Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

hearing – digital assets

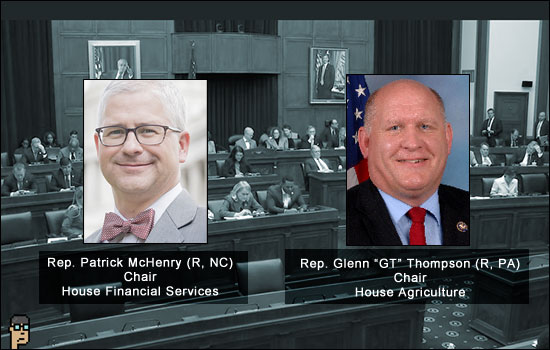

House Financial Services (HFS) Chair Patrick McHenry (R, NC) has opened the HFS subcommittee floodgates on 118th Congress hearings beginning next week with topics championed by Republicans. See them.

The first hearing of the Digital Assets, Financial Technology and Inclusion Subcommittee with its Chair Rep. French Hill (R, AR) presiding will take place on Thursday, March 9 and echoes the partisan subterfuge theme of a recent letter sent to SEC Chair Gary Gensler, a Democrat, by the HFS Committee regarding the timing of the arrest of FTX founder and CEO Sam Bankman-Fried.

The subcommittee hearing next week -“Coincidence or Coordinated? The Administration’s Attack on the Digital Asset Ecosystem” – appears to take aim at the “Operation Choke Point 2.0” theory that crypto companies are being unlawfully targeted. As of late, Senator Bill Hagerty (R, TN) on February 9 and blockchain technologist and investor Nic Carter on February 10 have suggested that the current “Operation Choke Point” operation is similar to the one which took place in 2013.

The subcommittee’s hearing information will appear here and will include the witness list and live webcast information.

Claiming the dissolution of bipartisan “vibes” when it comes to crypto legislation on the Hill, The New York Times’ DealBook blog says the “committee is having trouble getting companies to agree to participate in the hearing… Even with crypto executives calling for legislative action, few seem eager to engage in a highly political forum.” The subcommittee may want to invite the Fed, FDIC and OCC instead?

hearing – crypto commodity

The House Agriculture Committee may be dipping its toe back in the crypto end of the pool again as the full Committee announced a hearing for March 9 titled, “Rising Risks: Managing Volatility in Global Commodity Derivatives Markets.” See hearing’s event page.

(If you’re keeping score: House Ag is in the morning March 9; HFS Subcommittee on Digital Assets is in the afternoon.)

House Ag Chair Glenn “GT” Thompson (R, NC) may be taking over Congress’ crypto commodity legislation interests while the Senate Ag committee, Chairwoman Sen. Debbie Stabenow (D, MI) and Ranking Member Sen. John Boozman (R, AR) keep their distance from crypto and any mention of DCCPA and Sam Bankman-Fried. It also helps that Senate Ag can bathe itself with its work on the enormous Farm Bill.

Silvergate – going concern

Things went from bad to worse for U.S. bank holding company and crypto/fiat rails provider Silvergate Capital Corporation as the company announced in the past couple of days that 1) Silvergate’s Annual Report would be delayed. 2) Its ability to remain a “going-concern” was in jeopardy 3) On the news of the first two, crypto company clients began piling out of Silvergate and signing up with other banks. CoinDesk’s Nikhilesh De writes, “Coinbase, Circle, Paxos, Crypto.com, Bitstamp, CBOE Digital Markets, Galaxy Digital and Gemini all announced they would suspend Automated Clearing House (ACH) transfers and other business operations with the bank.” Read more.

At this time, it’s unclear what the fallout would be from a potential bankruptcy of Silvergate. Crypto winter deepens or is this the final flush?

letter to Binance

Senator Elizabeth Warren (D, MA) sent a letter co-signed by Chris Van Hollen (D, MD), and Roger Marshall (R, KS) “asking for answers about the company’s finances, risk management, and regulatory compliance as it faces investigations into potential crimes – including sanctions evasion, money laundering, and unlicensed money transmission,” according to a statement by Senator Warren’s office.

Addressed to Binance CEO Changpeng “CZ” Zhao and Binance.US CEO Brian Shroder, the letter lists many of the challenges recently faced by the global cryptocurrency platform such as the disintegration of the Paxos-BUSD stablecoin and charges that it did not implement proper AML/KYC guardrails for its trading entities. The letter does not mince words, “Binance and its related entities have purposefully evaded regulators, moved assets to criminals and sanctions evaders, and hidden basic financial information from its customers and the public.” See it (PDF).

Answers to a detailed list of seven questions are due in two weeks – March 16.

Yesterday’s letter aligns well with Senator Warren’s interests in pushing through a re-introduced version of the Digital Asset Anti-Money Laundering Act of 2022 with Senator Marshall.

letter to banking regulators

Senator Cynthia Lummis (R, WY), who is a member of the Senate Banking Committee, and HFS Chair Rep. Patrick McHenry (R, NC) sent a letter to a group of federal banking regulators yesteday about the inadequacies of Staff Accounting Bulletin 121 – a controversial crypto accounting change made by the SEC. The Lummis/McHenry press release says that SAB 121 “was intended to clarify the treatment of digital assets by banks and financial institutions, but instead has created greater risk in the system and will likely create significant compliance costs for institutions that custody digital assets for customers.” Read more.

The Federal Reserve, the Federal Deposit Insurance Corporation (FDIC), the Office of the Comptroller of the Currency and the National Credit Union Administration are asked to answer seven questions by March 16 such as “Has the SEC indicated that it will modify or withdraw SAB 121 in light of widespread comments that the Bulletin is flawed?” See the letter (PDF).

Last July, SEC Chair Gary Gensler spoke with Capitol Account and defended SAB 121 saying in part, “… [SEC Chief Accountant Paul Munter] and his team took this up and thoughtfully put out a staff accounting bulletin that the custody arrangements aren’t well enough developed and that crypto is sufficiently different than custody for stocks and bonds. That this should be on balance sheet.” Read more about that one.

US CBDC FYI

A Central Bank Digital Currency (CBDC) is not imminent in the United States writes Politico’s Sam Sutton, but the United States Treasury department is preparing for one in case, you know, there’s interest.

Treasury Under Secretary for Domestic Finance Nellie Lang spoke at length on CBDC strategy in front of an Atlantic Council audience on Wednesday. She concluded, in part, “Treasury is leading an interagency CBDC Working Group to support the Fed and develop recommendations related to policy objectives for which a broader Administration perspective is helpful.”

Tip: Read U.S. Treasury Under Secretary Nellie Lang’s speech

quotable

The following are a selection of quotes from yesterday’s Milken Institute’s Future of Digital Assets Symposium in Washington, D.C.

Rep. French Hill (R, AR), Chair of the Subcommittee on Digital Assets, Financial Technology and Inclusion.

“…what we need to be focused on is a regulatory framework for digital assets that preserves the ability for developers and innovators to use the blockchain with a tokenized payment in the US and for people to be able to custody that, value it fairly, transparently, in a regulatory safe and sound framework that complies fully with American law, incl. AML BSA.”

Former CFTC Commissioner Brian Quintenz and current head of policy at Andreessen-Horowitz:

“…what we have in the US is a completely out of control federal regulator at the SEC, that is violating its statutory mandate of investor protection (…) that is running roughshod over Congress and Congress’s intent to seriously adjudicate this issue but not pass legislation on very ambiguous topics that are not agreed upon before, as well as running roughshod over the White House and an executive order that specifically respects the promises of this technology and the fascinating amount of innovation that it is going to unleash.”

Bryan Stirewalt, senior managing director of K2 Integrity and former chief executive of Dubai Financial Services Authority (DFSA):

“In [the SEC’s] defense, the US has probably got the most mature and deepest financial markets, so they may not see a need. The use case for a lot of digital assets fits better with mid-sized economies or economies with a volatile currency. So I think the US is ceding leadership in this field to those countries who put [crypto] in the opportunities box” … “Europe is the global leader in digital assets regulation right now.”

Brad Garlinghouse, CEO of Ripple:

On digital assets legislation: “I think it would be an error, to do a stablecoin bill and stop.”

On the SEC: “I think it’s really, really, really unfortunate that the SEC has engaged in trying to regulate through enforcement as opposed to do the work.”

If you would like this delivered as a newsletter, please sign up here.