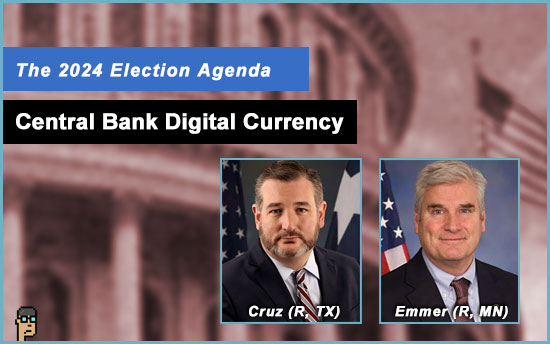

Cruz joins CBDC bill

Yesterday, Senator Ted Cruz (R, TX) brought his “upper house” seal of approval to anti-CBDC (Central Bank Digital Currency) sentiments currently being driven by Majority Whip Tom Emmer (R, MN) and his “CBDC Anti-Surveillance State Act” [H.R.5403] which includes 97 Republican co-sponsors.

Republicans see opportunity with the CBDC issue in the 2024 general election says Fox Business.

Senator Cruz, the Ranking Member on Senate Commerce, shares with Fox that he and five “Senate colleagues, including Bill Hagerty (R, TN), Rick Scott (R, FL), Ted Budd (R, NC), Mike Braun (R, IN), and Kevin Cramer (R, NC), will sponsor a new bill called the Central Bank Digital Currency Anti-Surveillance State Act.” Read more.

Treasury rumor

Commodity Futures Trading Commission (CFTC) Commissioner Kristin Johnson may be getting a new job. Politico reported yesterday that she’s under consideration for Assistant Secretary for Financial Institutions at Treasury. Read more from Politico (subscription).

Commissioner Christy Goldsmith Romero (D) has also been rumored for the position.

Commissioner Johnson, a Democrat, has been active on issues related to digital assets including public speaking at events such as Blockchain Association’s Policy Summit last November (her remarks). When she first arrived at the Commission in 2022, she moderated a CFTC webcast titled “Digital Assets and Financial Inclusion.”

SAB 121 – critique

In a Newsweek op-ed titled, “The SEC Must Change Course To Protect Bitcoin ETF Investors,” Reps. Mike Flood (R, NE) and Wiley Nickel (D, NC) deliver a bipartisan critique of the Securities and Exchange Commission’s (SEC) Staff Account Bulletin 121 (SAB 121) which prevented the regulated banking industry from custody-ing on behalf of Bitcoin ETF funds (Coinbase got all the business.).

The Members write, “Staff accounting bulletins are not usually controversial. They are typically technical accounting guidance—not the sort of thing that elicits an editorial response by members of Congress. SAB 121’s effects on bank custody of digital assets, however, is cause for serious concern.” Interesting to see Flood and Nickel target consumers (via Newsweek) with this message. Read more.

what you should know: The bipartisan, bicameral Congressional Review Act resolution from Reps. Flood and Nickel and Senator Cynthia Lummis (R, WY) is looming in Congress and seeks to overturn SAB 121.

SAB 121 – markup

Late yesterday, House Financial Services announced that it will be holding a markup this Thursday at 10 a.m. Among the bills to be discussed and voted on will be the joint resolution looking to overturn SAB 121 from Reps. Flood and Nickel [H.J.Res. 109].

(h/t @CodyCarboneDC)

use case – bill of lading

Lloyds Bank in the United Kingdom became one of the first companies to use blockchain for electronic bills of lading (eBL). Ledger Insights explains, “A bill of lading is usually a piece of paper issued at the docks once cargo is loaded. It controls cargo ownership once loaded onto a ship or aircraft. In the simplest mode, the exporter would send the paper via courier to the importer, enabling them to collect the cargo on arrival.” The electronic bills of lading are via the blockchain and offer improved speed and security -but still only account for 2% of the market says Ledger Insights. Read more.

AI coins

Don’t look now, but artificial intelligence (AI) has its own cryptocurrencies, too. The so-called AI coins “offer exposure to niche blockchain technologies rather than the broader market of AI technology, which would be more accessible through Nvidia or Google shares,” explains Unchained. AI coins’ prices have been pumping in crypto markets, too, recalling the alt-coin bubble of 2017-2018. Read more.

more tips:

Top 10 Artificial Intelligence (AI) Cryptocurrencies – Forbes

number go up

Prospect of spot ETFs not behind ether’s break above $3,000: Bernstein – The Block

Ethereum Ecosystem Continues To Rally Into New Year-To-Date Highs – The Defiant

Stablecoin Market Jumps by Over $2.5 Billion in 10 Days, Led by Rise in Key Players – Bitcoin.com

what you should know: If Bitcoin exceeds its all-time high of $65k or so, there is no question cryptocurrency will join the 2024 election agenda as crypto conversation returns to the dinner table. As of last night, Bitcoin was at $56k+ and up nearly 10% for the day.

tornado cash hacked

In the past year, Tornado Cash has been at the center of discussions about crypto mixing, privacy and money laundering. Now, it joins the list of crypto platforms which have been hacked. CoinDesk reports that “an exploit” – new code added to Tornado Cash’s backend – has potentially enabled the theft of user deposits. Read more.

correction

The new “Financial Services Innovation Act of 2024” [H.R.7440] introduced last Friday by House Financial Services Chair Patrick McHenry (R, NC) which creates a new “Financial Services Innovation Office” (FSIO) across a group of agencies does not include the CFTC because, well, the agency is not the jurisdiction of the House Financial Services Committee. The CFTC is the domain of House Agriculture. See H.R.7440 on Congress.gov.

what you should know: This Thursday’s House Financial Services markup will include a vote on H.R.7440. See hearing page.

still more tips

Italy launches two public consultations on draft decrees on markets in crypto-assets (MiCAR) and transfers of funds and certain crypto-assets (TFR) – JD Supra

Stung by FUD, Hong Kong’s web3 dream is in jeopardy – DL News

Opinion: Crypto is pretty bad internet cash – Blockworks