Will artificial intelligence someday solve our legislation and regulatory roadblocks? “ChatGPT, can you please make the perfect legislation? -or create the perfect regulatory approach in the United States?”

blockchain tipsheet decided to take artificial intelligence (AI) chatbot ChatGPT for a spin and asked four questions today:

What are 100 use cases for blockchain technology?

What regulation is needed for digital assets in the United States that can be passed quickly?

Who is the most effective, current commissioner of the CFTC or SEC?

The answers may not have been perfect – there is a repetition on “insurance” and “loyalty”-related use cases, for example – but ChatGPT is thought-provoking at a minimum, articulate, unwilling to share opinion and sometimes wrong.

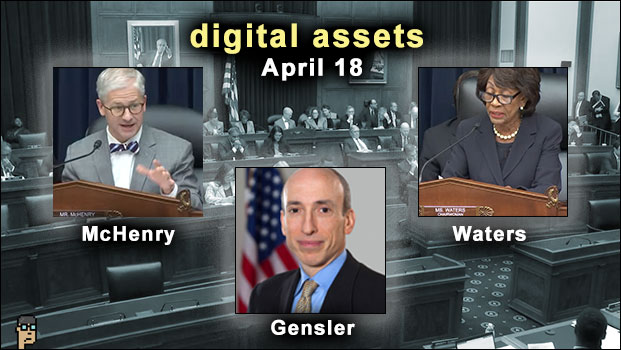

The second question about legislation and “passed quickly” attempts to press ChatGPT to apply some critical thinking around the complexity of getting legislation passed by both houses of Congress, let alone the President’s signature. ChatGPT seems to be unaware of the very latest legislation – such as coming stablecoin legislation from Rep. Patrick McHenry (R, NC) and Rep. Maxine Waters (D, CA) – by mentioning a rarely-discussed bill from 2021… or is it trying to tell us something?

Let’s begin:

blockchain tipsheet: What are 100 use cases for blockchain technology?

ChatGPT: There are numerous use cases for blockchain technology across various industries, here are 100 examples:

1. Digital Identity Management

2. Voting Systems

3. Supply Chain Management

4. Gaming

5. Copyright Protection

6. Real Estate Management

7. Health Records Management

8. Personal Data Management

9. Digital Asset Management

10. Social Networking

11. Smart Contracts

12. Crowdfunding

13. Insurance Claims Processing

14. Tax Compliance

15. Energy Trading

16. Charity Fundraising

17. Online Payments and Remittances Continue reading “ChatGPT Q&A: 100 Use Cases for Blockchain, U.S. Digital Assets Legislation, Most Effective Regulator and More”