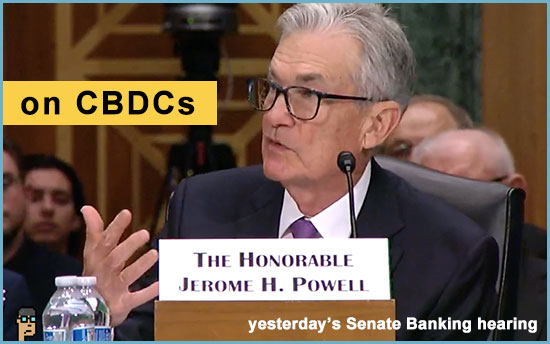

Powell on CBDC

At the urging of Sen. Kevin Cramer (R, ND) during yesterday’s Senate Banking Federal Reserve oversight hearing, Fed Chair Jerome Powell tried to put to rest any interest the Fed may have in Central Bank Digital Currencies (CBDCs).

Powell said, “We’re nowhere near recommending – let alone adopting – a Central Bank Digital Currency in any form. The idea is that as technology has evolved, money has become digital.”

“But, the government doesn’t issue digital money. It’s digital if you look at your bank account. People don’t hold those physical dollars. They’re digital.”

“So, the thought was that the government could create a digital form of money that people could then transfer among themselves. Of course, that raises the concern that if that were a government account, the government would see all your transactions. And that’s just something we would not stand for or do or propose here in the United States.”

“That is how it works in China, for example. If we were ever to do something like this – we are a very long way from even thinking about it – we would do this through the banking system. The last thing, we the Federal Reserve would want, would be to have individual accounts for all Americans or any Americans for that matter. Only banks have accounts at the Fed.”

“So, it’s really just a question of following technology as it evolves in a way that serves the public better. People don’t need to worry about a Central Bank Digital Currency. There is nothing like that remotely close to happening anytime soon.”

Later in the hearing, Senator Cynthia Lummis (R, WY) asked Chair Powell to re-confirm that the Fed would not create a CBDC without Congressional authorization. Powell confirmed.

wholesale CBDC

The Hong Kong Monetary Authority announced a new wholesale CBDC initiative yesterday which will allow for settlement of banks’ tokenized deposits.

Ledger Insights reports, “The ‘wCBDC Sandbox’ (wCBDC = wholesale or non-consumer CBDC) will be used to trial the settlement of tokenization use cases (…) such as: carbon credits; tokenized aircraft instruments; electric vehicle charging stations; electronic bills of lading; and treasury management.” Read more.

more tips:

-

- Hong Kong central bank unveils Project Ensemble for tokenization – Forkast News

op-ed zeitgeist

Opinion: “FINRA’s intrusive crypto sweeps are misguided” – Lowenstein-Sandler law firm on Blockworks

Opinion: “Shapeshifting Justice: The SEC’s Weakest Case Yet” – CoinDesk

approps for blockchain

Appropriations for blockchain research and technology is in H.R.4366 – “Consolidated Appropriations Act, 2024” in an “explanatory statement” from Senate Appropriations Chair Patty Murray (D, WA) published here on Congress.gov.

Highlights of funding which carries forward funding levels from 2023 include NIST’s Scientific and Technical Research and Services (STRS) account:

“Blockchain Research at the National Cybersecurity Center of Excellence (NCCOE). – The [appropriations] agreement encourages the NCCOE to research challenges with blockchain and distributed ledger technologies and to leverage the resources at the NCCOE to explore the advancement of distributed ledger technologies. Further, the agreement encourages the NCCOE to consider these technologies in relation to the competitive position of the United States, to research the ability to foster uniform standards that allow for global collaboration in communications and free trade, and to explore any government use cases with the potential for ancillary adoption by the private sector.”

Within salaries and expenses for the Department of Justice:

“Blockchain Analysis Tools. – In an effort to reduce crimes involving the illicit use of cryptocurrency, the agreement encourages the Department to acquire blockchain analysis tools, attributed blockchain data, training on cryptocurrency-related investigations, and cryptocurrency-related investigative and analytical support. The agreement directs the Department, including the FBI, the United States Marshals Services, and the Asset Forfeiture Program, to provide a briefing on its cryptocurrency-related activities within 90 days of the enactment of this act.”

cryptocurrency scams

The Better Business Bureau has released its annual “BBB Scam Tracker Risk Report.” If the title doesn’t scare you away, you can download it here (PDF) from the BBB’s website.

The BBB says that for 2023 they have “combined investment and cryptocurrency scams into one category because most cryptocurrency scams involved investment opportunities. The result was investment/cryptocurrency scams rising to the top of our list of riskiest scams, with a high percentage of people reporting a monetary loss (80.4%) and a high median dollar loss ($3,800).”

The report also explores the connection between romance scams and cryptocurrency scams.

education

What is a seed phrase and how does it work? – The Block

Everything is a Perp(etual) – opyn research

still more tips

Bitcoin Bulls Cite a Simple Reason for Its Rally: Not Enough Coins – The Wall Street Journal

The metaverse wars heat up – Politico

Federal Bureau of Investigations (FBI) Crime Report 2023 (PDF) – iC3.gov

OpenSea’s partnership with Coachella is a sign that NFTs can be more than profile pictures – TechCrunch