, at least 5 companies total had refiled (see Cboe’s filing) with the SEC given the reported guidance by the agency earlier in the day, according to Bloomberg. Also, amended to each of the filings was “that Coinbase Global Inc. will provide market surveillance in support of” each of the funds. Read more in Bloomberg.

SEC, your serve.

Bitcoin ETF – McHenry

When the news on the SEC rejection of the Bitcoin Spot ETF applications on Friday, House Financial Services (HFS) Committee Chair Patrick McHenry (R, NC) didn’t take it well. He tweeted, “If these reports are accurate, [Gary Gensler] has a lot of explaining to do. An ETF would provide everyday investors with an SEC-regulated product. The only reason for Chair Gensler to oppose is if he wants to kill crypto in the U.S. all together.” See the tweet. Continue reading “Bitcoin ETFs Boomerang Refilings; OTC Framework For Tokens?”