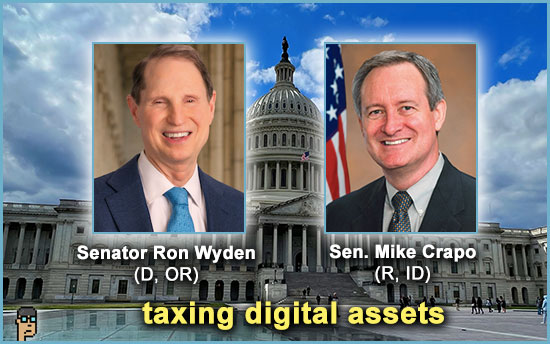

digital assets taxation

“In Letter to Stakeholders and Experts, Finance Leaders Seek Input to Address Uncertain Tax Treatment of Digital Assets” … so begins a press release from Senate Finance Committee Chairman Sen. Ron Wyden (D, OR) and Ranking Member Sen. Mike Crapo, (R, ID), who are attempting to address the need for proper taxation of digital assets beginning with feedback from the digital assets community and anyone else who cares to share. As evidenced by the detail of the release, this will be no small undertaking – just like most things in digital assets. Read it.

To breakdown where digital assets tax stands today, the Committee’s leaders asked the Joint Committee on Taxation (JCT) to compile a report on the taxation of digital assets – get the 24-page PDF here.

Jason Schwartz, a tax partner & digital assets co-head at law firm Fried-Frank, who also calls himself “Crypto Tax Guy,” quickly offered an analysis via a tweet thread examining each section of the Senators’ outline.

On wash sales, for example, Schwartz opined, “If you sell stock or bonds at a loss and buy back within 30 days, the tax loss is disallowed. The same rule doesn’t generally apply to crypto. Sound tax policy probably dictates that the wash sales apply to crypto in the same way they apply to stock & bonds.” Read the thread. Continue reading “Senate Finance Begins To Explore Digital Assets Taxation; DOJ Unveils DEX Fraud Arrest”