subpoena stick

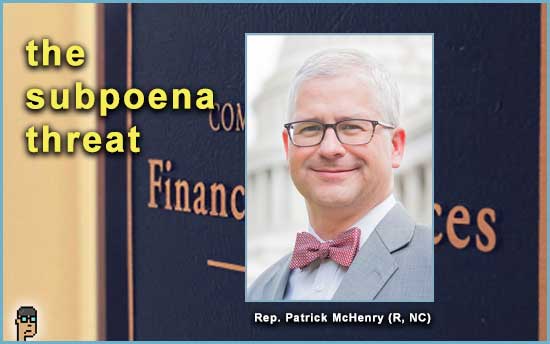

House Financial Services Chair Patrick McHenry (R, NC) made clear in a tweet on X yesterday that he’s serious about potentially issuing a subpoena to Securities Exchange Commission Chair Gary Gensler, a Democrat, if he doesn’t answer Congressional requests – primarily from Republicans. “SEC Chair [Gary Gensler] refuses to schedule a Commission vote to provide Congress with requested documents. Should Gensler continue to stonewall, Republicans will have no choice but to issue the first subpoena to the SEC from my Committee to compel their production.” See more.

McHenry first broached the subpoena at last week’s HFS SEC oversight hearing.

How serious is McHenry about using an unprecedented subpoena with an SEC Chair? Hard to say. But, the threat of a subpoena could create another lever in negotiations with Democratic leadership as Chair McHenry attempts to get key digital assets legislation (stablecoin and market structure bills) through Congress.

Senate Banking machinations

Politico reported yesterday that Senate Banking Chair Sherrod Brown (D, OH) is under pressure by Senator Elizabeth Warren (D, MA) to advance her Digital Asset Anti-Money Laundering Act (see S.2669), but he’s not convinced. Brown tells Politico, “We’re all trying to figure out what regulators can do and where the holes are that we need legislation (…) That’s the real problem. And I don’t know that Warren’s bill does that.” Read more.

Cato Institute policy analyst Nicholas Anthony commented on X about the news: “Senator Brown is right here. It was a bit bizarre when Senator Warren introduced this bill during the FTX hearing as it would do nothing to address the issues behind FTX, but it would levy a hefty blow to financial privacy for American citizens.” Read Anthony’s blog post on the Warren bill from last December on Cato’s blog.

Senator Brown could be in the “no regulation” for digital assets camp – “let it rot” rather than bringing it under the U.S. financial system regulatory umbrella with customized regulations. See Brown’s question to SEC Chair Gary Gensler during last month’s SEC Oversight hearing.

de minimis exemption

CoinCenter policy counsel Landon Zinda picks up the baton of his former boss, retired Senator Pat Toomey (R, PA), and advocates for the “Virtual Currency Tax Fairness Act” which addressed the de minimis exemption for crypto transaction.

Toomey introduced the bill in the last Congress to solve the age-old problem of every crypto transaction turning into a taxable event according to current Internal Revenue Service tax rules. Zinda says CoinCenter has addressed the rule-making gap during the recent comment period related to a crypto tax review by Senate Finance Chair Ron Wyden (R, OR) and Ranking Member Mike Crapo (R, ID). On the crypto industry advocate’s blog, Zinda writes, “Giving cryptocurrencies the same exemption that government-issued currencies enjoy would help to foster the use of cryptocurrencies in retail transactions and new innovative methods of transacting that cryptocurrencies excel in, like micro-transactions.” Read more.

De minimis tax legislation has a relatively long history in crypto terms. Back in 2017, Rep. David Schweikert (R, AZ) and a bipartisan group of co-sponsors, which included current House Majority Whip Tom Emmer (R, MN), introduced H.R. 3708 via the House Ways and Means Committee and tried to set a limit for taxable crypto transactions at $600.

Read more about about the de minimis exemption’s legislative history on blockchain tipsheet.

FTX-inspired legislation

Last Thursday, Rep. Don Beyer (D, VA) threw his “hat” in the crypto legislation ring with the “Off-Chain Digital Commodity Transaction Reporting Act” (see PDF). A press release from Rep. Beyer’s office describes the new bill which “would protect participants in the digital asset market by requiring trading platforms to report all transactions to a repository registered with the Commodity Futures Trading Commission (CFTC).” Read it.

Yesterday, Bill Hughes, counsel at blockchain software company Consensys, commented on the legislation saying, in part, “Rep. Beyer is not on House Financial Services or Agriculture committees, so Hill folks will say this isn’t going anywhere. Probably right. But it is indicative of the post-FTX pile on that is all too fashionable right now.” Read Hughes’ analysis on X, He adds that even social security numbers with associated transactions would require reporting under Beyer’s legislation.

Rep. Beyer sits on House Ways and Means and its Trade and Tax subcommittees.

more tips:

U.S. House Bill Seeks Centralized Record of Off-Chain Crypto Transactions – CoinDesk

going offshore: Singapore

U.S. crypto platform Coinbase has been granted a “Major Payment Institution” license in Singapore. It’s already listed in the Singapore Monetary Authority’s database here.

The Block reports, “The licence paves the way for Coinbase’s Singapore entity to offer a wider range of Digital Payment Token services to both retail and institutional customers in the region, while also cementing its ties with local institutions. Standard Chartered is its local banking partner.” Read more. Also, read about it on the Coinbase blog.

enforcement trumpet

Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam trumpeted his agency’s recent enforcement actions – such as with Ooki DAO – in a speech to attendees at the Futures Industry Association Expo yesterday. Behnam said, “Continuing our success in the fight against fraud and illegal conduct involving digital assets, 45 of those actions this fiscal year involved digital asset related misconduct, representing over 34% of the 131 such actions brought by the Commission since 2015.” Read the speech.

FTX trial stuff

Crypto Goes on Trial, as Sam Bankman-Fried Faces His Reckoning – The New York Times

Sam Bankman-Fried and the FTX Collapse: What to Know Before the Trial – The Wall Street Journal

FTX founder Sam Bankman-Fried’s rise and fall at center of new Michael Lewis book “Going Infinite” – CBS News’ 60 Minutes

Opinion: “Play it again, Sam” – Inside Bankman-Fried’s last year in the crypto game – Michael Lewis in Washington Post

still more tips

Franklin Templeton CEO: tokenization is securitization on steroids – Ledger Insights

UK Regulator Saw ‘Poor’ Engagement From Some Overseas Crypto Firms on Upcoming Ad Rules – CoinDesk

Web3 funding is down again as the crypto winter drags on – TechCrunch

Grayscale Files to Convert Ethereum Trust Into Spot ETF – Decrypt