Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

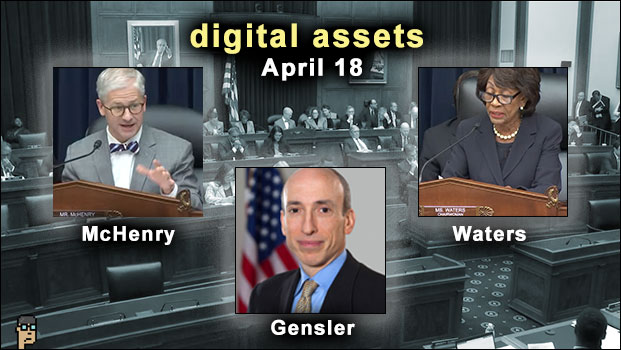

McHenry – SEC hearing

House Financial Services Committee Chair Rep. Patrick McHenry (R, NC) announced that a Securities and Exchange Commission (SEC) oversight hearing with Chair Gary Gensler will take place on April 18 and digital assets will be a key focus of the hearing. Read a bit more on Politico.

Tip: April 18 is also the same day that the EU will be hosting final discussion in European Parliament on its Markets in Crypto-Assets regulation. The final vote on MiCA should be the next day.

McHenry – House Ag’s Thompson

Speaking to Punchbowl News yesterday in Washington, DC, Chair McHenry said that he has “come to terms with the political reality that we’re not going to create a new regulator” and, furthermore, he’s “spent the last couple of months working out a set of principles” with House Agriculture Committee Chair Glenn “GT” Thompson (R, PA) on a digital assets approach:

-

- “That means you have a securities regime and a commodities regimes, and then we have potentially an ‘other,’ which means you raise capital through an existing securities regime methodology, which we have to legislate. Then, once an asset becomes effectively a commodity, it would then switch out of that jurisdiction into the commodities jurisdiction. And so we’ve worked this thing out… (market structure)”

McHenry – stablecoins

Chair McHenry saw light at the end of the tunnel for stablecoins – echoing Ranking Member Rep. Maxine Waters (D, CA) comments two weeks ago – and a timetable:

-

- “On stablecoins, [Ranking Member Waters] and I had very healthy conversations about this. We have the broad frame of how to approach stablecoin legislation… The specifics of that were the dividing points for our two conferences. House Republicans and House Democrats were in different spots on a lot of the specifics. But, the general architecture, we have, and so we will move forward with both those pieces of legislation, market structure and stablecoins, and I hope to do this before it gets miserably hot here in DC.”

speaking of digital assets – CFTC

Digital assets was featured in Commodity Futures and Trading Commission (CFTC) Chair Rostin Behnam‘s prepared testimony in front of House Appropriations regarding his agency’s 2024 budget request.

Behnam stated: “The CFTC has risen to the challenges brought on by the burgeoning digital asset market by ensuring that the markets and market participants acting within its jurisdiction comply with their statutory and regulatory requirements. The CFTC does not have direct statutory authority to comprehensively regulate cash digital commodity markets. Its jurisdiction is limited to its fraud and manipulation enforcement authority. In the absence of direct regulatory and surveillance authority for digital commodities in an underlying cash market, our enforcement authority is by definition reactionary.”

Blockchain Association’s Ron Hammond tweeted about yesterday’s CFTC Appropriations Hearing and noted two new congressional voices expressing interest in digital assets: “[Rep. Ben Cline (R, VA)] asked a question in regards to Ethereum as a commodity, which Benham again reaffirmed as such. [Rep. Lauren Underwood (D, IL)] focused on consumer protection and fostering generational wealth.”

speaking of digital assets – pivotal months

In a detailed thread (read it), BA’s Hammond takes a broad look at next steps for the blockchain industry in Washington D.C. He sees bipartisan interest in digital assets legislation in Congress, but there are plenty of challenges. Still, he remains sanguine, “This is why we expect April/May/June to be pivotal. There are several oversight hearings planned, legislation in the works, and court decisions which can even the playing field. In a split Congress anything is hard to accomplish but there is a strong coalition ready to fight.”

Among the challenges is the decrease in the percentage of blockchain developers from the United States says Hammond who cites data collected from GitHub by crypto venture capital firm Electric Capital: “The U.S. has lost its lead in blockchain developers & has gone from 40% to 29% market share of open source devs.”

-

- U.S. Share of Blockchain Developers is Shrinking – March 2023 (PDF) – Electric Capital

anti-CBDC state

Echoing concerns of Capitol Hill Republicans such as Sen. Mike Lee (R, UT) and Majority Whip Rep. Tom Emmer (R, MN), South Dakota Governor Kristi Noem (R) turned down the opportunity to sign into state law a new cryptocurrency bill due to a provision she saw as a loophole for a future central bank digital currency (CBDC). According to Blockworks, Noem said, “I believe it’s to pave a way for the federal government to control our currency, and thus control people. (…) It should be alarming to people and it’s being sold as a UCC guidelines update.” Read more.

Tips:

-

- SD House Bill 1193: “An Act to amend provisions of the Uniform Commercial Code“

- The Uniform Commercial Code and Digital Assets: What You Need to Know – Orrick

restricting crypto

Crypto policy think tank CoinCenter has concerns about the new RESTRICT Act from Senator Mark Warner (D, VA) and Senator John Thune (R, SD) – although the Act targets foreign adversaries and companies like TikTok, it could hurt cryptocurrencies like Bitcoin says CoinCenter.

From its advocacy blog, “While the primary purpose of the Act is to address national security concerns, its potential implications for the cryptocurrency space cannot be ignored. The differences between the RESTRICT Act and IEEPA, coupled with the potential constitutional issues, warrant close scrutiny and a cautious approach to ensure that the legislation does not result in unintended consequences for the cryptocurrency ecosystem and Americans’ access to innovative technologies.” Read more.

Tips:

-

- S.686 – RESTRICT Act – Congress.gov

- SWIFT › Cryptocurrency › International Emergency Economic Powers Act (IEEPA) – JD Supra

crypto asset exclusion

At a Bank of International Settlements event, Pablo Hernández de Cos, chair of the Basel Committee on Banking Supervision, said that under new international crypto rules to be implemented by banks in January 2025, holding Bitcoin will be problematic.

Nevertheless, de Cos says, “Since we know that is market is evolving, what we will be doing with this standard is to focus on certain elements that might be particularly exposed to changes in the market. (…) We should be prepared to modify the standard if needed, to try to cover the potential endogenous response of the market.” Read more on CoinDesk.

more tips

-

- NFT: Plans for Royal Mint produced token dropped – BBC

- Restaking protocol EigenLayer closes $50 million raise – The Block

- Disney Eliminates Its 50-person Metaverse Division as Part of Company Layoff Plan – The Wall Street Journal

- Sam Bankman-Fried sought to bribe Chinese officials in an effort to unfreeze accounts belonging to his hedge fund, Alameda Research – CNN

- North Korea Is Now Mining Crypto to Launder Its Stolen Loot (subscription) – Wired

If you would like this delivered as a newsletter, please sign up here.