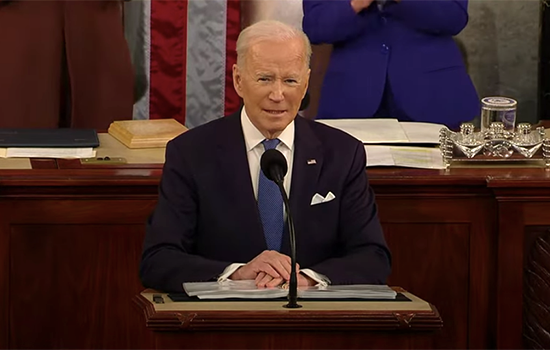

In today’s executive order delivered from the White House, U.S. President Joseph Biden revealed his government’s near-term plans for harnessing the world of cryptocurrency with its estimable culture of innovation and increasing need for a regulatory framework within the United States.

Though protecting the consumer and business remains front and center, the United States appears to be obliquely embracing the idea that in order to remain the leader of the free world, it must keep pace with technology – and the blockchain industry, specifically.

Biden’s order begins:

“By the authority vested in me as President by the Constitution and the laws of the United States of America, it is hereby ordered as follows:

Section 1. Policy. Advances in digital and distributed ledger technology for financial services have led to dramatic growth in markets for digital assets, with profound implications for the protection of consumers, investors, and businesses, including data privacy and security…”

Read the full order on the White House website here.

In a coordinated effort, other members of Biden’s cabinet chimed in shortly after release of the order including Secretary of State Antony Blinken who identified one of the blockchain industry’s key talking points – that the United States is in jeopardy of falling behind as the World’s leader in innovation.

Today’s digital assets Executive Order reinforces our support for responsible financial innovation. The technology underpinning new forms of payments and capital flows in the international financial system can benefit consumers and businesses if deployed correctly.

— Secretary Antony Blinken (@SecBlinken) March 9, 2022

At the SEC, Commissioner Gary Gensler offered a brief statement on Twitter and echoed the Commission’s role in markets beginning with protecting investors…

Over the years, our disclosure regime has evolved to reflect evolving risks & investor needs. I think companies & investors alike would benefit if info about how issuers are managing growing cybersecurity risks were required in a consistent, comparable, & decision-useful manner.

— Gary Gensler (@GaryGensler) March 9, 2022

On the other side of the aisle, Republican congressman Patrick McHenry, who has been a crypto bull for a while, offered a tweet with urgency.

It's critical we recognize the benefits and opportunities #DigitalAssets provide.

Biden must work with Congress—specifically the House Financial Services Committee—to find bipartisan solutions to help this growing industry flourish here in the U.S. https://t.co/sXjjB0VUnb

— Patrick McHenry (@PatrickMcHenry) March 9, 2022

Meanwhile, over at the Consumer Financial Protection Bureau Director Rohit Chopra said in a brief release:

“Today’s Executive Order recognizes that the dramatic growth in digital asset markets has created profound implications for financial stability, consumer protection, national security, and energy demand. The Consumer Financial Protection Bureau is committed to working to promote competition and innovation, while also reducing the risks that digital assets could pose to our safety and security. We must make sure Americans in all financial markets are protected against errors, theft, or fraud.”

Blockchain Association head of policy Jake Chervinsky offered several quick takes on Twitter (1, 2, 3) and made note of taxation and crypto:

One feature of the EO that I can't figure out: it doesn't mention tax policy once. That's pretty weird given how many tax issues are unresolved.

Maybe the thinking is Treasury doesn't need to study taxation b/c the infrastructure bill already handled it? That would be a mistake.

— Jake Chervinsky (@jchervinsky) March 9, 2022

The full court press from the Biden administration also included U.S. Treasury Secretary Janet Yellen who had a release of her own. Yellen called out some of her department’s previous work on stablecoins:

“This work will complement ongoing efforts by Treasury. Already, the Department has worked with the President’s Working Group on Financial Markets, the FDIC, and OCC to study one particular kind of digital asset – stablecoins– and to make recommendations. Under the executive order, Treasury and interagency partners will build upon the recently published National Risk Assessments, which identify key illicit financing risks associated with digital assets.”

Get more:

-

- FACT SHEET: President Biden to Sign Executive Order on Ensuring Responsible Development of Digital Assets – WhiteHouse.gov

- Background Press Call by Senior Administration Officials on the President’s New Digital Assets Executive Order – WhiteHouse.gov

- Bitcoin Price Surges on Biden’s Crypto Executive Order – The Wall Street Journal

- Biden’s Executive Order on Digital Assets Splits Crypto Industry and Bitcoin Idealists – Decrypt

- Biden Issues Long-Awaited US Executive Order on Crypto – CoinDesk

- White House issues executive order on regulating cryptocurrencies – Axios

- Executive Order on Digital Asset Innovation – Blockchain Association blog