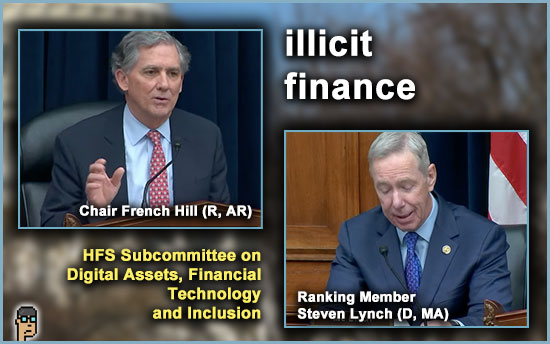

Following up on a hearing from last November, the House Financial Services Subcommittee on Digital Assets, Financial Technology and Inclusion held yesterday, “Crypto Crime in Context Part II: Examining Approaches to Combat Illicit Activity.” See the on-demand webcast.

Led by Chair French Hill (R, AR) and Ranking Member Steven Lynch (D, MA), industry witnesses included the following (click name for prepared testimony):

-

- Caroline Hill, Senior Director of Global Policy, Circle

- Michael Mosier, Co-Founder, Arktouros

- Grant Rabenn, Director, Financial Crimes Legal, Coinbase

- Ari Redbord, Global Head of Policy, TRM Labs

- Carole House, Senior Fellow, Atlantic Council

Of note, Ms. House was the behind-the-scenes creator of President Joseph Biden‘s Digital Assets Executive Order released in March 2022.

The Subcommittee also previewed a slew of new legislation – see it on the hearing page – including a study requiring Treasury, SEC and CFTC to look at decentralize finance (DeFi).

(Will HFS Chair Patrick McHenry (R, NC) hold another HFS markup soon?)

In his opening remarks, Chair Hill noted that crypto was not a primary source of financing for terrorists – traditioinal finance was the culprit. Hill referenced Treasury Undersecretary Brian Nelson’s testimony on the previous day in front of the HFS full committee. But, Hill admitted any use of crypto in illicit finance is too much and pointed to the digital asset market structure bill as a solution.

The bill awaits a House floor vote after passing through a markup last July.

Ranking Member Lynch spoke next and said that digital assets were “vulnerable” to illicit finance. Overall in his opening statement, Lynch’s tone was more muted on digital assets than past hearings by a key member of Democratic leadership on HFS. He said that he favored promoting responsible innovation.

After opening remarks by the witnesses, Ranking Member of the full committee, Maxine Waters (D, CA), brought down the hammer to make clear that Democratic leadership hasn’t changed it’s mind and called out the work of “MAGA Republicans” as it relates digital assets.

Q&A

Chair Hill started his questioning about cryptocurrency or blockchain “validators” (definition) and asked Mr. Mosier whether it would be effective to shut them down. He was emphatic that it wouldn’t as Hill made the case for why illicit finance is an offshore problem rather than something that needs to be fixed onshore in the United States. Turning to stablecoins, Hill wanted to know if they were a particularly acute problem.

HFS Ranking Member Waters took her Q&A turn next and said she was “especially concerned” about tools that anonymize which relates to DeFi and crypto mixers, in particular. Ms. House replied that some issues exist both onshore and off and pointed to non-compliance with AML/CFT standards.

Pointing to a plan Ms. House had made as part of her role on the current TAC CFTC Technology Advisory Committee, House discussed the DeFi particulars with the Ranking Member.

In his questions, Rep. Warren Davidson (R, OH) explored the ability of tools to solve illicit finance challenges today. He also entered into the record his January op-ed in the Hill titled, “Setting the record straight and debunking unworkable illicit finance proposals.” Read it.

Though he complimented Coinbase at first, Subcommittee Ranking Member Lynch spoke, at first, to Coinbase’s Rabenn. Lynch brought up a $50 million fine that his company had to pay regarding anti-money laundering violates in New York State as well as another $50 million the company had to invest in upgrading compliance (Read this from Jan. 2023.). Next, the Ranking Member asked Ms. House about unhosted digital wallets. House said that FinCEN needed to put in tigher rules for CVC mixers.

Senator Elizabeth Warren (D, MA) was the subject of Rep. John Rose’s (R, TN) Q&A time. He said Warren’s statements about digital assets was “false” and then had the witnesses talk about the compliance necessary in the United States today. Coinbase’s Rabenn, Circle’s Hill and TRM Labs’ Redbord discussed their companies’ compliance strategies and tools they use for their AML/CFT efforts.

Rep. Ritchie Torres (D, NY) spoke next and mentioned that crypto is “eminently traceable.” The pro-crypto lawmaker pointed to how the funds used in the Colonial Pipeline ransomware attack were eventually recovered and asked witnesses rhetorically, “Should we eradicate money to eradicate money laundering?” Torres advocated for legislation for “cyber hygiene” rather than “scapegoating crypto.”

Rep. William Timmons (R, SC) walked through use cases for illicit finance with witnesses. TRM Labs Redbord noted the blockchain analytics tools that allow law enforcement to trace and seize back proceeds from fraud, scams and ransomeware. Law enforcement can “follow the money.” Noting the impact in his district from the Colonial Pipeline attack, he asked Redbord to recount the recovery process in that case.

Rep. Sean Casten (D, IL) offered compliments to the blockchain analytics and their ability to track on-chain crime. But, Casten was clearly skeptical that they knew about all of the illicit activity. Mixers was a particular concern for Rep. Casten and he mentioned “chain hopping,” cross-chain bridges and areas of obfuscation. Ms. House concurred that there was a problem. TRM Labs’ Redbord noted that his firm follows funds across chains. But, Rep. Casten interrupted saying that North Korea used these “chain hopping” techniques.

Rep. Bryan Steil (R, WI) asked about how the U.S. should be improving non-compliant areas offshore. Circle’s Hill noted that FATF is trying to make sure “high risk” countries comply. Coinbase’s Rabenn said that crimes involving crypto across borders is challenged by the fact it needs to get off-chain and into the traditional finance system.

Rep. Brad Sherman (D, CA), a leading voice of the “anti-crypto army,” said that crypto wasn’t a currency but just a “collectible.” He said a “mixer was there for helping criminals.” In a gotcha moment, Sherman asked for a show of hands of those who would support the outlawing of mixers. No one, including Ms. House who was like a Democrat witness, raised their hands. Rep. Sherman asked the same type of question regarding crypto tax scofflaws – a topic he raised last week with Treasury Secretary Janet Yellen.

Rep. Mike Flood (R, NE) made clear in his 5 minutes that illicit finance in digital assets isn’t something anyone wanted. Coinbase’s Rabenn responded to the Congressman that his company must comply with the Bank Secrecy Act. For Rep. Flood, Mr. Mosier defined “off chain” transactions as anything happening in traditional finance. “Digital Assets are assets,” said Flood in connecting it to other assets.

During his Q&A time, Rep. Wiley Nickel (D, NC) said that Binance and Tether were examples of “bad actors” with “next to no compliance controls” and made a point about the problems beyond the U.S. jurisdiction. He noted U.S> firm’s Cantor Fitzgerald’s custody-ing of Tether’s assets and asked whether issues presented by Tether could be addressed through custody. Circle’s Hill essentially said it was possible.

Rep. Byron Donalds (R, FL) asked Coinbase’s Rabenn about the scale of digital asset crimes versus traditional finance. Rabenn cited figures at around 1% that are related to digital assets. TRM Labs’ Redbord reviewed the use of existing laws, sanctions and enforcement to shut down the illicit use of digital assets.

Rep. Bill Foster (D, IL) geared his questioning toward “revolving door politics” and the salary increase once one leaves the public sector for the private sector. Mr. Mosier said an 8x increase was possible. Foster said he wants to improve Federal salaries. Ms. House addressed Rep. Foster’s interests in digital, verifiable credentials.