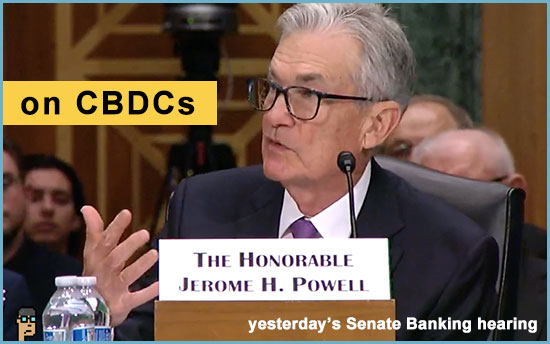

Powell on CBDC

At the urging of Sen. Kevin Cramer (R, ND) during yesterday’s Senate Banking Federal Reserve oversight hearing, Fed Chair Jerome Powell tried to put to rest any interest the Fed may have in Central Bank Digital Currencies (CBDCs).

Powell said, “We’re nowhere near recommending – let alone adopting – a Central Bank Digital Currency in any form. The idea is that as technology has evolved, money has become digital.”

“But, the government doesn’t issue digital money. It’s digital if you look at your bank account. People don’t hold those physical dollars. They’re digital.”

“So, the thought was that the government could create a digital form of money that people could then transfer among themselves. Of course, that raises the concern that if that were a government account, the government would see all your transactions. And that’s just something we would not stand for or do or propose here in the United States.”

“That is how it works in China, for example. If we were ever to do something like this – we are a very long way from even thinking about it – we would do this through the banking system. The last thing, we the Federal Reserve would want, would be to have individual accounts for all Americans or any Americans for that matter. Only banks have accounts at the Fed.”

“So, it’s really just a question of following technology as it evolves in a way that serves the public better. People don’t need to worry about a Central Bank Digital Currency. There is nothing like that remotely close to happening anytime soon.” Continue reading “Chair Powell Denies Fedreal Reserve Interest in CBDC; Appropriations For Blockchain”