JPEG as a security

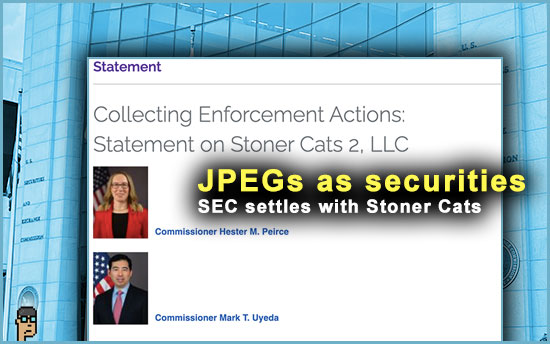

The Securities and Exchange Commission (SEC) charged a non-fungible token (NFT) creator called Stoner Cats with conducting “an unregistered offering of crypto asset securities.” Read the SEC release. The company agreed to a $1 million fine and to return funds to investors.

Reuters reports on one of the securities trip wires that Stoner Cats violated: “The NFTs provided holders with exclusive access to watch ‘Stoner Cats’ online. Investors were told the NFTs were like a ticket, and that ‘the more successful the show, the more successful your NFT’ will be.” Read more.

more tips:

What is Stoner Cats? (July 2021) – Decrypt

JPEG as a security – reaction

The two Republican SEC Commissioners – Hester Peirce and Mark Uyeda – issued a dissent to the Stoner Cats settlement seeing a threat to artists and creators. (This dissent also indicates the three Democrat SEC Commissioners voted “for” the SEC-approved settlement with Stoner Cats.)

Peirce and Uyeda wrote, “The application of the Howey investment contract analysis in this matter lacks any meaningful limiting principle. It carries implications for creators of all kinds. Were we to apply the securities laws to physical collectibles in the same way we apply them to NFTs, artists’ creativity would wither in the shadow of legal ambiguity. Rather than arbitrarily bringing enforcement actions against NFT projects, we ought to lay out some clear guidelines for artists and other creators who want to experiment with NFTs as a way to support their creative efforts and build their fan communities.” Read it all.

Willkie Farr lawyer Mike Selig said on X, “The fact that the NFTs were not CC0 (no rights reserved) was relevant to the security status analysis. The settlement order notes that the issuer reserved all commercial rights to the underlying intellectual property associated with each PFP (profile picture).” Read his tweet thread.

Alexander Grieve, a policy executive at venture firm Paradigm saw an opening for Congress in the enforcement action: “IMO these NFT enforcements are a call to action for [House Energy & Commerce] and [Senate Commerce]. NFTs, as collectibles, (and, more specifically, as ways to represent static data on a blockchain network – car titles, land deeds, records etc) – should be firmly in FTC/Commerce jurisdiction.” Read his short thread on X.

hear ye, hear ye

Today, House Financial Services (HFS) Digital Assets Subcommittee led by Chair French Hill (R, AR) will hold a hearing titled, “Digital Dollar Dilemma: The Implications of a Central Bank Digital Currency and Private Sector Alternatives.”

See the hearing’s page which will include a link to the livestream beginning at 2 p.m. ET.

Witnesses include (click names for prepared testimony PDFs):

Mr. Yuval Rooz, CEO, Digital Asset

Ms. Paige Paridon, SVP and Senior Associate General Counsel, Bank Policy Institute

Ms. Christina Parajon Skinner, Assistant Professor, The Wharton School of the University of Pennsylvania

Dr. Norbert Michel, VP and Director, Center for Monetary and Financial Alternatives, Cato Institute

Mr. Raúl Carrillo, Academic Fellow, Lecturer in Law, Columbia Law School

Read the Memorandum for the hearing here.

hear ye, hear ye – what to watch for

Democrats on HFS have been relatively silent compared to the Committee’s majority Republicans, who are staunchly against any CBDC as witnessed by yesterday’s re-introduction of “CBDC Anti-Surveillance State Act” by the Majority Whip Rep. Tom Emmer (R, MN) and a hoard of Republican co-sponsors. Other bills listed on the hearing’s landing page are the bipartisan “Power of the Mint Act” [H.R. 3402] and the “Digital Dollar Prevention Act” [H.R. 3712] with 19 Republican co-sponsors.

Rep. Jake Auchincloss (D, MA) and Rep. French Hill (R, AR) introduced the Power of the Mint Act in May and the bill reminds the Federal Reserve that only Congress has the power to “coin money.” Rep. Ritchie Torres (D, NY), Rep. Wiley Nickel (D, NC) and Rep. Barry Moore (R, AL) round out the co-sponsors. The Digital Dollar Prevention Act aims to prevent any attempt by the Fed to try or test (a pilot program) a CBDC without Congressional approval.

Note the “lightweight” legislation trend with these bills… In addition to sending a message, the best hope for passing anything in a divided Congress may be to keep it very simple.

Also, where some HFS Democrats stand on CBDCs could be revealed in the course of the hearing’s Q&A. Will Dems see advantages in CBDCs? (For example, could the Fed fine tune interest rates in near real-time to manage the economy?) How will Democrats perceive the privacy question around the government’s ability to potentially track or “surveil” payments of their citizens with a CBDC?

The hearing also takes aim at understanding “private alternatives,” or stablecoins, and will likely support the recent bipartisan passage of HFS Chair Patrick McHenry’s (R, NC) “Clarity for Payment Stablecoins Act” [H.R. 4766] out of the Committee.

Finally, the education element of the hearing is important, too – a stablecoin is not the same as a CBDC. This differentiation needs to be understood by many members in both houses of Congress -not to mention voters. Last month, Chair Hill discussed educating members on digital assets legislation this fall.

director on DeFi

Ian McGinley, Enforcement Director for the Commodity Futures Trading Commission (CFTC), made a rare public appearance on Monday in front of the Practising Law Institute’s White Collar Crime conference. His keynote, “Enforcement by Enforcement: The CFTC’s Actions in the Derivatives Markets for Digital Assets,” takes a deeper look at decentralized finance (DeFi) including a recent enforcement action against DeFi companies Opyn, ZeroEx and Deridex.

Echoing CFTC Chairman Rostin Behnam’s “cop on the beat” mantra, McGinley’s overall message to DeFi is that the CFTC is committed to making decentralized exchanges adhere to the law: “The existence of unregulated DeFi exchanges is an obvious threat to the markets regulated and customers protected by the CFTC, and it is one we have taken very seriously. For example, small errors in smart contract code can—and have—been exploited by wrongdoers, resulting in the potential for customer losses in the tens or hundreds of millions.” Read his speech.

McGinley joined the CFTC in February after a stint at law firm Akin Gump and, prior to that, 10+ years with the United States Attorney’s Office for the Southern District of New York.

more tips:

Solidus Labs: Wash Trading Is Rampant on Decentralized Crypto Exchanges – Bloomberg

underserved served

Chainalysis published what the blockchain analytics firm is calling the “Global Crypto Adoption Index” using on-chain and real-world data.

According to the Index, “Lower Middle Income (LMI) populations have seen the greatest recovery in ‘grassroots’ crypto adoption over the last year.” Chainalysis observes, “This could be extremely promising for crypto’s future prospects. LMI countries are often countries on the rise, with dynamic, growing industries and populations. Many of them have undergone significant economic development in the last few decades to rise from the low income group.” Read more.

still more tips

Binance.US CEO Leaves Embattled Crypto Exchange – The Wall Street Journal

Ripple Will Do 80% of Its Hiring This Year Outside the U.S – CoinDesk

One Coin co-founder sentenced to 20 years and fined $300 million – The Block