SEC charges Coinbase

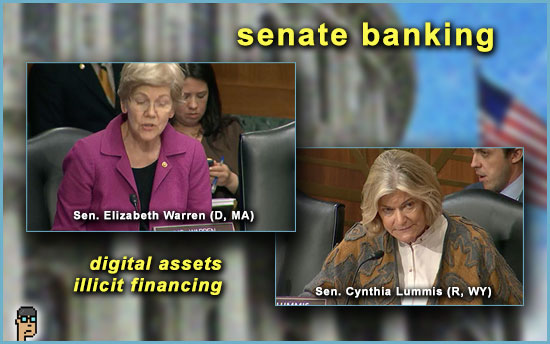

Coinciding with another round of hearings aimed at creating legislation for digital assets – and Monday’s action against Binance – the Securities and Exchange Commission (SEC) delivered an enforcement action against Coinbase. The agency said in a statement that Coinbase was “operating its crypto asset trading platform as an unregistered national securities exchange, broker, and clearing agency.” The SEC also charged Coinbase for “failing to register the offer and sale of its crypto asset staking-as-a-service program.”

Read the statement. And, see the 101-page lawsuit (PDF).

The suit was not unexpected given the “Wells notice” Coinbase received in March suggesting an enforcement action was on the way.

It was only two years ago that Coinbase’s registration statement allowing it to go public was approved by the SEC.

SEC charges Coinbase – states

The lawsuits for Coinbase didn’t stop with the SEC yesterday either. Though likely well-coordinated with the securities agency, “a multistate task force comprising state regulators from Alabama, California, Illinois, Kentucky, Maryland, New Jersey, South Carolina, Vermont, Washington and Wisconsin have issued a Show Cause Order against cryptocurrency exchange Coinbase,” reports Cointelegraph. Note the inclusion of both “red” and “blue” states in the group.

“The Order gives Coinbase 28 days to show cause why they should not be directed to cease and desist from selling unregistered securities in Alabama” and in coordination with the other states mentioned. The action stems from the Coinbase’s staking rewards service says the Order. Read the order (PDF). Continue reading “SEC, States Aim Enforcement Actions Against Coinbase; SWIFT Testing Tokenized Asset Systems”