Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

digital asset AML returns

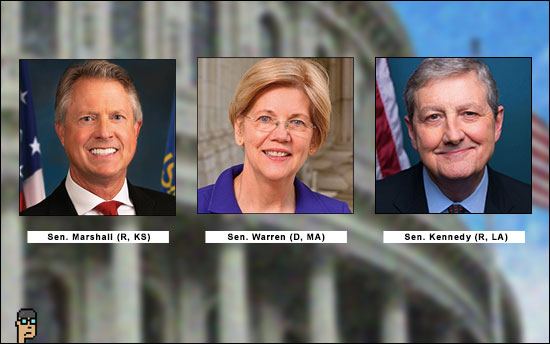

Building on momentum from her appearance at yesterday’s Senate Banking hearing, Senator Elizabeth Warren (D, MA) announced yesterday afternoon that she would re-introduce her and Senator Roger Marshall’s (R, KS) Digital Asset Anti-Money Laundering Act of 2022. “… Legislation that would put up guardrails around crypto by closing loopholes in the existing anti-money laundering and countering of the financing of terrorism (AML/CFT) framework and bringing the whole of the digital asset ecosystem into compliance with the rules that govern the rest of the financial system.”

Read yesterday’s press release by Senator Warren.

Also, read Senator Warren’s press release from last December on the bill.

The bill puts stringent Anti-Money Laundering (AML) and Know-Your-Customer (KYC) restrictions on crypto and is generally reviled by the industry including industry organization Coin Center which called it “unconstitutional” when it was initially introduced. Read that one.

Warren’s bipartisan coalition – Marshall

The bipartisan coalition focused on reining in crypto and put together by Senator Elizabeth Warren (D, MA) is the subject of a feature on Politico. One of her Republican partners, Senator Roger Marshall (R, KS) says, “The physician in me says the risks [of crypto] do not outweigh the benefits. (…) Until they solve the national security issues, I don’t see the benefits outweigh the risks.” Read more.

Warren’s bipartisan coalition #2 – Marshall + Kennedy

Separately, in December and January, Warren, Marshall and Senator John Kennedy (R, LA) combined their efforts to put pressure on U.S. bank holding company Silvergate Capital Corporation for its participation in the crypto ecosystem.

policy strategy

Blockchain Association’s Jake Chervinsky rallies the troops in a tweet thread on blockchain policy dynamics in the United States. He identifies five priorities for effecting a positive policy outcome for the crypto industry and begins, “FIRST, we can participate in public process and make our voices heard. (…) SECOND, we can take the agencies to court if they fail to observe proper process, overstep their authority, or infringe constitutional rights.” Read the final three points.

New York state of mine

An ongoing dispute with a Bitcoin mining company and the city of Niagara Falls, New York, is reaching a crescendo in court after the city charged that the mining facility is creating “a public nuisance” and violating the city’s zoning code.

The Lockport Union-Sun Journal in upstate New York reports that a judge has already found the crypto mining company, U.S. Bitcoin, in contempt. Niagara Falls lawyers are seeking “a preliminary injunction to force the cryptocurrency mining company to comply with a new zoning ordinance governing high-energy use industries.” Read more.

compliant non-compliance

In an interview with CoinDesk, TuongVy Le, a Bain Capital partner and head of regulatory and policy, expresses frustration with the Securities and Exchange Commission (SEC) in the wake of the Kraken enforcement action. She explains, “When the SEC tells us that something is not compliant, it’s not necessarily the same thing as telling us what they would consider compliant.” Read more.

edges and fringes

-

- US Crackdown Seeks to Push Crypto Back to the Fringes of Finance – Bloomberg

- Crypto markets on edge as U.S. regulatory crackdown on industry intensifies – CNBC

- Crypto is joining the grown-up table, and no one is happy about it – CNN

- Serious about your crypto project? Binance’s CEO says you should move – The Block

You want more

If you would like this delivered as a newsletter, please sign up here.