CFTC Chair on Congress

Yesterday, Commodity Futures Trading Commission (CFTC) Chair Rostin Behnam (D) appeared on CNBC’s Squawk Box and provided an update on his agency’s views related to digital assets and legislation.

Here are some quick clips…

Chair Behnam: “It’s taken a bit longer than I would hope. (…) I think members in Congress are trying to figure out the landscape. We have a lot of regulators in the US – both on the market side and the banking side. But ultimately, I’ve said this for a while, there is a gap in regulation, and Congress is going to have to step in and really overcome this feeling of not wanting to legitimize the technology and seeing this as not something that’s tenable or sustainable. It’s here. It hasn’t gone away and we’re seeing it with the price and some of the bigger coins and there are issues around regulation in terms of customer fraud and manipulation.”

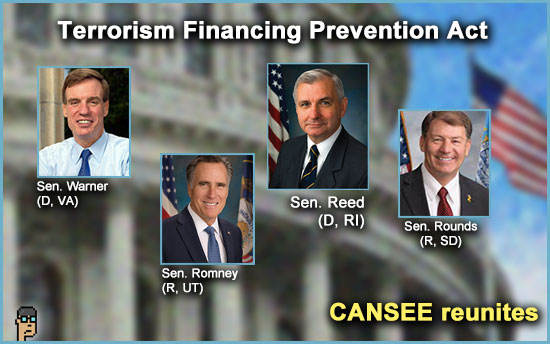

“But then some of this illicit activity and terrorist organization use, I think, should be really concerning for members of Congress and all of us as Americans… I mean, that seems like an easy bipartisan fix, but it’s just knowing how politics works. You’re probably not likely to get a clean bipartisan issue without weighing into the areas where there is a bunch of arguments back and forth.”

the three-legged stool

Chair Behnam: “I view [digital assets] as a three-legged stool: you have the AML KYC issues, which is around illicit activity and terrorist financing; you have the stablecoin issues (…); and then you have the market structure issues which is very important to me as a market regulator.”

“A lot of momentum has been around the the anti-money laundering (AML) and know your customer (KYC) [issues] … and that really goes to the heart of some of the issues that we’ve elevated at the CFTC around Binance and things that they were doing. But a lot of members are very focused on that. I’m very focused on markets. There’s a lot of focus on stablecoins.” Continue reading “CFTC Chair Behnam Waiting On Congress; Senate Stablecoin Bill Bubbles”