Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

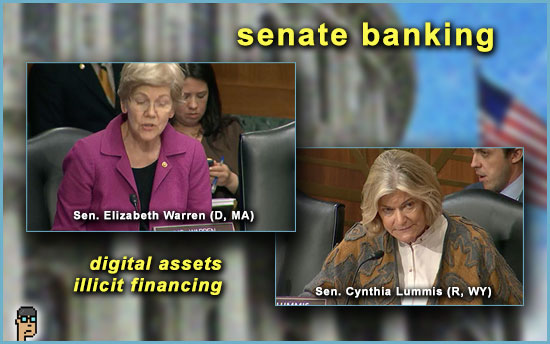

Senate Banking – Warren

A Senate Banking hearing yesterday titled, “Countering China: Advancing U.S. National Security, Economic Security, and Foreign Policy,” brought to light a report last week by blockchain analytics firm Elliptic that found “…more than 90 China-based companies [willing] to supply fentanyl precursors, 90% of which accepted cryptocurrency payments. ” The precursors equated to a street value of $54 billion of fentanyl according to the company. See the report.

During the hearing, committee member Senator Elizabeth Warren (D, MA) tied the finding to her Digital Asset Money Laundering Act from the 117th Congress and co-sponsored by Senator Roger Marshall (R, KS). Warren began by confirming with U.S. Treasury’s Assistant Secretary for Terrorist Financing and Financial Crimes, Elizabeth Rosenberg, that crypto was being used for purchases of fentanyl precursors. Rosenberg added that the perceived “pseudonymity” and “anonymity” of digital assets was attractive to fentanyl precursor sellers.

When Senator Warren pressed on how crypto was “their payment of choice” for fentanyl dealers, Rosenberg gently corrected her, “It is one. Unfortunately, there are others. But, it is certainly one.” After repeating insights from the Elliptic report and a quick outline on the re-introduction of the bill with Senator Marshall, the Massachusetts Senator concluded, “Crypto is helping fund the fentanyl trade, and we have the power to shut that down. It’s time.” See video of Senator Warren’s questioning beginning at 01:35:35.

Senate Banking – Lummis

Largely taking the other side of Senator Warren’s questions, fellow Banking committee member Senator Cynthia Lummis (R, WY) noted in her questioning of witnesses that the Responsible Financial Innovation Act (RFIA) – which “will be re-introduced soon”- will include “an entirely new title on combatting illicit finance.”

Sen. Lummis asked Assistant Secretary Rosenberg, if she agreed “that digital assets today are subject to the U.S.’s comprehensive laws on money laundering and sanction?” She did saying, “It’s certainly true that financial institutions that offer services in the digital asset domain are covered by AML/CFT obligations.” See video beginning 02:14:43.

Continuing her questioning, Senator Lummis asked if new legal authority or new personnel and funding was more desired by Ms. Rosenberg. Rosenberg offered her help to the Senator in creating new authorities but concluded, “We can do more with more.. more resources.”

Senate Banking – Treasury

Assistant Secretary Rosenberg‘s prepared testimony shed light on some of the work of U.S. Treasury -especially within the Financial Action Task Force (FATF).

She wrote, “… we protect our national security interest (…) by raising international financial standards and building partner consensus. Leadership in the Financial Action Task Force, the international standard-setting body for anti-money laundering and countering the financing of terrorism, is a major way we accomplish this. For example, my team helps lead the international virtual assets contact group, working to define the rules of the road for international financial systems in regulation of digital assets and countering their use in money laundering.” Read her testimony.

hear ye, hear ye

Three hearings this month on digital assets – get ready.

The full committee on House Agriculture will convene a hearing titled, “The Future of Digital Assets: Providing Clarity for Digital Asset Spot Markets” next Tuesday, June 6 at 10 a.m. See the hearing page.

The House Ag hearing is a continuation of a carefully coordinated “dance” of digital assets hearings by the majority Republicans aimed at producing digital asset legislation led by their respective Chairs: Rep. GT Thompson (R, PA) on House Ag and Rep. Patrick McHenry (R, NC) on House Financial Services (HFS).

It was a little over a month ago that House Ag and HFS convened an historic dual hearing on digital assets.

Coming up on June 13, House Financial Services has let it be known that it will have a digital asset “market structure” hearing of its own.

Meanwhile, House Energy & Commerce led by Chair Rep. Cathy McMorris Rodgers (R, WA) announced, “Building Blockchains: Exploring Web3 and Other Applications for Distributed Ledger Technologies” for Tuesday, June 7 at 10 a.m. ET. This will be run by the Subcommittee on Innovation, Data, and Commerce Chair Rep. Gus Bilirakis (R, FL). The Chairs said in a statement, “The applications of emerging technologies have the potential to increase digital commerce, strengthen our supply chains, and enhance data privacy and security.” See the hearing announcement.

Pro-crypto forces in Congress may start making the case for digital assets and blockchain technology beyond the financial system. This Energy & Commerce hearing could be a first step. It would also not be surprising that HFS Chair McHenry – along with Majority Whip Rep. Tom Emmer (R, MN) – is/are pulling the strings here. McHenry is the House’s digital assets maestro.

Meanwhile in the Senate… [cricket sounds].

TradFi prepares

The Financial Times reports that traditional finance firms such as Standard Chartered, Nomura and Charles Schwab are building out cryptocurrency infrastructure either by themselves or through partners in spite of the crypto winter and regulatory uncertainty. What’s the opportunity TradFi sees? Bernstein digital assets analyst Gautam Chhugani tells the FT, “The large, pedigreed, traditional institutional investors definitely prefer dealing with counterparties who they know have been in existence for years and have been regulated in the traditional sense.” Read more.

WaaS up

Web3 funding continues to pulse. Wallet-as-a-Service (WaaS) startup Magic announced it has raised $52 million in a funding round led by PayPal Ventures. Magic founder and CEO Sean Li tells Fortune that “the company’s goal has been to offer Web3 tools that can be accessed via Web2-style interfaces customers already know. One of the biggest barriers to entry in Web3 is onboarding.” Read more.

In March, Coinbase announced its own WaaS product targeting business customers. Here’s Coinbase’s definition of WaaS: “WaaS is a scalable and secure set of wallet infrastructure APIs, enabling companies to create and deploy fully customizable onchain wallets to their end users.” Read more about it.

new-ish bills

Two new-ish bills catch the eye of Blockworks’ Casey Wagner who breaks down yet another anti-CBDC bill from Republicans – the Digital Dollar Pilot Prevention Act from Rep. Alex Mooney (R, WV) and a gaggle of Republican co-sponsors – and the Dark Web Interdiction Act re-introduced by Reps. Chris Pappas (D, NH) and Tony Gonzales (R, TX) in the House and Sens. Maggie Hassan (D, NH) and John Cornyn (R, TX) in the Senate. Read more.

Wagner reports on the “Dark Web” legislation which made its original appearance in the 117th Congress, “The bills seek to impose harsher penalties on trafficking controlled substances on the dark web and directs the Attorney General to issue a report to Congress on the role of cryptocurrencies in dark web drug dealing.”

crypto run risk

In a Chicago Federal Reserve “Letter,” researchers look at the collapse of crypto-asset platforms in 2022 which it says “were subject to run risk.”

Authors Radhika Patel and Jonathan Rose go on to review data about the runs it observed saying in part, “… while the platforms had many retail clients, the runs were spearheaded by customers with large holdings, some of which were sophisticated institutional customers. For example, figure 4 breaks down the outflows at Celsius by three groups of customers according to the size of their accounts.” See “figure 4” and several more graphics in the letter.

The WSJ offers its take on the findings here.

tokenizing ETFs

The blockchain remains of keen interest to financial product specialists. “We will be looking at the tokenization of ETFs (exchange-traded funds)… And then the tokenization of private assets. That for me will be game-changing,” said Matteo Andreetto, Senior Managing Director at State Street Global Advisors, at a recent industry event. Ledger Insights reports that Andreetto believes clients “would love to have SPDR digital asset classes or SPDR (S&P Depositary Receipts) tokenized ETFs.” Read more.

still more tips

CFTC to Hold an Open Commission Meeting on June 7 – CFTC.gov

EU officials sign Markets in Crypto-Assets framework into law – Cointelegraph

Investment Bank Cowen Shuts Down Crypto Digital Asset Unit – Bloomberg

Bybit follows Binance in departure from Canadian market – The Block

Crypto lobbying in 2022 – Forex Suggest

Crypto Infrastructure Firm Anoma Foundation Raises $25M – CoinDesk

If you would like this delivered as a newsletter, please sign up here.