Who says Washington is hopelessly divided along partisan lines?

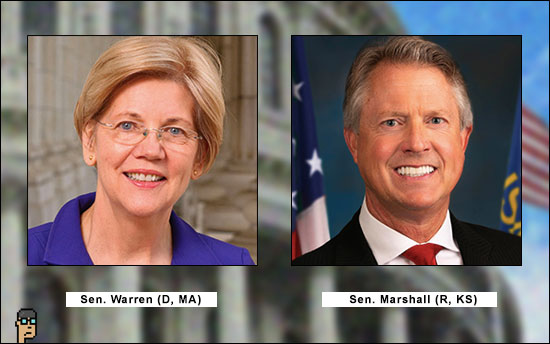

Yesterday, Senators Elizabeth Warren (D, MA) and Roger Marshall (R, KS) co-sponsored a new bill requiring US Treasury’s FinCEN – Financial Crimes Enforcement Network – to further interwine the requirements of Anti-Money Laundering (AML) and Know-Your-Customer (KYC) rules within digital assets.

Titled “Digital Asset Anti-Money Laundering Act of 2022,” the legislation appears, in part, to build on actions taken by the U.S. Treasury with mixing service Tornado Cash back in August.

Industry advocate CoinCenter responded unequivocally to the bill’s introduction:

“[The bill] is the most direct attack on the personal freedom and privacy of cryptocurrency users and developers we’ve yet seen. It would force anyone who helps maintain public blockchain infrastructure, either through software development or validating transactions on the network, to register as a Financial Institution (FI).”

The bill would also likely inhibit the growth of the crypto sector due to additional costs associated with cumbersome financial institution compliance requirements.

Bipartisan

Senators Warren and Marshall’s partnership took a page from Capitol Hill’s bipartisan crypto supporters by reaching across the aisle in hopes of driving passage. RFIA, DCCPA, DCEA and many other crypto bills have bipartisan support including the stablecoin bill which is being developed in the House Financial Services Committee.

Marshall’s break is notable in that Republican libertarian views have appeared to mesh well with crypto which promotes self-custody and autonomy even as Republicans support the development of new regulatory guardrails.

Looking ahead to how the House could take action with a similar bipartisan bill, no Republican sponsor immediately to mind. But, it’s hard to say what’s bubbling these days in the minds of legislators after FTX and Sam-Bankman-Fried’s ugly demise humiliated many in DC.

On the House Democratic side – as witnessed by the House Financial Services Committee’s hearing on FTX on Tuesday – there would appear to be many possible sponsors such as Brad Sherman (D, CA) or Rep. Rashida Tlaib (D, MN) who described crypto as “bullsh*t.”

With little time left for this session of Congress, the bill would appear to require re-introduction in the next Congress to be considered for passage. But, given the blow up of FTX, there was no time like the present in the eyes of Senators Warren and Marshall to promote more restrictions for digital assets with the glare of unfavorable light, i.e. criminality.

Define it

One of the ongoing effects of bills being introduced in Congress is the growing digital asset dictionary. The bill includes a series of definitions for “digital kiosk” (ATM), “digital asset mixer,” “privacy coin,” “financial institution,” and begins with digital assets:

“The term ‘digital asset’ means an asset that is issued or transferred using distributed ledger, blockchain technology, or similar technology, including but not limited to virtual currencies, coins, and tokens.”

At yesterday’s Senate Banking hearing which looked at the collapse of cryptocurrency exchange FTX, Senator Warren teed up the need for the bill enhanced KYC rules for crypto.

A press release from Senator Warren’s office provided a snippet from the Senator who pulled no punches yesterday, “A lot of crypto firms are not doing these kinds of checks – so crypto has become the preferred tool for terrorists, for ransomware gangs, for drug dealers, and for rogue states that want to launder funds.”

Tax professional may be happy with some of the bill, too, given reporting requirement provisions:

“The Financial Crimes Enforcement Network shall promulgate a rule that requires United States persons engaged in a transaction with a value greater than $10,000 in digital assets through 1 or more accounts outside of the United States to file a report…”

Toward the end of the bill, one provision requires the Drug Enforcement Agency to participate: “The Drug Enforcement Administration shall issue a report identifying recommendations to reduce drug trafficking with digital asset kiosks.” In other words, ATM’s that have been set up to offer digital assets such as Bitcoin, Ethereum, Litcoin and so on will be under the DEA’s purview.

The breadth of U.S. government agency oversight continues to grow apace as evidenced by the Act.