lawsuit pre-empts SEC

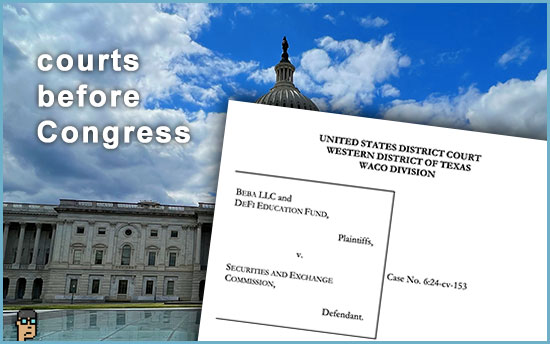

Here’s a novel, industry approach to the Securities and Exchange Commission’s (SEC) “regulation by enforcement” approach to digital assets: sue the SEC before they sue you.

Amanda Tuminelli, Chief Legal Officer of DeFi Education Fund, announced yesterday that her organization along with a digital assets and apparel startup Beba had formally sued the Securities and Exchange Commission.

Tuminelli said on X, “Today, DeFi Education Fund and Beba Collection

sued the SEC. It has everything to do with airdrops + stopping the SEC’s regulation by enforcement crusade against our industry.” See the complaint.

The complaint notes the startup’s beginnings and the two brothers, originally from East Africa, who had started a business in Waco, Texas, which featured local artisans and incorporated the use of digital asset tokens.

Axios covers the news and explains, “The [lawsuit] is part of an evolving legal strategy for the crypto industry that strikes back at what it believes is an unlawful pattern of enforcement actions, and seeks to compel the regulator to create a clear set of rules.” Read more.

what you should know: It’s a long road to hoe but this is another element of industry strategy in the United States: hammer out a regulatory framework through the courts if Congress and regulators aren’t cooperating.

Fidelity hearts crypto

Reporter Leo Schwartz recounts the crypto origin story as well as the roadmap ahead for investment behemoth Fidelity for a feature story in Fortune.

Did you know the company has dabbled in the mining of Bitcoin since 2014? You do now.

Fidelity’s head of product strategy at its digital assets subsidiary, Terrence Dempsey, tells Fortune that the company will move beyond its current crypto trading execution services for Bitcoin and Ether: “We did not set out to be a Bitcoin and Ethereum-only shop.” Read the big vision (Fortune on Yahoo).

op-ed – Majority Whip Emmer

An op-ed by House Majority Whip Tom Emmer (R, MN) in The Hill yesterday promoted his CBDC Anti-Surveillance State Act [H.R.5403], which passed out of a House Financial Services markup last September and awaits a House Floor vote.

Mr. Emmer writes in The Hill, “If not open, permissionless and private – a CBDC (Central Bank Digital Currency) is nothing more than a China-style surveillance tool that can be weaponized to oppress the American way of life.” Read more.

more links:

-

- What Is a Central Bank Digital Currency (CBDC)? – Investopedia

what you should know: Support for the bill, which is now also guided by Senator Ted Cruz (R, TX) in the Senate [S.3801], has become a litmus test of sorts for Republicans with 136 co-sponsors and counting for Emmer’s bill in the House. The conservative Heritage Foundation has said it will “grade” lawmakers according to whether they are “for” or “against” a CBDC. Side note: The unspoken message to Speaker Mike Johnson (R, LA) from Whip Emmer is, “Let’s make sure we put this to a floor vote in the 118th Congress.”

Rep. Flood event

Rep. Mike Flood (R, NE) announced the second annual Flyover Fintech event for October 21 in Lincoln, Nebraska. See the FlyoverFintech.com website.

Last year’s event included House Financial Services Subcommittee Chair French Hill (R, AR) and HFS member Rep. Warren Davidson (R, OH) among many others. One of the highlights of last year’s meeting was an “insiders” discussion between the three Congressmen on the digital assets legislative agenda, in particular. Sign up is here.

what you should know: With the event taking place a couple of weeks before the general election, no doubt this event will have a unique set of fintech insights.

today’s news about Ripple

“As you will see when the SEC’s brief is made public tomorrow, they ask the Judge for $2B in fines and penalties. (…) Rather than faithfully apply the law, the SEC remains bent on wanting to punish and intimidate Ripple – and the industry at large” (yesterday afternoon) – Stuart Alderoty, Chief Legal Officer, Ripple on X

op-ed – Democrats and legislation

The PROOF Act [S. 3087], introduced by Senators Thom Tillis (R, NC) and John Hickenlooper (D, CO) in October 2023 and Rep. Don Beyer’s (D, VA) Off-Chain Digital Commodity Transaction Reporting Act [H.R.5966] take centerstage in a opinion piece on CoinDesk.

Bruce Tupper of CoinRegTech and Galaxy counsel Tyler Williams argue that “These legislative efforts are novel in using blockchain technology’s noteworthy public transparency and auditability functionality.” The authors effectively argue something is better than nothing. Read more.

what you should know: Together, these bills would appear to be a far cry from the more comprehensive digital asset market structure bill [H.R.4763] or Lummis-Gillibrand‘s Responsible Financial Innovation Act [S.2281] . On the other hand, the two bills with Democrat sponsors could offer the seeds of a winnowed compromise that interests Senate Democrats – a significant hurdle to date – and House Republicans looking for a “win” for their agenda in the 118th Congress.

op-ed – crypto clean

In an op-ed in the Harvard Business Review titled, “Is Crypto Cleaning Up Its Act?“, Mariia Petryk, a professor at George Mason University, is optimistic on crypto in the United States in spite of current regulatory challenges.

She writes, “While political gridlock may prevent lawmakers from drafting tailored regulations for crypto anytime soon, encouraging crypto projects’ self-initiated compliance with comparable frameworks such as those implemented by FinCEN may serve as a functional workaround.” Read it.

still more tips

Elizabeth Warren: Crypto is helping rogue states, terrorists and criminal organizations on a scale ‘we have never seen before’ (from March 21 hearing) – The Block

Bitcoin’s Surge Stirs Crypto VC From Its Slumber – The Wall Street Journal

Bitcoin ‘Halving’ Spurs Exodus of Old US Mining Computers Abroad – Bloomberg

How Binance exec made daring escape from Nigerian custody after prayer service – DL News

Terraform Labs founder Do Kwon built ‘house of cards,’ SEC lawyer says at crypto fraud trial – New York Post