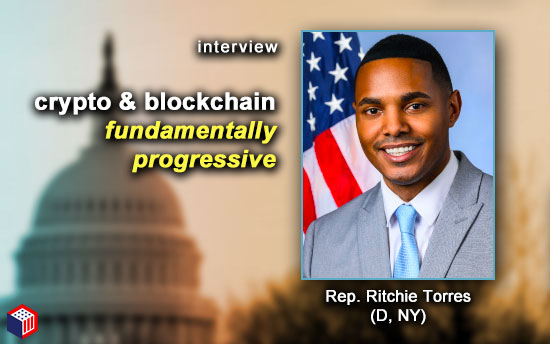

As a member of the House Financial Services (HFS) Committee and proud representative of his district in the Bronx, New York, Rep. Ritchie Torres (D, NY) has been at the front of lines of the evolution of the U.S. financial system in the 118th Congress.

And though he’s a staunch supporter of the Democratic Party, Torres has been unafraid to break with his Caucus’ leadership when he has believed it’s in the best interests of his constituency. Digital assets has been one such beneficiary of his independence.

Congressman Torres voted in support of the stablecoin and digital asset market structure bills at markup hearings last July, co-sponsored the bipartisan Keep Innovation In America Act of 2023 [H.R.1414], signed on to support numerous bipartisan Congressional letters on digital assets and consistently delivered engaged, tough questioning of U.S. government regulators at public hearings.

After the conclusion of an HFS Subcommittee for Digital Assets, Financial Technology and Inclusion hearing on illicit finance earlier today, Rep. Torres discussed his views on digital assets and Congress with blockchain tipsheet.

Topics included:

-

- The progressive case for digital assets

- Where “Big Tech” fits in

- Stablecoin legislation

- The SEC and crypto

- Congressional generational divide

- On the industry

- SAB 121

The interview has been lightly edited for clarity.

blockchain tipsheet: What is the progressive case for digital assets?

Rep. Torres: There’s a sense in which crypto is something of a Rorschach test on which you can project your own ideological biases. I see the project of crypto and blockchain as fundamentally progressive.

It seems to me a project of radically decentralizing finance – creating a better, cheaper, faster payment system – strikes me as progressive.

The project of radically decentralizing the Internet – creating a new layer of the Internet known as web3 – strikes me as progressive.

If you’re concerned about the concentrated power of “Big Tech” and Wall Street, there’s a compelling alternative to be found in crypto.

There is some bipartisan pushback in Congress these days with “Big Tech.” As you make the case on digital assets, do you think the “Big Tech” element is affecting things?

It’s unclear because you have Members of Congress who might rail against Wall Street, for example, but then also reject the very technology that would decentralize the power of Wall Street. I’ve seen cognitive dissonance from the critics of crypto.

Stablecoin law has taken a lot longer than people have expected. What are you looking for in federal stablecoin legislation? And do you see stablecoin law this year?

The President’s Working Group – particularly the Treasury – has proposed banking regulation for stablecoins. It seems to me that unlike a bank, a stablecoin issuer has no fractionalization of reserves and no lending function. And so if a stablecoin issuer has no lending and no fractional reserves, it would seem to me that it operates differently from a bank and therefore should be regulated differently.

I find it straightforward. First, I consider stablecoins to be the natural starting point for crypto regulation. It’s the lowest hanging fruit. And there’s a consensus that the reserves of a stablecoin should consist of 100% cash or cash equivalents and those reserves should be verified not only by self-attestation, but by third-party audits.

And so it seems the easiest to achieve in the way of crypto regulations. And as I understand, there could be a compromise between [House Financial Services Chair Patrick McHenry (R, NC)] and [Ranking Member Maxine Waters (D, CA)] on the subject of stablecoins.

The most intractable issue is the balance of power between the federal government and the states. That’s the hardest issue to resolve in the debate about stablecoin regulation.

Do you have a solution there?

I’m a strong supporter of the New York State Department of Financial Services. I would oppose any and all proposals that would pre-empt New York State DFS. Having said that, I could imagine a regime of tiered regulation in which… if a stablecoin reaches a certain size or passes a certain threshold, then it’s primarily subject to federal regulation. So there is a compromise to be struck.

Regarding the Securities and Exchange Commission (SEC), is there a problem at the SEC regarding crypto? How would you solve it if there is?

I fundamentally disagree with the approach that [Chair Gary Gensler] has taken with respect to crypto.

The first has been… a lack of regulatory clarity. Now, Mr. Gensler has said that Ethereum is not a security. He then said it was a security. He then said it depends. So the CFTC insists that Ethereum is a commodity, whereas the SEC insists that it may be a security. And so not only do you have mixed messaging between regulatory agencies, you have mixed messaging within those regulatory agencies and it creates more confusion than clarity.

And I’m critical of what has been described as regulation by enforcement. For me, the SEC is the equivalent of a traffic agent who excessively and overzealously tickets drivers without telling them the speed limit. Clarity is the cornerstone of compliance. We have an obligation to tell people what the law is in order to enable their compliance.

With Rep. Mike Flood (R, NE) and others in September, you signed a letter to the SEC coming out of the Grayscale decision that you were supportive of Bitcoin ETFs going forward and urged the Commission to expedite approval. Should we expect another letter regarding Ethereum ETFs?

If it’s compliant with the law, then it should be granted approval.

In the past, you’ve talked about a generational divide in digital assets in Congress. Can you speak to what you mean by that and… will it take a generation for effective digital assets legislation in your opinion?

It’s hardly a state secret that Congress is a gerontocracy. When I first arrived in Congress, all of our leaders were at or above the age of 80. All but a few of our committee chairs were at or above the age of 70. There’s a danger in generalizing, but I find that the “old guard” tends to be more suspicious of change and more skeptical about emerging technologies. There’s a kind of a xenophobia about emerging technologies like crypto and blockchain.

Whereas there’s a new generation of Members – like myself and [Rep. Wiley Nickel (D, NC)] – who are much more receptive to the potentialities of emerging technologies. And we see it as the role of government not to sabotage the growth of emerging technologies, but to properly regulate it… create a regulatory framework that enables the best actors to innovate while filtering out the worst.

Turning to the industry…. what is the industry doing well, in your opinion? And then, as it relates to digital assets legislation, what can it do better?

So, I have noticed that the industry has become much more active in DC. For a long time, I felt the crypto community was more active on Twitter than in DC. And I’ve said to my friends in the crypto community: there is no universe in which politics is irrelevant. Politics will determine the future of crypto and blockchain as it will for all emerging technologies.

If you do not define what you stand for, others will define it for you. If you do not tell your story for yourself, others will tell it for you. For far too long, the crypto community has allowed itself to be defined by its critics rather than by its own pro-active storytelling. Finally, I’m beginning to see the crypto industry assert itself in DC, tell its story and make the case for the technology.

Is there anything the industry can do better?

It’s improving, but there’s considerable disinformation and “mal information” surrounding the nature of crypto and blockchain. There’s quite a bit of educating that needs to be done. If you were ask to the average Member to define crypto, blockchain and web3 and to distinguish among the three, I’m not clear that most Members could answer that question.

Regarding SAB 121, you were involved in a bipartisan letter in November to prudential regulators urging them NOT to support SAB 121 in light of a GAO report. There’s a Congressional Review Act resolution out there right now regarding SAB 121. What’s your expectation there?

If it came to the floor for a vote, I would vote for it.

The bulletin is not so much about crypto as it is about blockchain. It’s more about tokenization of real assets. It will enable more efficient custody. And the bulletin from the SEC is inhibiting innovation from banks that want to bring custody into the 21st century. It’s an example of the SEC overstepping its boundaries and stifling technological innovation.

One can be suspicious of crypto – as many people are – and still see value in tokenization, still see value in the technology of blockchain. It’s a distinction that’s often made by JP Morgan CEO Jamie Dimon. Jamie Dimon is no friend of crypto, but he sees immense value in blockchain technology. And banks like JP Morgan have their own blockchain.