crypto caucus – Senate

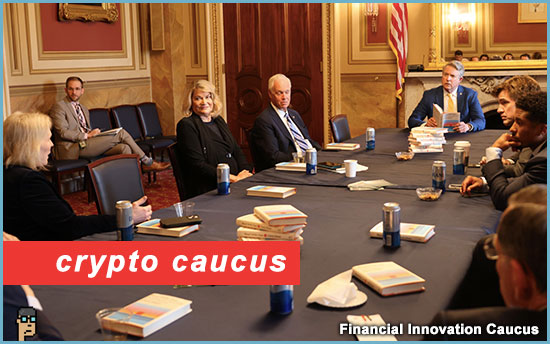

The Senate version of the House’s dormant Congressional Blockchain Caucus awakened last week with a revealing photo op. Known as the “Financial Innovation Caucus,” it was originally founded by Sen. Cynthia Lummis (R, WY) and Kyrsten Sinema (I, AZ) – see the Caucus landing page.

The Caucus’ X account announced in a tweet on Friday that senators had gathered together with a16z crypto venture investor Chris Dixon, who released a new web3 book at the beginning of the year called, “Read, Write, Own”:

“This week, [Chris Dixon] joined the Financial Innovation Caucus for a bipartisan discussion about the importance of crypto assets and the need for the U.S. to be a world leader in regulatory clarity for crypto assets.”

Sen. Lummis office confirmed to blockchain tipsheet:

“Since she arrived in the Senate in 2021, Senator Lummis has been committed to helping educate her colleagues on a host of issues related to bitcoin, crypto, web3 and blockchain in general. Mr. Dixon recently published a new book on the evolution of the internet as well as the role blockchain technology can play in countering the overreach of big tech, so Senator Lummis invited him to meet with her colleagues to discuss.”

“The overreach of big tech” – that’s something that appeals to both sides of the Senate aisle

Senators who were present for the Caucus meeting included:

-

- Sen. Lummis and Sen. Kirsten Gillibrand (D, NY) who co-sponsor the Lummis-Gillibrand Responsible Financial Innovation Act (RFIA) [S.2281]

- Rep. Wiley Nickel (D, NC) – A member of House Financial Services, Nickel has supported both the stablecoin [H.R.4766] and digital asset market structure [H.R.4763] bills awaiting votes on the House Floor.

- Sen. Ted Budd (R, NC) – He supported digital assets legislation consistently as a Member of House Financial Services and became a Senator in the 118th Congress.

- Sen. John Thune (R, SD) – co-sponsor of the now-defunct Digital Commodity Consumer Protection Act (DCCPA) [S.4670] from the 117th Congress. Thune is also the Senate Minority Whip.

- Sen. John Cornyn (R, TX) – considered pro-crypto and has sponsored introduction of legislation dealing with crypto’s use on the Dark Web [S.1728].

- Sen. John Barrasso (R, WY) – Sen. Lummis fellow Wyoming Senator. Member of the Senate Finance Committee where Lummis-Gillibrand’s RFIA is currently assigned. Also, he’s Ranking Member of Senate Energy and Natural Resources.

- Sen. Ron Johnson (R, WI) – Member of Senate Finance Committee.

- Sen. Roger Marshall (R, KS) – Member of Senate Agriculture with Sen. Gillibrand. See more below.

North Carolina Blockchain Initiative noted on X about the Caucus meeting: “North Carolina’s [Sen. Ted Budd] and [Rep. Wiley Nickel] participated in an important dialogue with [Chris Dixon] & a16z crypto regarding the importance of [digital assets] and regulatory leadership in [crypto].”

more tips:

-

- Review: In ‘Read Write Own,’ venture capitalist Chris Dixon makes a serious case for crypto in wake of FTX debacle (from January) – Fortune on Yahoo

what you should know: With a Senate meeting such as this, Team Lummis-Gillibrand could be in the process of educating Members on digital assets as well as “clearing the runway” so that HFS Chair Patrick McHenry (R, NC) and Ranking Member Maxine Waters (D, CA) can “land the plane.” That is to say.. a “stablecoin plane” which rides a “legislative vehicle.”

No doubt more Senate Dem support would be helpful, too.

crypto caucus – Sen. Marshall

The appearance of Sen. Marshall (thumbing through Dixon’s book) at the Financial Innovation Caucus meeting is the most eye-opening – beyond the fact that a group of Senators appeared to gather for what could be characterized a “pro-innovation” meeting.

For crypto proponents, Sen. Marshall is most well-known for providing bipartisan co-sponsorship of Sen. Elizabeth Warren’s “Digital Asset Anti-Money Laundering Act” [S.2669] as well as this speech in front of a banking lobby. Meanwhile, he has been feeling the heat from conservative groups for his partnership with Warren on digital assets.

what you should know: Both Sen. Marshall and Sen. Warren have shown a willingness to work with pro-crypto advocates in Congress. Back in July 2023, the two Senators co-sponsored an amendment [S.712] to the National Defense Authorization Act which outlined a review regimen for government as it related to digital assets and AML. Senators Lummis and Gillibrand were also co-sponsors. Read more from blockchain tipsheet.

Rep. Lucas on crypto

Punchbowl News’ The Vault newsletter reported yesterday on the priorities for Rep. Frank Lucas (R, OK) if he becomes the head of the Republican House Financial Services caucus in the next Congress. Spoiler alert: crypto is nowhere to be found.

Lucas admits to Punchbowl, “I have a sense of caution toward crypto.” That’s a far cry from the digital assets agenda of the current Chair, Patrick McHenry, who will retire at the end of this Congress. Read more.

what you should know: For crypto proponents, the good news is that Lucas is not the front-runner in the Republican HFS race. Rep. French Hill (R, AR), the current Vice Chair, still feels like the odds-on-favorite.

markup this Wednesday

On Friday, House Financial Services (HFS) Committee Chair Patrick McHenry that HFS will be holding a markup this Wednesday, April 17 at 10 a.m. in the Rayburn House Office Building. See the release.

The Wednesday hearing picks up where an abbreviated HFS markup on February 29 left off -that was the hearing where the joint resolution rescinding Staff Accounting Bulletin 121 was approved with bipartisan support.

Among the 13 bills under consideration with at least tangential implications to digital assets are:

-

- H.R.7440 — “Financial Services Innovation Act” – This bill was re-introduced by Chair McHenry and co-sponsored by Rep. Byron Donalds (R, FL) According to the Feb. 27 press release from HFS, Chair McHenry said: “Budding fintech firms currently operate in fear of heavy-handed penalties brought down by regulators that have failed to work with Congress to provide clear rules of the road. (…) This commonsense legislation will give entrepreneurs an opportunity to test legal and regulatory waters before taking new products and services to market..” Read the release.

- H.R.7437 — “Fostering the Use of Technology to Uphold Regulatory Effectiveness in Supervision Act ” – or FUTURES Act- This bill was introduced by Rep. Erin Houchin (R, IN) in February and has bipartisan support from Rep. Bill Foster (D, IL), Rep. French Hill (R, AR) and Rep. Brittany Pettersen (D, CO). The bill requires government involved in financial services monitoring and oversight to update their systems to the latest and greatest tech. Rep. Foster is quoted in the February: “The collapse of Silicon Valley Bank demonstrated that threats to our financial system can move much faster than previously thought…” Read that press release.

what you should know: As we noted back in February, H.R.7440 ties well with themes of the “Token Safe Harbor Proposal 2.0,” a crypto development sandbox proposed by Republican SEC Commissioner Hester Peirce in 2021.

digital assets and sanctions

Michael Mosier of law firm Arktouros, who was a former Deputy Director and Digital Innovation Officer of the Financial Crimes Enforcement Network (FinCEN) among other stops, disputed the recent characterization by certain members of Congress that digital assets are a key avenue for sanctions evasions over the weekend.

Here’s his argument published on X Saturday citing recent data:

-

- “Iran: 1.8 million barrels of oil/day, despite sanctions (Mar. 2024)”

- “Russia: $94 billion oil revenue Q1 2024; 53.5% increase; trading $15/barrel above price cap. (Bloomberg, Apr. 2024)”

- “E.Warren: ‘cryptocurrency is now the method of choice for countries to evade sanctions’ (5/4/23)”

what you should know: Mr. Mosier participated in HFS Subcommittee on Digital Assets, Financial Technology and Inclusion hearing, “Crypto Crime in Context Part II: Examining Approaches to Combat Illicit Activity” in mid-February. See coverage on blockchain tipsheet. Mosier was also co-author of a pro-industry paper titled, “Genuine DeFi as Critical Infrastructure: A Conceptual Framework for Combating Illicit Finance Activity in Decentralized Finance” published in January. See it (PDF).

quotable – Commissioner Peirce

SEC Commissioner Hester Peirce (R) in an April 8 speech: ” the SEC has met inquiries about blockchain technology with a stubborn and decidedly uncreative insistence that existing rules work just fine. We have not worked seriously with people in the industry to figure out how to achieve our regulatory objectives…”

-

- “Pourquoi Pas? Securities Regulation and the American Dream: Remarks before the Association of Private Enterprise Education” – SEC Commissioner Hester Peirce, SEC.gov

h/t @AlexanderGrieve

hacking a smart contract

On Friday, the Department of Justice announced that Shakeeb Ahmed, who had said he was a cybersecurity engineer, was sentenced to three years in prison “for hacking two separate decentralized cryptocurrency exchanges and stealing cryptocurrency worth over $12 million.” Ahmed had previously pled guilty to computer fraud, said Attorney General Damian Williams of the Southern District of New York in the press release.

What’s of particular note in the DOJ release is the type of hack: hacking a smart contract.

The press release notes, “At the time of both attacks, Ahmed, a U.S. citizen, was a senior security engineer for an international technology company, whose resume reflected skills in, among other things, reverse engineering smart contracts and blockchain audits, which are some of the specialized skills Ahmed used to execute the hacks. Read more.

And, read CoinDesk’s coverage.

what you should know: In addition to a warning to crypto hackers about running afoul of the law, crypto skeptics may find this example of the “hackability” of certain smart contracts useful as they look to make a case on why digital assets needs to stay out of the U.S. financial system in order to insure the system’s stability.

Coinbase court machinations

-

- “Today [Coinbase] filed a brief asking the Court’s permission to seek an interlocutory appeal in our [SEC] case on this controlling question: whether an “investment contract” requires something contractual – we think it does, the SEC disagrees…” Read the argument and tweet thread from Coinbase chief legal officer Paul Grewal on X.

Senator Warren

Politico reviews the campaign donation support for lawyer and pro-crypto candidate John Deaton, a Republican, as he takes on Senator Elizabeth Warren (D, MA) for her Senate seat in the November general election.

Politico says, “Deaton has virtually no chance of unseating Warren in deep-blue Massachusetts. But that’s not stopping crypto proponents from personally spending to boost him — and potentially blunt their Capitol Hill adversary.” Read more.

what you should know: Given the characterization by Politico, the Deaton campaign could be considered the Congressional equivalent of a message bill for crypto proponents. Furthermore, any publicly-televised debate between the two candidates could be compelling theater.

Hong Kong ETFs and Prometheum

Not to be left out of the exchange-traded fund (ETF) business ignited by the recent approval of Bitcoin spot market ETFs in the United States, Hong Kong is believed to be approving ETFs in both Bitcoin and Ether as early as next week.

Bloomberg reports that issuers in the Hong Kong jurisdiction include “an international arm of Chinese asset manager Harvest Fund Management Co., as well as a partnership between Bosera Asset Management (International) Co. and HashKey Capital.” Read more.

According to Pitchbook, “Established in 2018, Hashkey Capital is a corporate venture capital of HashKey Digital Asset Group and it is based in Central, Hong Kong. The firm focuses on making investments in financial technology sector.”

And on that note… controversial crypto securities platform Prometheum raised $12 million from HashKey Capital sister-company HashKey Digital Asset Group while signing a “strategic partnership” with Wanxiang Blockchain Labs in 2018.

more tips:

-

- Hong Kong digital assets exchange warns over viability of city’s new crypto rules – Financial Times

breaking it down

The bill from Senators Thom Tillis (R, NC) and Bill Hagerty (R, TN) known as “Ensuring Necessary Financial Oversight and Reporting of Cryptocurrency Ecosystems Act” – or “ENFORCE Act” – gets a deeper look from Cap Hill Crypto’s George Leonardo. He writes, “…the bill will likely serve as a foundation for future Republican AML bills and a counter to more crypto-hostile bills like DAAMLA and CANSEE. It’s also a good example of how smaller standalone proposals can get rolled into more comprehensive bills.” Read his breakdown.

still more tips

Crypto Owners a Growing Force Heading into 2024 Election: Galaxy Digital – Decrypt

IRS’ criminal investigation chief says agency prepared for crypto tax crimes (video) – CNBC Crypto World on YouTube

Ukraine’s cyber police talks crypto, ransomware and documenting war crimes after Russia’s invasion – TechCrunch

Opinion: Get ready, the Bitcoin ‘halving’ is coming — and there are reasons to be bullish – Alex Tapscott in The New York Post

BlackRock bitcoin fund accounts for 20% of the firm’s Q1 ETF net inflows – Blockworks