Here’s today’s blockchain tipsheet… prefer it by email? Sign up here.

Market Structure – House Agriculture

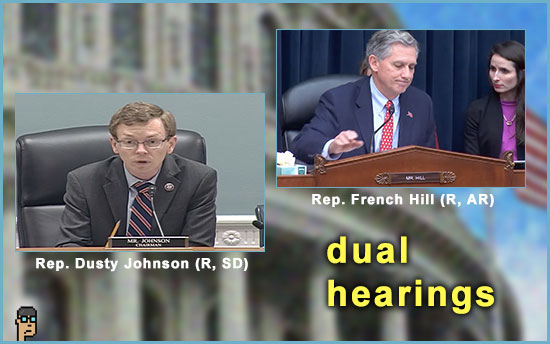

It was a day of cooperation among Republicans yesterday as the House Republican majority convened two simultaneous hearings that began their quest for more and better market structure in digital assets.

Rep. Dusty Johnson (R, SD), Chairman of the House Agriculture’s Subcommittee on Commodity Markets, Digital Assets, and Rural Development, said in his opening statement, “[There]’s plenty of work for our regulatory agencies to do, including the CFTC, the SEC, and our state and federal banking regulators.”

In his statement, House Ag Chair Rep. Glenn “GT” Thompson (R, PA) reiterated his Committee’s partnership with Chair Rep. Patrick McHenry (R, NC) and the House Financial Services (HFS) Committee. See the House Ag Subcommittee hearing video and list of witnesses who participated here.

more tips:

Urgency appears to be the message from Republicans on digital assets, as House Ag and HFS said they will partner again next month on digital assets legislation in a combined hearing according to a release. Read more from Financial Services Committee (Majority).

Market Structure – HFS

Meanwhile, Chair Rep. French Hill (R, AR) guided the market structure hearing on HFS Subcommittee on Digital Assets, Financial Technology and Inclusion. The hearing’s Committee Memorandum read in part, “Committee Republicans seek to establish a digital asset market structure framework appropriate for the unique characteristics of digital assets. This framework would provide digital asset firms with regulatory certainty and prevent the regulatory turbulence created by jurisdictional infighting and punitive enforcement actions.”

See the hearing video and list of five witnesses which included Marta Blecher, President of Filecoin and Hilary Allen, a previous Senate Banking witness and law professor from American University.

Democrats were not interested in the pursuit of market structure if HFS Ranking Member Rep. Maxine Waters’ (D, CA) opening statement was any indication. She pointed to the SEC’s “success” to this point and said, “[We] do not need to create an entirely new and special framework for crypto—we already have one. Rather, crypto firms, like other tech companies before them, must recognize that they are not exceptional; they need to comply with the laws of the land. To the extent there are actual gaps in our laws, such as limitations on the SEC’s reach overseas, we should focus on those, and not on creating more complexity through a whole new regulatory framework.” Read the statement.

more tips:

“SBF’s ‘ghost is still in this room,’ congressman [Rep. Brad Sherman (D, CA)] says at digital asset hearing” – The Block

Gensler growls

Not to be left out of the conversation generated by the two House market structure hearings, SEC Chair Gary Gensler created a video of his own to reiterate his position on digital assets. He said on Twitter: “Intermediaries for investment contracts are required to comply with securities laws & register with [the SEC]. Instead, many crypto platforms are contending that their investment contracts are something else. The law cares about what something actually is, not what you call it.” Read the tweet with video.

Coinbase responds

Yesterday, cryptocurrency platform Coinbase formally – and informally – took issue with the Securities and Exchange Commission’s Wells Notice received on March 22 (PDF) which warned of an impending enforcement action against the company. CNBC reports, “Perhaps most consequentially for the rest of the U.S. crypto industry, Coinbase (…) argues that proposed charges rely on ‘flawed and untested’ theories involving investment contracts, spot markets, and custody services.” Read more on CNBC.

more tips:

Coinbase responds to the SEC’s Wells notice – Coinbase blog

Budd back

Bipartisan cooperation is back? Senators Kirsten Gillibrand (D, NY) and Ted Budd (R, NC) and Representatives Zach Nunn (R, AI) and Jim Himes (D, CT), re-introduced a bill called the “Financial Technology Protection Act” which “would create a working group tasked with studying how terrorists or other criminals might use cryptocurrencies and other new financial technologies, and create proposals for Congress and regulatory agencies aimed at countering these uses.” Read more in CoinDesk.

Chainalysis, TRM Labs, Elliptic are going to love this one – it’s always a great day to be a blockchain analytics company.

Of interest with this legislation is the return of Senator Ted Budd (R, NC) to the crypto discussion -this bill was intro’d in the 117th Congress. Budd had been an active member of House Financial Services and its crypto framework efforts.

Senator Cruz on CBDCs

Senator Ted Cruz appeared at a Bitcoin Policy Institute event and saw a cabal behind Central Bank Digital Currencies (CBDCs). According to Decrypt, he told the audience, “The same people that want to see a CBDC, they hate Bitcoin, and they hate cash. (…) Let’s be clear, they don’t like cash for exactly the reason I like cash because it is not subjected to centralized control that is not subject to constant surveillance. And so I hope we see growing resistance to a CBDC.” Read more.

crypto and contagion report

A new Congressional Research Service report was released on Tuesday titled, “The Role of Cryptocurrency in the Failures of Silvergate, Silicon Valley, and Signature Banks.” Download the 3-pager (PDF).

Blockworks breaks down the the report and finds, “The Congressional Research Service found that crypto did have a role to play in the failure of Silvergate, Silicon Valley and Signature Bank, but only an indirect one based on risk perception.” Read more.

dual system, please

Speaking via a livestream at CoinDesk’s Consensus yesterday, New York Department of Financial Services (NYDFS) Superintendent Adrienne Harris, a Democrat, continues to whistle a different tune than the Biden Administration, SEC Chair Gensler or many Congressional Democrats. She sees the need for a crypto regulatory framework: “Just like we have a dual regulatory system for banking, we should have one for crypto currency because it allows nimble fast moving state regulators like New York, to put in place consumer protections and market protections that can keep pace with the market.” Read a Twitter thread on her remarks.

still more tips

Crypto’s Cure for a Shrinking Customer Base: Buy Government Bonds – The Wall Street Journal

Yesterday’s Hearing Entitled: “Oversight of the Financial Crimes Enforcement Network (FinCEN) and the Office of Terrorism and Financial Intelligence (TFI)” – Subcommittee on National Security, Illicit Finance, and International Financial Institutions – house.gov (video and memo)

CCI and CRADL will produce ethnographic research and analysis focused on how crypto/Web3 is tangibly impacting people and communities – Crypto Council for Innovation on Twitter

If you would like this delivered as a newsletter, please sign up here.