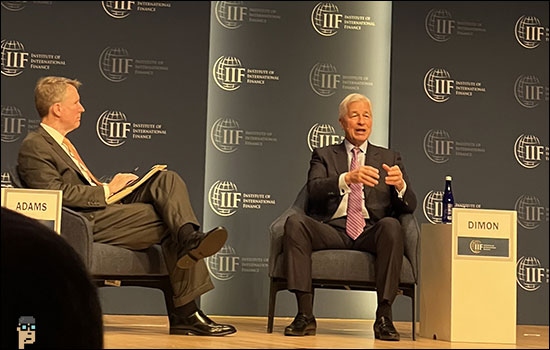

This afternoon at a session of the Institute for International Finance (IIF) Annual Meeting in Washington, D.C., JP Morgan CEO Jamie Dimon pleased the crowd with his increasingly legendary response to the efficacy of cryptocurrency.

He wasn’t the only one talking crypto at the conference. The IIF brings together the top leaders in traditional finance to help coordinate a global approach in financial policies. Crypto and digital assets was among the meeting’s hottest topics.

The IIF’s Tim Adams teed up Dimon asking: “You’ve had strong opinions in the past on digital currencies, speculative currencies, stablecoins… still have strong views?”

Dimon, clearly reveling in the moment, “Yeah. [audience laughter] But, I’ll clarify them.”

He explained that “blockchain technology is real” and that JP Morgan deploys it in many places through their Onyx coin system. Using distributed ledger technology, it’s a business-to-business system that enables a stablecoin backed by US dollar deposits at JP Morgan which purports to efficiently clear assets between banks.

Dimon said, “My issue is …. what you guys call cryptocurrency – which I call a crypto token – that doesn’t do anything.”

Invoking Voltaire (not a type-o), he said he respected people’s right to do what they want, but Dimon saw crypto as a “decentralized Ponzi’ scheme hyped around the world and responsible for “fraud, stealing, sex trafficking, drugs, ransomware, tax avoidance – it’s extraordinary.”

He continued, “There’s no real use for it other than speculation, and it’s also dirty and expensive and volatile.”

Finally, he equated crypto to Beanie Babies.

The bright side

For crypto supporters, the fact the JP Morgan CEO never made a tulip bulb reference could be seen as a limited win.

However, Dimon’s doom-and-gloom makes sense when considering the stakes for traditional finance as well as his declaration on an unrelated topic that “Banks are guardians of the financial system.”

Crypto, blockchain, and the like have the potential to threaten today’s banking models and cut out the proverbial middlemen which help fill bank coffers. JP Morgan’s own Onyx platform does so today with settlement services.

So, what’s next?

Regulatory clarity stands out as the precedent to US banks like JP Morgan jumping in on crypto on behalf of its alpha-focused clients whether CEO Jamie Dimon likes it or not. The customer comes first.