Stablecoin legislation is on the minds of DC policymakers this fall as it remains among the lowest of the low-hanging legislative initiatives in crypto which could ultimately result in a law.

Given the widespread agreement on its need, the only question seems to be – is it this year or next?

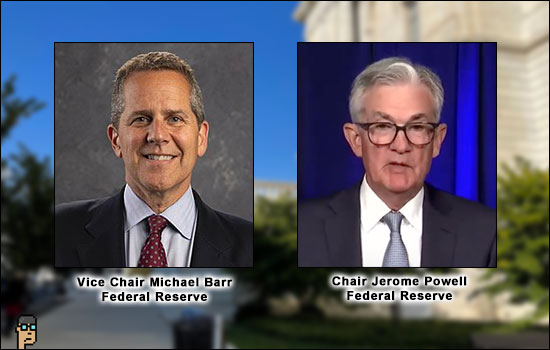

As Congress began its return from recess last week, The U.S. Federal Reserve brought its lens to stablecoins. Fed Chair Jerome Powell and its new Vice Chair for Supervision, Michael S. Barr, participated in D.C. think tank events.

Mr. Barr presented at the Brookings Institution conference and provided a broad overview of his priorities which center on maintaining the stability of the U.S. banking system which seemingly puts him front-and-center in the stablecoin debate.

The Vice Chair position Barr now holds was originally established due to passage of the Dodd-Frank Act and addressed the need for a financial watchdog given the extreme risk-taking by banks that led to the Great Financial Crisis of 2008.

Prior to joining the Fed, Barr was in academia as dean of the University of Michigan. He’s also very familiar with crypto having served as an advisor in 2015 to Ripple Labs.

Stablecoins

In his speech, Barr aligned himself with the urgent calls in favor of stablecoin rulemaking saying, “Stablecoins, like other unregulated private money, could pose financial stability risks. History shows that in the absence of appropriate regulation, private money is subject to destabilizing runs, financial instability, and the potential for widespread economic harm.”

Vice Chair Barr added that he believed Congress needs to work quickly on legislation that brings stablecoins “inside the prudential regulatory perimeter.”

Read the entire speech here.

Currently, stablecoin legislation abounds in Congress with Senator Pat Toomey (R, PA) offering The Stablecoin Trust Act as well as separate legislation from Senator Hagerty (R, TN) and Rep. Trey Hollingsworth (R, IN) called The Stablecoin Transparency Act.

This past summer’s much heralded Responsible Financial Innovation Act from Senators Cynthia Lummis (R, WY) and Senator Kirsten Gillibrand (D, NY) has stablecoin rule elements. And, Ranking Member of the House Financial Services Committee Rep. Patrick McHenry (R, NC) and its Chair Rep. Maxine Waters (D, CA) have been rumored to be working on legislation which nearly made it to a markup vote in July.

And that’s just a few of the stablecoin law possibilities. Still, with Fall elections in the way, it seems likely a stablecoin law won’t be passed until 2023.

Chair Powell

U.S. Federal Reserve Chair Jerome Powell threw his office’s weight behind the urgent need for stablecoin guardrails last week.

In an hour-long interview at Cato Institute’s 40th Annual Monetary Conference, Chair Powell first addressed a Central Bank Digital Currency (CBDC) saying that the Fed is a long way from nailing down the necessary working mechanics and that privacy protections will be critical if there ever is a CBDC.

And then he discusssed private stablecoins:

“The question is, ‘Are there forms of private money like stablecoins which can play a role in our financial system?’ And the answer is, of course – we don’t want to stand in the way of appropriate innovation, particularly digital innovation. But, we think that something purporting to be money would need to be appropriately regulated.

“I hear there’s wide agreement on [the need for regulation]. A lot of the stablecoin companies are now seeing that as part of getting to a place where they are a legitimate part of the financial system.”

“So if people are going to think something is money, then it needs to actually have the qualities of money. If it doesn’t then you don’t want to take money and make it into just another consumer product where sometimes it fails and sometimes it’s good. You want it to be guaranteed – to be good – if the public is gonna look at it like it is $1. You want to have clarity, transparency, you want to have full reserves, very liquid high quality assets. And things like that.”

“So, we need legislation on this – and that’s typical of technological innovations.”

“There isn’t a regulatory framework that [addresses] payment stablecoins. I think that’s what’s needed. But, I wouldn’t think of us as being opposed to that kind of innovation. We’re more the people who are saying that we need appropriate regulation.”

You can view Chair Powell’s discussion of stablecoins and a Central Bank Digital Currency (CBDC) beginning at 35:59 of Cato Institute’s event video on YouTube.

Everyone wants a stablecoin law. So, where is it?