Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

anti-CBDC bill

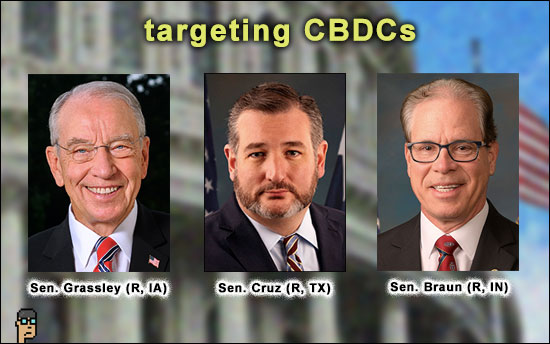

Yesterday, Senator Ted Cruz (R, TX) who has been making noise lately (see his bill on Jobs Act crypto taxation changes) that he wants a seat at the digital assets legislation table, announced the re-introduction of an anti-Central Bank Digital Currency (CBDC) bill co-sponsored by Senator Mike Braun (R, IN) and Senator Charles Grassley (R, IA).

See: S.887 – A bill to amend the Federal Reserve Act to prohibit the Federal reserve banks from offering certain products or services directly to an individual, and for other purposes – Congress.gov

From the press release: “Specifically, the legislation prohibits the Federal Reserve from developing a direct-to-consumer CBDC which could be used as a financial surveillance tool by the federal government, similar to what is currently happening in China. The bill aims to maintain the dollar’s dominance without competing with the private sector.” Read the release.

This bill echoes the efforts of Majority Whip Rep. Tom Emmer (R, MN) who introduced the “CBDC Anti-Surveillance Act” in late February – read more on that one.

Coinbase – enforcement action imminent

Coinbase announced yesterday afternoon that the Securities and Exchange Commission served the company a Wells notice which means an enforcement action is imminent. The company’s reaction was measured and disappointed as Coinbase’s Chief Legal Officer Paul Grewal explained on the company blog, “Today’s Wells notice does not provide a lot of information for us to respond to. The SEC staff told us they have identified potential violations of securities law, but little more. We asked the SEC specifically to identify which assets on our platforms they believe may be securities, and they declined to do so.”

Decrying a lack of a regulatory framework, the company says it will fight -in so many words. Read this detailed defense.

Tips:

Coinbase – on bank failures

Prior to the Wells Notice announcement (or perhaps knowing it was imminent?), Coinbase announced it was going on the offensive when it comes to protecting its hard-won crypto turf in the United States. In a post on the Coinbase blog, the company’s Chief Policy Officer Faryar Shirzad provides a top 10 “lessons learned” from the recent/current banking crisis:

He writes, “TLDR: The recent failures of three U.S. banks have raised questions about the role of crypto in the American financial system. Here’s what we know from a crypto perspective:” And then begins with #1 on the list: “Crypto did not cause the recent bank failures.” Read the other 9.

Coinbase – international

With crypto prices climbing, (and, once again, before the Wells Notice was announced) Coinbase is in an increasingly strong position in spite of regulatory headwinds in the U.S. says The Information. Rumors have been circulating recently – see this article from The Block – that the company is looking offshore to improve the company’s long term growth prospects. MoffettNathanson analyst Lisa Ellis comments, “I think it’s become increasingly evident to Coinbase over the last six months or so that they’d be best served as a company to diversify internationally.” Read more (subscription).

The Information adds, “Coinbase is already operating in dozens of countries like Australia, Brazil and Germany. But ,a new trading platform with derivatives products not offered in the U.S. could set it up to compete with firms like Binance.”

CFTC – decentralized finance

Yesterday’s meeting of the “newly constituted” Technology Advisory Committee (TAC) of the Commodity Futures Trading Commission (CFTC) commenced and was led by Commissioner Christy Goldsmith Romero. She outlined that TAC’s purpose is to provide a “foundational understanding of the technology, and the specific implications for finance and law.” It’s also an important way for the Commission to communicate with industry and the public.

On the subject of decentralized finance – a major topic in the day’s agenda – Goldsmith Romero said, “While DeFi may hold the promise of avoiding some of the vulnerabilities of centralized exchanges, and may hold the possibility for making our financial system more accessible and inclusive, DeFi presents unique challenges, which we will hear about today. One is the foundational issue of accountability. Some say that accountability rests in code, protocols, and smart contracts, or in evolving governance structures. However, organizations may also have varying degrees and areas of centralization that can lead to accountability.” Read her statement.

Coming out of the TAC meeting, there will be a new Subcommittee created on Digital Assets and Blockchain Technology.

Tips:

CFTC – privacy-identity use case

Digital identity was among the hot topics of yesterday’s CFTC Technology Advisory Committee. In a similar vein, Jill Gunter, Chief Strategy Officer of Espresso Systems, mentioned that Tornado Cash was seen as instrumental in helping make donations to Ukraine and offered up Ethereum co-founder Vitalik Buterin as a use case: “Given his background and nationality (Russian), he was primarily comfortable at the time of donating to the Ukraine efforts on-chain with the theory that he could use Tornado Cash as a privacy tool.” See the video at 1:51:38.

crypto derivatives

When FTX imploded, it let go of a dominant position in crypto derivatives. Multiple companies are trying to fill that void. “For crypto exchanges aiming to diversify their revenue streams, expanding into institution-focused derivatives can help them weather bear markets. Many exchanges primarily rely on revenue from transaction fees collected from spot trades by retail traders, whose interest in crypto has waned, particularly after FTX,” reports Bloomberg. Blockchain.com and Gemini are showing interest in FTX’s derivatives exchange LedgerX, which is registered with the CFTC. Read more (subscription).

more tips

-

-

- Tron Founder Justin Sun Sued by U.S. SEC on Securities, Market Manipulation Charges – CoinDesk

- Crypto Entrepreneur and Celebrity Promoters Face S.E.C. Charges – The New York Times

- Crypto Is Mostly Over. Its Carbon Emissions Are Not – The Atlantic

- Unregulated crypto ATMs give criminals a loophole to prey on unsuspecting victims – CBS News

- Judge approves Celsius custody account settlement to return 72.5% of crypto assets – The Block

-

If you would like this delivered as a newsletter, please sign up here.