Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

FedNow and CBDCs

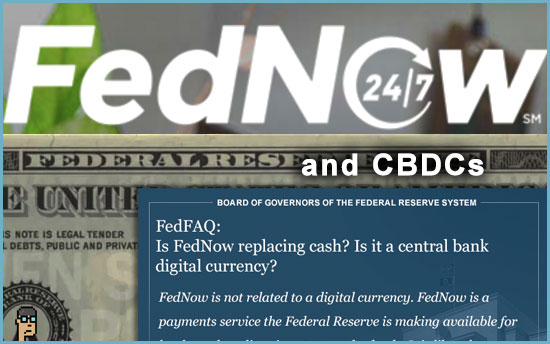

The U.S. Federal Reserve slid out an “FAQ” on Friday regarding its new FedNow payment system. Among the brief series of questions and answers, the Fed tries to debunk the idea that FedNow is replacing cash or has anything to do with a Central Bank Digital Currency (CBDC). It’s an “instant payment system” launching this July.

In the FAQ, the Fed reiterates previous statements on its CBDC strategy saying, “The Federal Reserve has made no decision on issuing a [CBDC] and would not do so without clear support from Congress and the executive branch, ideally in the form of a specific authorizing law. A CBDC would not replace cash or other payment options.” Read the FAQ.

Circle’s Head of Global Policy Dante Disparte tweeted about the FAQ saying it was “a useful myth busting FAQ from the @federalreserve.” Read more.

Meanwhile, on the Unchained podcast last week, Majority Whip Rep. Tom Emmer (R, MN) remains skeptical about FedNow and CBDCs. On FedNow, Emmer said, “Let the private sector do this stuff. This is our government once again trying to compete with the private sector. This is our government once again, I believe, controlling all finance. You control the money, you control the water -and you control the people. This is literally what defines our freedom, our financial system in our country – our ability to create an idea and then go out and solicit startup capital. By the way, I should not need my government’s permission or oversight to go out and seek that. That’s the definition of freedom in this country.” Hear the podcast. Continue reading “FedNow Is Not A Cash Replacement Or CBDC Says The Fed”