Spinning out of the Labor Day holiday, U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler unleashed a public relations blitz about cryptocurrency and its regulation.

His position mostly reinforced what the Chair has said before: crypto companies should “come in” and connect with the SEC to ensure regulatory compliance, the Howey Test is the unquestionable arbiter of all things securities-related and Bitcoin is a commodity.

Putting his many appearances together such as SEC Speaks 2022, The Wall Street Journal and CoinDesk, Chair Gensler appears either increasingly defiant or defensive in relation to the crypto hordes depending on your point-of-view.

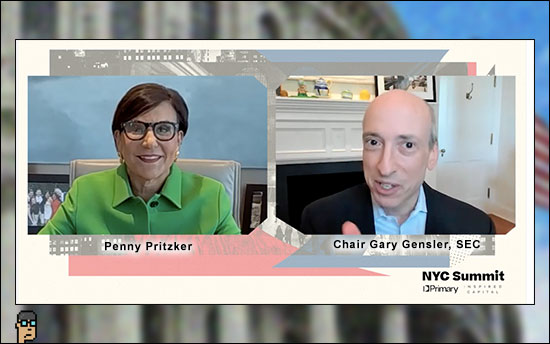

The least publicized of his media appearances on Wednesday was his 10-minute taped interview (see the video) with former Commerce Secretary Penny Pritzker for NYC Summit. Ms. Pritzker’s firm Inspired Capital co-hosted the New York City entrepreneurial ecosystem event along with Primary Capital.

Gensler’s role as head of the CFTC (2009-2014) overlapped six months with Pritzker’s Commerce Secretary role (2013-2017) during the Obama administration.

Interview highlights

Among the questions, Ms. Pritzker inquired about “Bitcoin or other cryptocurrencies” and how the Chair saw them evolving from a regulatory standpoint. Chair Gensler avoided mentioning any cryptocurrency by name other than Bitcoin:

(lightly edited for clarity)

“This is a bit of innovation that came along, whomever Satoshi Nakamoto, whoever she was, or he, this innovation. And the investing public got interested – certainly by five, six years ago – got pretty interested. I think that it’s similar to what I said earlier. I think the investing public benefits from disclosures, understanding what a group of entrepreneurs might be doing, and, frankly, that most of the tokens and there’s five or 10,000 tokens to buy most of the tokens have a group of entrepreneurs and the public is trying to invest in those projects and get a better future. Well, those are the attributes of a security. And those are things that the SEC does well. I’ve said come in, talk to us, help get the the intermediaries registered, the crypto exchanges, the crypto lending platforms, the crypto broker dealers, registered we can use exemptive authority to to where we can to tailor this but also the disclosures around the tokens.”

Continue reading “Defiant or Defensive, SEC Chair Gensler Unleashes PR Blitz On Crypto”