The “Accountability for Cryptocurrency in El Salvador Act” or “ACES Act” (S.3666) took another step forward this month as the Congressional Budget Office reported its estimation of costs to fulfill the Act.

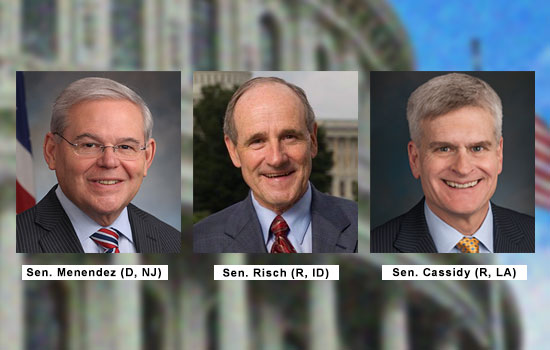

The bi-partisan legislation is sponsored by Senator Jim Risch (R, ID) and co-sponsored by Senator Bill Cassidy (R, LA) and Robert Menendez (D, NJ) as part of their efforts on the Senate Foreign Relations committee.

As Protocol notes, the Senators position this as a study to make sure the US financial system is not impacted negatively by El Salvador’s cryptocurrency experiment. A glass-half-full opportunity of this legislation could be to understand benefits accrued to the tiny Central American nation by its adoption of bitcoin as a legal currency. But, there’s no mention of that angle.

Published on the CBO site today, the details and costs are summarized:

“In 2021, El Salvador officially adopted a cryptocurrency as legal tender. S. 3666 would require the Department of State to report to the Congress on the details and ramifications of that action. The bill also would require the department to devise, implement, and report to the Congress on a plan to mitigate any potential risk to the U.S. financial system from El Salvador’s action and similar actions by other countries.

On the basis of information about the costs to prepare similar reports, CBO estimates that satisfying that requirement would cost less than $500,000 over the 2022-2026 period. Such spending would be subject to the availability of appropriated funds.”

That’s about 13 Bitcoin at today’s prices -seems like enough for either a few analysts or Walter Isaacson on his own.

Update: On April 29, 2022, Congressional Research Service released “El Salvador: In Brief” and noted the Bitcoin adoption process:

“In September 2021, El Salvador’s National Assembly enacted a [President Nayib] Bukele-backed initiative to adopt Bitcoin as a form of legal tender, a move the IMF had warned could expose the economy to money laundering and high crypto-asset price volatility.

To encourage its adoption, the government established a $150 million trust fund to allow any Salvadoran citizen or firm to exchange Bitcoin for U.S. dollars without cost; the trust fund subsidized the transaction and exchange rate costs. The Bukele government reportedly hopes designating Bitcoin as a national currency will reduce transfer fees for remittances, foster financial inclusion, increase investment from international crypto-asset investors, and decrease dependence on U.S. monetary policy. Bukele may seek to use the crypto-asset as an alternative avenue for investment, given El Salvador’s increasingly strained relations with the United States and international financial institutions. In November 2021, the IMF urged the government to stop using Bitcoin; Bukele rejected that recommendation.”