Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

big conference

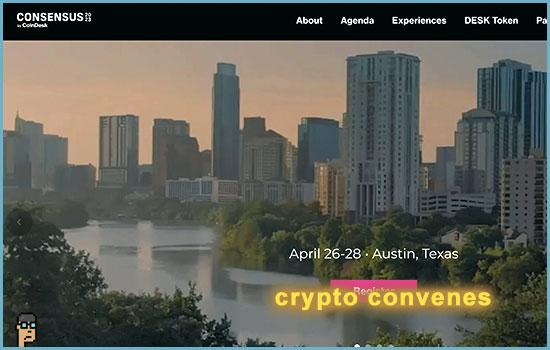

CoinDesk’s big Consensus 2023 conference is upon us and being held this week in Austin, Texas. The conference’s “Policy Summit” on Friday is devoted to regulation and crypto and includes a discussion with Commodity Futures Trading Commission (CFTC) Commissioner Christy Goldsmith Romero.

See the “Policy Summit” agenda.

Perhaps due to FTX’s implosion and the crypto regulation winter in Washington, the agenda is noticeably slimmer in terms of U.S. government participation when comparing to last year’s agenda which included Senators Cynthia Lummis (R, WY), Kirsten Gillibrand (D, NY), Patrick Toomey (R, PA), Rep. Patrick McHenry (R, NC) and CFTC Chair Rostin Behnam.

Hear CoinDesk’s Nikhilesh De discuss the Policy Summit highlights including participation by a number of global regulators – go now.

co-sponsoring the fix

If there’s one digital assets-related bill that could – or should – pass, it’s this one.

House Financial Services (HFS) Chair Rep. Patrick McHenry’s (R, NC) “Keep Innovation in America Act,” – which is the latest bill to offer fixes to onerous Internal Revenue Service (IRS) reporting requirements coming out of the 2021 Jobs Act and affected crypto miners and wallet providers – has added Rep. Byron Donalds (R, FL) as a co-sponsor and brings the total number of legislators on the bill to ten along with McHenry:

Rep. Ritchie Torres (D, NY)

Rep. Warren Davidson (R, OH)

Rep. Ro Khanna (D, CA)

Rep. Tom Emmer (R, MN)

Rep. Eric Swalwell (D,CA)

Rep. David Schweikert (R, AZ)

Rep. Darren Soto (D, FL)

Rep. French Hill (R, AR)

Rep. Donalds

Chair McHenry

See: H.R.1414 – Keep Innovation in America Act – congress.gov

As suggested above… if anything is going to pass the House and Senate in terms of digital assets legislation, it would seem to be a lightweight bill such as this one with bipartisan support – or even as a rider to something larger.

In the Senate, Senator Ted Cruz’s (R, TX) S.695 bill or a re-introduction of Senator Mark Warner (D, VA) and Senator Patrick Toomey’s (R, PA) bill from the previous Congress could also do the trick.

The increasingly apparent “anti-crypto” strategy by Democratic party leadership may undermine any support, though, as being “anti-crypto” is seen as a winning position by Democrats for the 2024 general election. This stance likely led to Ranking Member Rep. Maxine Waters (D, CA) abrupt about-face last week and the implosion of stablecoin bill efforts. (She supported it in March.)

HFS Digital Assets Hearings

In addition to this Thursday’s House Ag hearing on digital assets, Chair Rep. French Hill (R, AR) will reconvene his Subcommittee on Digital Assets, Financial Technology and Inclusion for a hearing on Thursday at 2 p.m. titled, “The Future of Digital Assets: Identifying the Regulatory Gaps in Digital Asset Market Structure.” See a bit more on the HFS website. No agenda is available yet, but HFS Chair McHenry has promised close coordination with his doppelgänger on House Agriculture, Chair Rep. Glenn “GT” Thompson (R, PA) on digital assets legislation.

On that note, HFS will roll out another hearing likely to be crypto-related on Thursday at 2 p.m. titled, “Oversight of the Financial Crimes Enforcement Network (FinCEN) and the Office of Terrorism and Financial Intelligence (TFI).” Subcommittee Chair Rep. Blaine Luetkemeyer (R, MO) will lead the meeting with Ranking Member Rep. Joyce Beatty (D, OH). No agenda yet on that one either, but will be available here.

DeFi ban efforts

Morrison Cohen lawyer Jason Gottlieb says, “The SEC is simply seeking to ban DeFi protocols in America,” as The Wall Street Journal’s Paul Kiernan looks at how decentralized finance (DeFi) exchanges are being brought under the umbrella of the Howey Test and the SEC. Kiernan notes that you don’t need to be an exchange to be defined as an “exchange” by the SEC – you just need some governance tokens. Oh really?

blockchain detective dollars

In a feature article, the New York Times takes a look at blockchain analytics firms – including Chainalysis, TRM Labs and Elliptic – and their flourishing government agency-fueled businesses. Regarding Chainalysis, “Two-thirds of its revenue comes from partnerships with public institutions, including law-enforcement agencies, the company says, a source of income that remains relatively stable even when the market implodes,” reports the Times. Read this one.

crypto and penny stocks

On Friday, Axios’ Crystal Kim reports that guidance by the Securities and Exchange Commission for broker-dealers and investment adviser conduct may preclude suggestions about crypto. Kim writes, “Among other things, brokers and advisers should ‘apply heightened scrutiny’ in recommending or advising about complex and risky products, such as, but not limited to penny stocks, inverse or leveraged exchange-traded products, and crypto are adopted.” Read more.

from the twitter

“Yesterday, Kraken filed its response to the IRS’s attempt to obtain user data for US customers through a John Doe summons. It has been 2 years since the IRS served Kraken with the summons. The IRS sought court enforcement earlier this year…” (thread) – Miles Fuller, @TaxBitMiles on Twitter

Yuga Labs Wins Key Victory in NFT Trademark Lawsuit (thread) – Jessica Neer McDonald, @neermcd on Twitter

still more tips

Grading Gensler: SEC Advocates Offer Some Takes Two Years In – Capitol Account

Do Kwon, Jailed Crypto CEO, Rejects SEC Fraud Allegations – The Wall Street Journal

Opinion: How is artificial intelligence revolutionizing financial services? – CoinTelegraph

If you would like this delivered as a newsletter, please sign up here.