In Congress, crypto mixing and its privacy-enhancing use of blockchain technology has been a troubling innovation for some Members. Case and point: crypto mixer Tornado Cash has been front-and-center in illicit finance deliberations within the U.S. government and was sanctioned in 2022 by U.S. Treasury.

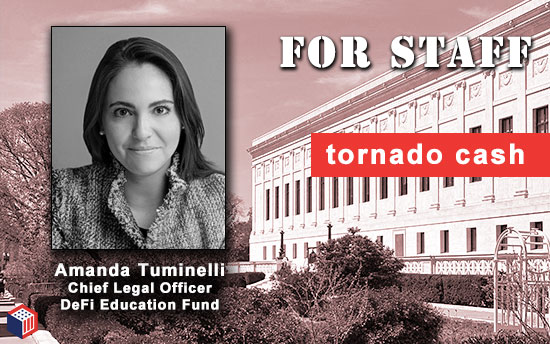

Last Friday, blockchain tipsheet sat down with Amanda Tuminelli, Chief Legal Officer of decentralized finance advocacy firm DeFi Education Fund (DEF). We discussed both the latest and the “basics” in crypto mixing as well as the Department of Justice’s indictment in August 2023 of Tornado Cash software developers Roman Storm and Roman Seminov.

Roman Storm is currently in custody and his case has been delayed until later in the year in the Southern District of New York. Roman Seminov remains at large.

Also, last October, the U.S. Department of the Treasury’s Financial Crimes Enforcement Network (FinCEN) announced a Notice of Proposed Rule Making (NPRM) – see it – that identified crypto mixer transactions as a source of money laundering. DeFi Education responded with a formal comment (PDF).

With lawmakers and their staffs in mind, blockchain tipsheet’s interview with Ms. Tuminelli covered:

-

- why crypto mixers are controversial

- the lawful purpose of mixers

- balancing AML regimes and mixers

- crypto wallets and identifiers

- overview on indictment of Storm and Seminov

- Dutch court convicts Tornado Cash developer Alexei Pertsez

- scenarios pending U.S. court decisions

- unlicensed money transmitting

- crypto mixing 5-10 years from now

The transcript has been lightly edited for clarity.

blockchain tipsheet: Why have crypto mixers become controversial?

Amanda Tuminelli: I think that many lawmakers are concerned that “mixing” automatically means unlawful conduct or a national security concern. And it has become fraught with national security issues because of the DPRK (North Korea) using Tornado Cash or the allegations that various terrorist groups are using mixing services in order to fund their activities. I think that is happening. And we absolutely are not here to support that in any way.

But, there is a disproportionate focus on those groups using mixers. And I think their focus should be more properly on the technology: what is mixing and what is it really going on under the hood, and who in the mixing tech stack is the appropriate person to regulate. Continue reading “Tornado Cash And Crypto Mixing Today: An Interview With DEF’s Amanda Tuminelli”