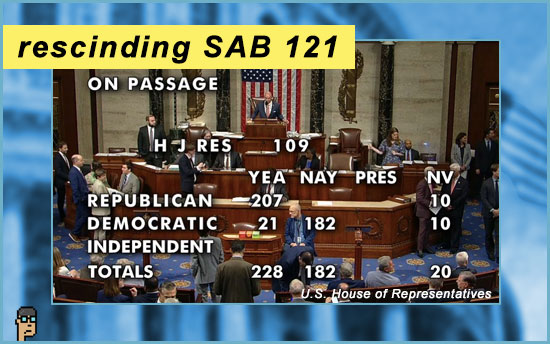

SAB 121 resolution – passage

H.J.Res 109, which rescinds the Securities and Exchange Commission’s (SEC) Staff Accounting Bulletin 121 – a “guidance” preventing regulated banks from providing crypto custody – was easily passed in the House yesterday by voice vote.

Given the Republican majority, the result was not surprising.

In the wake of the voice vote, House Financial Services (HFS) Chair Patrick McHenry (R, NC) asked for a roll call vote likely seeking to shed light on support across the aisle.

Minority Whip Katherine Clark (D, MA) told House Dems to vote “No” on the resolution.

But just as the roll call vote was to begin, Rep. Marjorie Taylor Greene (MTG) disrupted the floor proceedings with a motion to remove Rep. Mike Johnson (R, LA) as speaker.

After MTG‘s motion was tabled (killed), voting began on H.J.R.109 – Members had only 5 minutes in which to submit their preference.

Final vote was 228-182 to support the resolution to repeal SAB 121.

Visit the Clerk’s website for the complete tally.

21 Democrats voted for the resolution – prior to the vote, only three HFS Democratic members (Nickel/Gottheimer/Torres) had been known to support the resolution.

This was a win for Chair McHenry. (He celebrated.)

It was also a win for Reps. Flood and Nickel, the resolution’s sponsor and co-sponsor, respectively.

The other big news may have been President Joseph Biden‘s statement on the resolution which made clear where his Administration stands on digital assets. More below… Continue reading “House Votes To Rescind SEC Rule On Crypto Custody; President Biden Threatens Veto”