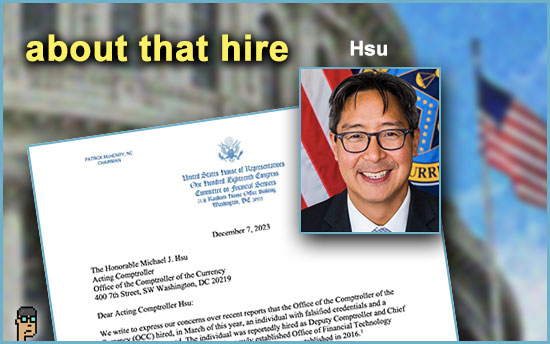

letter – OCC blunder

Republican members of the House Financial Services (HFS) Committee have sent a letter to the Office of the Comptroller of the Currrency’s Acting Comptroller Michael Hsu (D) demanding answers for his agency’s recent hiring blunder. The OCC hired a new Deputy Comptroller and Chief Financial Technology Officer in April, but his resume was discovered to be falsified and he was quietly let go over the summer and replaced by an OCC insider – read about it in The Information.

In a Congressional letter dated December 7, Rep. Andy Barr (R, KY), Rep. Bill Huizenga (R, MI), and Rep. French Hill (R, AR), who is Chairman of the Digital Assets, Financial Technology and Inclusion Subcommittee, ask for more info on OCC hiring practices and note that “To date, there has been no clarification provided by the OCC surrounding the reports regarding the agency’s prior Deputy Comptroller and Chief Financial Technology Officer. During the hearing at which you testified on November 15, 2023, it was made clear by Chair [Patrick McHenry (R, NC)]: ‘the stakes are too high to take your eyes off the ball.’” The Members ask for a response by December 21.

Read the letter. And, read the House Financial Services press release.

what you should note: At a November HFS prudential regulator hearing, the OCC’s Hsu expressed surprising “concerns” about the Securities and Exchange Commission’s (SEC) bank custody rules and carrying digital assets on a bank’s balance sheet. Will Republicans “go hard” on a Democrat who has expressed a dissenting opinion to Democratic leadership’s (including SEC Chair Gary Gensler)?

AML/CFT compromise

In Punchbowl News, House Financial Services (HFS) Chair Patrick McHenry (R, NC) participated in another interview discussing his 2024 agenda. With the Senate looking to to address anti-money laundering (AML) and countering the financing of terrorism (CFT) in digital assets, the Chair saw opportunity for compromise with his bicameral colleagues saying, “We want to identify workable policies for [Bank Secrecy Act]-AML as it relates to digital assets. We want to make sure that the regime works and is effective. And I think we need a broader policy effort to make that work.” Read more.

Also of note, McHenry is not conciliatory on stablecoin legislation – i.e. the Fed isn’t getting any power over state-issued stablecoins.

what you should know: This sounds similar to another compromise effort made by the now-defunct amendment attached to the National Defense Authorization Act by Senators Cynthia Lummis (R, WY), Kirsten Gillibrand (D, NY), Elizabeth Warren (D, MA) and Roger Marshall (R, KS). Regarding the “broader policy effort’, McHenry may want all or part of HFS’s stablecoin [H.R. 4766] and digital asset market structure [H.R. 4763] bills as an AML legislation “give back.” The trouble is – powerful senators such as Warren and Senate Banking Chair Sherrod Brown (D, OH), in the Democrat-controlled Senate, have expressed no interest in the House bills.

promoting the bill

Senator Elizabeth Warren (D, MA) put out a press release yesterday in support of her Digital Asset Anti-Money Laundering Act [S.2669] and included quotes from new Democratic co-sponsors which have trickled out over the past few weeks.

Co-sponsor Senator John Hickenlooper (D, CO) says in the release, “We have safeguards for banks to protect everyone from crime and terrorism. Crypto should have similar safeguards…. These reforms will protect safe, transparent innovation.” Recent co-sponsors and Senators Raphael Warnock (D, GA), Laphonza Butler (D, CA), Chris Van Hollen (D, MD) and Ben Ray Luján (D, NM) are also included. Read more.

Other financial, consumer and law enforcement organizations such as the Bank Policy Institute are noted as bill supporters, too.

what you should know: Given that the last co-sponsor for the Senator’s AML bill was added on December 6 according to Congress.gov, and considering the public relations push by the Senator yesterday, perhaps this will be the last of the co-sponsors for the Senate bill for a while. Meanwhile, Rep. Sean Casten (D, IL), a member of the HFS Committee, is expected to announce the House version of the bill at some point. Before recess at the end of the week?

power vacuum

Claiming “a power vacuum” in the crypto industry with the demise of FTX’s Sam Bankman-Fried and Binance’s Changpeng “CZ” Zhao, The New York TImes talks with a favorite witness of Senate Banking Chair Sherrod Brown (D, OH) – professor Hilary Allen of American University – who pours the gasoline on the crypto industry, “There is no intrinsic value to any of this… The only hope is to have more money sloshing around, and more people willing to buy into it to create demand.” She sees crypto merging with today’s financial systems rather than disrupting traditional finance models. Read more.

what you should know: This past April, Allen expressed a distrust for blockchain technology in a Foreign Affairs op-ed.

holiday fun

Advent (Calendar) of Crypto Data – Paradigm

crypto presidential forum

Calling it “The First in the Nation Crypto Presidential Forum,” Coinbase and its “Stand With Crypto” lobbying adjunct gathered the crypto community together yesterday for a discussion on relevant issues at St. Anselm College in New Hampshire. Entrepreneur Vivek Ramaswamy (R), Rep. Dean Phillips (D, MN) and former Arkansas Governor Asa Hutchinson (R) joined. See the video.

advertising coins

In an update to its advertising policy which allow crypto companies to advertise across Google’s network of ad placements, the company is appearing to crack the doors open again for crypto. Blockworks’ Katherine Ross reports that Google will allow ads for “Cryptocurrency Coin Trusts” beginning January 29, 2024. She adds, “Google defines the trusts as ‘financial products that allow investors to trade shares in trusts holding large pools of digital currency.'” Read about it.

what you should know: Speaking of which – it’s been a while since Congress openly weighed in on crypto advertising. The Lummis-Gillibrand [S.2281] Responsible Financial Innovation Act has an element dedicated to advertising. And this past April, Sen. Kyrsten Sinema (R, AZ) along with co-sponsor Sen. Cynthia Lummis (R, WY), introduced the comparatively-svelt “Responsible Digital Asset Advertising Act” which has yet to move forward. Meanwhile, in the UK, the Financial Conduct Authority is full-steam ahead with its new crypto advertising regimen.

Florida

“Here Is the List of the Bitcoin and Web3 Focused Bills We Are Pushing In Florida In 2024” – Samuel Armes, Florida Blockchain Business Association on X

the central bank regulator

Bloomberg covers an update in European Union regulation last week which empowers the European Central Bank (ECB) to monitor lenders’ transition to a net-zero carbon economy as well as overseee “bank-owned providers of crypto asset services.” Read more in Bloomberg. Central Bank as watchdog.”This expansion of authority comes as recognition of the ECB’s credibility, honed over a decade of serving as the EU’s primary banking regulator,” says CrowdfundInsider.

what you should know: Central-Bank-as-digital-assets-watchdog gets a boost in the European Union.

still more tips

A Spot Bitcoin ETF Is Easy. What Comes Next Could Get Dangerous. – The Wall Street Journal

Beijing court’s ruling that AI-generated content can be covered by copyright eschews US stand, with far-reaching implications on tech’s use – South China Morning Post

The Binance Crackdown Will Be an ‘Unprecedented’ Bonanza for Crypto Surveillance – Wired

Pension Fund M&G Invests $20 Million Into UK Crypto Derivatives Platform – Bloomberg