stablecoin bill – FAA

The McHenry/Waters stablecoin bill will probably not be added to the FAA Reauthorization according to a CoinDesk report yesterday afternoon.

CoinDesk’s Jesse Hamilton wrote, “A Democratic aide familiar with the negotiation said House and Senate leaders are insisting on a clean FAA reauthorization that wouldn’t allow the attachment of a stablecoin bill.”

Later yesterday, Senate Banking Chair Sherrod Brown (D, OH) was apparently not giving up hope on getting “stablecoin + cannabis” into the FAA Reauthorization according to Politico’s Eleanor Mueller. Mueller also reports that New York Department of Financial Services Superintendent Adrienne Harris had been encouraging Majority Leader Chuck Schumer (D, NY) to move forward with the stablecoin bill. Read more (subscription). Dual banking rights, for the win?

what you should know: Whenever the stablecoin bill eventually passes, assuming it does, Harris’s support seems to indicate that she’s getting dual banking rights for her state agency which she has advocated for in the past. That’s big – that’s reportedly been the major sticking point between McHenry, Waters and the White House.

McHenry: Gensler misled

HFS Chair Patrick McHenry publicly addressed on X yesterday the idea that Securities and Exchange Commission (SEC) Chair Gary Gensler may have misled Congress with his responses in March 2023 SEC oversight hearing where he avoided saying his agency had classified the Ethereum network token as a security five days prior.

This latest revelation came to light in the past week courtesy of a court filing by blockchain technology firm Consensys in its lawsuit against the regulator.

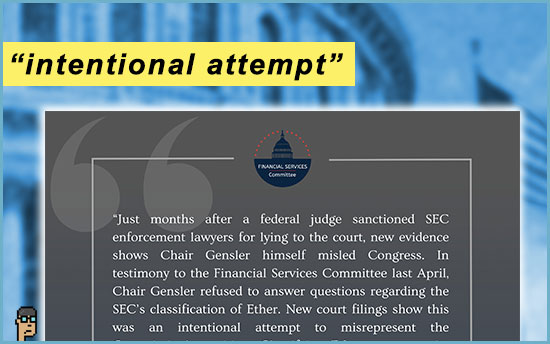

McHenry: statement

McHenry said in a statement yesterday on the ETH-as-a-security revelation: “Just months after a federal judge sanctioned SEC enforcement lawyers for lying to the court, new evidence shows Chair Gensler himself misled Congress. In testimony to the Financial Services Committee last April, Chair Gensler refused to answer questions regarding the SEC’s classification of Ether. New court filings show this was an intentional attempt to misrepresent the Commission’s position.”

He continued, “Classifying Ether as a security contradicts previous statements of the SEC and Chair Gensler-yet another example of the arbitrary and capricious nature of the agency’s regulation by enforcement approach to digital assets. This episode underscores the urgency of Congress passing the bipartisan FIT for the 21st Century Act to provide a clear regulatory framework and robust consumer protections for digital asset markets. Committee Republicans will continue to hold Gary Gensler’s SEC accountable for its regulatory overreach that is stifling innovation, leaving American consumers unprotected, and risking our national security.”

McHenry: FIT 21

what you should know: Chair McHenry is still hunting for a way forward for FIT 21 [H.R.4763]. Was Chair Gensler’s overstep/misstatement (when grouped with others such as the DEBTbox lawyer “abuse of power” fiasco) enough to inch FIT 21 forward as part of a negotiation?

Passage of FIT 21 – or legislation like it – still seems like a huge reach in the 118th Congress given the Democrat-controlled Senate and the White House’s anti-crypto stance. Previous push back by Senators such as Senate Banking Chair Sherrod Brown has typified Democratic leadership’s thinking. Brown said last November he won’t support an “industry bill” -and that’s even though Brown has recently started sounding like a member of the Problem Solvers Caucus.

elections and crypto

[Republican Congressional candidate Mike Speedy] Urges Smaller Gov’t, Better System For Crypto In Campaign For Congress – WIBC, Indianapolis

hear ye, hear ye

The House Financial Services Committee announced a Capital Markets Subcommittee Hearing titled, “SEC Enforcement: Balancing Deterrence with Due Process” for next Tuesday morning, May 7, in Rayburn. Chair Ann Wagner (R, MO) will lead the hearing. See the press release.

what you should know: It’s not a digital assets subcommittee hearing per se, but this one seems ripe for digital assets discussion. Not only are there a myriad of lawsuits between industry and the SEC, the DEBT Box fiasco and now sanctioned overreach by SEC lawyers will probably be raised by the subcommittee’s Republicans. And then there’s the securities designation of Ether by the SEC in in early 2023 which was divulged only this week. Can’t abide by the rules if no one knows the rules.

new crypto tax bill

Reps. Drew Ferguson (R, GA) and Wiley Nickel (D, NC) announced a new bipartisan bill dealing with tax treatment clarity for crypto mining and staking. Rep. Ferguson said on X yesterday, “Proud to introduce the bipartisan ‘Providing Tax Clarity for Digital Assets Act’ with [Rep. Wiley Nickel] to clarify within the tax code that digital asset rewards are to be collected at the point of sale, while codifying staking rewards as ‘created property.'”

The press release from Rep. Ferguson’s office explains, “… H.R. 8149, the Providing Tax Clarity for Digital Assets Act, a bipartisan bill that would clarify within the tax code that digital asset rewards be collected at the point of sale and codifies staking rewards as created property. The bill also explicitly prevents any future situations of double taxation and provides long awaited clarity for the digital asset industry, ultimately encouraging more companies to stay in the United States and increasing the U.S. revenue base.”

Read the release. And, see the discussion draft of H.R.8149

more tips:

-

- “New Legislation Proposes Clear Tax Guidelines for Crypto Block Rewards” – Landon Zinda of Coin Center analyzes the bill

what you should know: This is a bipartisan policy “marriage” of House Ways and Means (Ferguson) and House Financial Services (Nickel). Though not identified in the discussion draft, the bill would seem to be logically referred to Ways and Means for next steps.

tokenization

Tokyo subsidizes digital securities issuance costs – Ledger Insights

BlackRock’s USD Institutional Digital Liquidity (BUIDL) Fund hits $375 million AUM – The Block

CZ sentenced

Even as He Faces Prison Time, Binance’s Founder Plans a Comeback – The New York Times

Ex-Binance CEO Changpeng Zhao sentenced to four months in prison – Cointelegraph

CZ sentenced – reaction

In an op-ed in The Hill in January, Duke law professor Lee Reiners – a past witness at Senate Banking and House Financial Services hearings and an advocate of the Securities and Exchange Commission (SEC) – decried the settlement with cryptocurrency platform Binance and its CEO and founder Changpeng “CZ” Zhao. Read the January opinion piece.

Yesterday, Mr. Reiners wasn’t pulling any punches on X saying, “Today’s sentence for [CZ] confirmed what I wrote in January – Binance got away with a slap-on-the-wrist. Thus concludes DoJ’s post-SBF victory lap.”

still more tips

“TL;DR: Starting today, Coinbase is rolling out support for the Lightning Network enabling instant, low-cost bitcoin transfers” – Coinbase

RWA.xyz on X yesterday, “Announcing the Stablecoins Dashboard: Today we’re launching the most comprehensive view into crypto’s biggest real world use case.” See the dashboard on rwa.xyz

DOJ charges Roger Ver with tax fraud – Blockworks