Congressman Darren Soto (D, FL), who is also co-Chair of the Congressional Blockchain Caucus, reiterated today that he wholeheartedly supports creating effective regulation that offers guardrails to crypto markets. But in an on-stage interview with Axios, if anyone thinks Rep. Soto is going to let the Senate take the lead, they appear to be mistaken.

He said in regards to the new “Responsible Financial Innovation Act” introduced in the Senate by Senator Cynthia Lummis (R, WY) and Senator Kirsten Gillibrand (D, NY), “We definitely agree that the SEC jurisdiction should be narrowly defined to treat securities [such that] if you’re doing an issuance that results in stock later on – which every now and again has happened in the past – that should be a security. But others should be either a currency or governed by the FTC or CFTC. We agree broadly with some of the ideas in [the Lummis/Gillibrand] bill and certainly have our own ideas in the House and we need to reconcile those eventually.”

The seeds of Rep. Soto and Rep. Warren Davidson’s (R, OH) Digital Taxonomy Act and Token Taxonomy Act began back in 2018/2019.

Rep. Soto responded to Axios on several topics…

On Promoting Innovation and Regulating Simultaneously

CONGRESSMAN DARREN SOTO: Existing regulators need their scope and jurisdiction redefined while making sure to foster innovation. The very laws we’re working on are trying to strike that balance with the Token Taxonomy Act, with the Digital Taxonomy Act. There’s an issue right now with whether the SEC is going to regulate futures, while not allowing for spot investments – this is an example where existing laws are just antiquated.

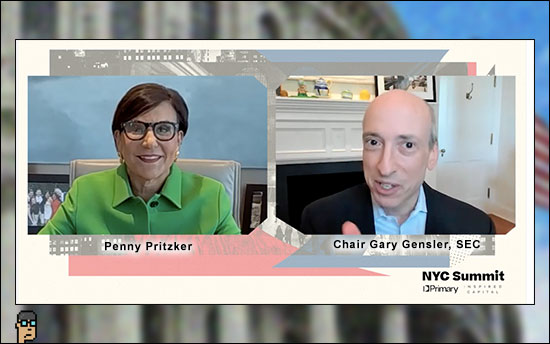

On SEC Chair Gary Gensler Desire to Maintain Existing Laws

CONGRESSMAN DARREN SOTO: I’m in Congress. Of course I disagree with that.

Our job is to pass new laws to evolve to what society has in the case of cryptocurrency, it could be one of four different types of archaic assets that are being discussed by Chair Gensler: it could be a commodity, a security, a currency and even could be a future.

Trying to fit it into 20th century boxes just doesn’t work. But, there is good news. We had bills that passed the House to help get the agencies to respond and get their input before we pass laws. While the Senate didn’t take it up, President Biden put out his Executive Order and utilized a lot of that language. The holdup is Congress needs to hear back from agencies. I’d wave a magic wand tomorrow and start defining these things but some of my colleagues want to hear from the executive branch as well. So, right now Congress is in that dialogue. We expect over the next couple of months to get those reports back, and then we’ll put pen to paper… but saying that 20th century financial definitions are going to define 21st century cryptocurrencies is just off the mark.

What is a Light Touch to Regulation

CONGRESSMAN DARREN SOTO: It starts with defining jurisdictions so that we don’t have agency overlap. It also makes sure that we’re starting with basic rules of the road like we did for the Internet… back in the late 90s, early 2000s. So now we’re at a point where things like 340, we may need to amend but at the time, we put in some basic rules the road to protect consumers. We just want to make sure we have guardrails for the most blatant frauds that you could see like “pump and dump” and other things that that are that are intentional rather than the risks of the market which are naturally going to be there similar to stocks and precious metals and other currencies. There needs to be basic rules to protect consumers. But other than that, we need to allow for innovation.

On Clarity

CONGRESSMAN DARREN SOTO: We are troubled by the fact that many new crypto firms are paying half their costs in legal just to help navigate so many of these different jurisdictions. That is troubling to us. We see a big move happening when China decided not to play anymore cryptocurrency – that puts us and Europe as natural leads on this. But without rules of the road and uncertainty, it’s tough to get capital to start a lot of these different companies.

What Parts of the Lummis/Gillibrand Bill Would Have Bipartisan Report

CONGRESSMAN DARREN SOTO: I can’t say that I’ve read every single word [of the Lummis/Gillibrand bill] and poured through it – we have two chambers, right? And, we in the House put out our own ideas with the Digital Taxonomy Act and the Token Taxonomy Act which is an even lighter touch than what they’re talking about in the Senate with Representative Warren Davidson, a Republican from Ohio, and I’m a Democrat from Central Florida. So we’ll put out and progress our own bills, [the Senate will] be putting out theirs and then we’ll either go to conference there will be negotiating between the chambers. But, we believe in the bills we’ve already put out.

On Using Crypto and Educating

CONGRESSMAN DARREN SOTO: I’ve been interested in it for a while for the use of it. I represent Central Florida place where folks come to travel from all around the world to our top theme parks, our beaches and so many other great things. When we’re talking about doing international services like putting together – as a travel agent – someone’s experience in Central Florida or helping out with other services in that are, you reduce friction costs by using cryptocurrency across several different nations. That’s a big, exciting part of what can help Central Florida in that we do so much international tourism business, but also for remittances. We have a lot of first generation immigrants and they have family members back in places that are not stable like Venezuela. And now we’re seeing in Ukraine how crypto was able to help – through decentralized currency – undermine the the attacks that have been [carried out by an] unjustified Russia.

Continue reading “House Has “Our Own Ideas” Says Rep. Soto Regarding Lummis/Gillibrand Bill”