Mark Elenowitz, an entrepreneur and self-described Wall Street veteran with a resume to back it up, produced one of the few regulatory-related presentations at NFT.NYC last Thursday.

Titled “Innovation And Regulatory Challenges in Digital Securities and NFTs,” not only did Elenowitz provide guidance, but pointed out that certain holders and purveyors of NFTs today may be headed for a meeting with the Internal Revenue Service (IRS) or an enforcement action by the Securities and Exchange Commission (SEC) in the future.

The success of Elenowitz’s own business(es) appears to be partially banking on the fact that compliance is no easy task in the current, wider NFT marketplace. He just launched Upstream, a Seychelles-based MERJ exchange powered by another one of his company’s, a FINRA compliance vendor called Horizon.

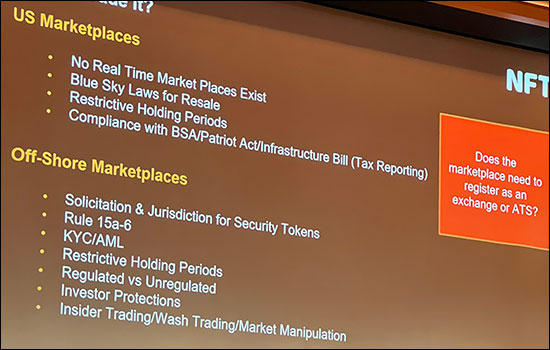

Upstream seeks to offer access to “IPOs, NFTs, celebrity ventures” according to its website. For example, given the challenges around securities regulations like those in the United States and certain NFT models, his exchange recently provided the ability to “geo-fence” an offering. This solution speaks to increasing wariness of regulators in the U.S. by market participants as well as the need for an easier and less costly way to be a security token.

(Upstream Exchange blog: “Music and film using NFTs to drive the future of fan engagement”)

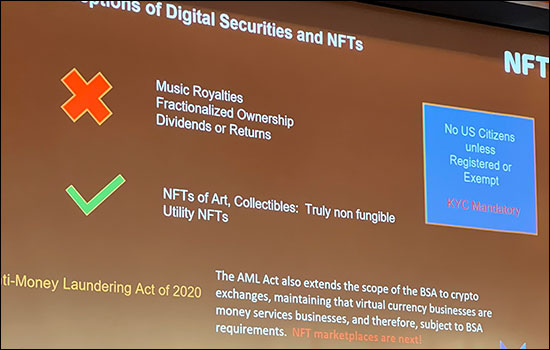

Notably, there was no talk about whether NFTs should be under SEC or CFTC jurisdiction. In fact, Elenowitz believes many of today’s NFT projects fall under the securities designation unless they are a collectible only or non-fungible utility.

“We are in a regulated world in the US. Securities that are sold in the US either have to be registered or exempt. (The ABA explains more here.) And what that means in plain English is a registered security or what you think of as an IPO – something that goes through the SEC which does a full review,” explained Elenowitz.

Many NFT buyers and sellers may be in the registered securities market whether they know it or not, but Elenowitz also pointed to several options as a result of the pre-NFT Jobs Act in 2015 where Reg A – or exempt – securities were enabled to trade on the New York Stock Exchange and NASDAQ for the first time.

Three such exemptions:

-

- Reg D 506, Private Placement – “The problem is you have to be accredited by the other law firms and have securities restricted for 12 months. You can’t trade – so that doesn’t really work for the NFT world.”

- Reg CF, Crowdfunding – “We can now raise up to $5 million from non-accredited investors. Unlike the first exemption, they’ve got $1 million net worth or a $300,000 trading account.” Elenowitz claimed challenges here, too.

- Reg A+ – “This is the best because you can sell it directly on your website or through your app, and it allows for non-accredited investors across all 50 states without what’s called ‘Blue Sky.’ It allows you to raise up to $75 million, too. The beauty is that those shares are eligible to be sold or traded afterwards, although there are secondary trading rules that come with that. The only downside is you actually have to file with the SEC. And that process can take anywhere from 90 to 120 days -perhaps much longer because the SEC is still trying to understand how to regulate and monitor this. But the main thing – and this is the most important – you must KYC (Know Your Customer) and have Bank Secrecy Act and Patriot Act compliance. And then there’s taxes and issuing 1099s.”

One of the biggest NFT misconceptions which Elenowitz has heard is around music NFTs in the U.S. and expectations on how NFTs may enable easy access to royalties to the creator and investors -especially without proper KYC and adherence to securities regulations. If you think those music NFTs with royalties are not a security, you’re wrong, he explained.

In closing, he cautioned, “Unfortunately, we’re going to see more and more enforcement actions as regulators here in the U.S. take notice. [Their key motivation] is to make a splash to deter others. (…) Unfortunately, the reality is we cannot use the ‘technology replacement’ position or ‘technology enhancing doctrine.’ There’s a way to do it in a compliant manner so make sure you talk to your tax advisor and legal counsel. Americans really need to tread carefully.”