Up until last week, few had ever heard of bZeroX, let alone Ooki DAO.

But what a difference an enforcement action makes as the Commodity Futures Trading Commission (CFTC) announced on Thursday a $250,000 penalty against bZeroX and its founders, Tom Bean and Kyle Kistner, as well as charges for members of the decentralized autonomous organization (DAO), Ooki DAO, for offering “illegal, off-Exchange digital-asset trading, registration violations, and failing to comply with Bank Secrecy Act.”

Wait… a DAO? Oh yes. Time will tell if the action creates a chilling effect for Americans participating or having an interest in DAOs. Many think that if they join a particular DAO’s Discord channel, they are now a part of a DAO.

But, the CFTC took it a step further saying Ooki DAO members were defined “as those holders of Ooki tokens that have voted on governance proposals with respect to running the business.”

The basis of the CFTC charges for the DAO suggest that the alleged offending assets of bZx Protocol may have been transferred to what was pitched to DAO members as a decentralized structure that could overcome today’s regulatory requirements:

“…On approximately August 23, 2021, bZeroX transferred control of the bZx Protocol to the bZx DAO, which subsequently renamed itself and is currently doing business as the Ooki DAO. The Ooki DAO operates the Ooki Protocol (formerly the bZx Protocol) in the exact same manner as bZeroX and thus is continuing to violate the law in the same manner as bZeroX. By transferring control to a DAO, bZeroX’s founders touted to bZeroX community members the operations would be enforcement-proof—allowing the Ooki DAO to violate the CEA and CFTC regulations with impunity, as alleged in the federal court action. The order finds the DAO was an unincorporated association of which Bean and Kistner were actively participating members and liable for the Ooki DAO’s violations of the CEA and CFTC regulations.”

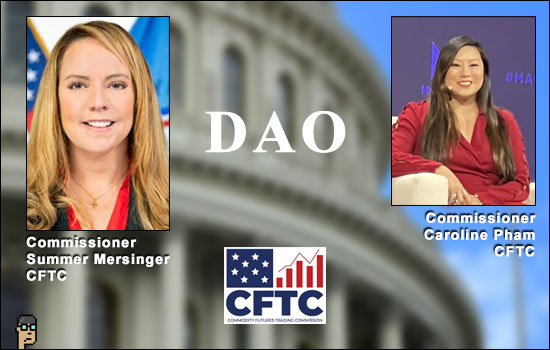

One of the Commission’s five members, Summer Mersinger, dissented (see the detailed release) on the part of the order related to token holders in the DAO but agreed on the punishment for bZeroX and its founders.

Specifically, she echoed criticism often heard of the CFTC’s sister agency, the Securities and Exchange Commission (SEC), saying “this approach constitutes blatant ‘regulation by enforcement’ by setting policy based on new definitions and standards never before articulated by the Commission.”

Overall, through crypto Twitter, the blockchain industry decried the action by the CFTC while praising Commissioner Mersinger’s dissent. Up until Thursday, the CFTC was thought to be the preferred agency for stewarding crypto through the regulatory “waters” with such current bills as DCCPA.

Blockchain Association Head of Policy Jake Chervinsky tweeted, “The CFTC’s bZx enforcement action may be the most egregious example of regulation by enforcement in the history of crypto. We’ve complained at length about the SEC abusing this tactic, but the CFTC has put them to shame.”

Meanwhile at crypto investor conference Mainnet in New York City on Thursday, CFTC Commissioner Caroline Pham commented on her past statement about the SEC’s enforcement action against several Coinbase employees including the identification of 9 crypto tokens as securities: “I don’t believe in a kind of gotcha enforcement. The right way to come out with new standards, rules, definitions – something that’s going to affect such a huge swath of industry and the economy – is to engage in public notice and comment rule-making under the Administrative Procedure Act, and that’s the law. So that’s what the first part of my statement was about and you know, as we discussed, it has pretty sweeping repercussions potentially, for utility tokens and for DAOs. And so I just really think that that’s something that the public ought to have a say in.”

But later, in answer to a different question about what solutions the CFTC could offer the crypto landscape, Commissioner Pham stressed, “…. one of the most powerful tools that we have is enforcement and the CFTC has also done regulation by enforcement. By the way, there’s two ways to make rules: you could do it through a rule-making, which takes longer, or you can do it through an enforcement action or through the courts.” Her point seemed to be that absent rule-making in the near term one needs to tell bad actors “you can’t be ripping people off.”

Final thoughts

One of the questions Congress had for the CFTC at the DCCPA hearing two weeks ago was in regards to its ability to oversee the fast growing crypto industry – it’s considerably smaller than the SEC by headcount and budget. But, Chair Rostin Behnam was unequivocal saying his CFTC would be the “cop on the beat.”

Perhaps, this enforcement action helps make the “cop” case?

Unfortunately for many DAO participants, the action may inhibit involvement in future crypto projects – or even a Discord thread – as worry grows about what the cop will do next.