Terrorism Financing Prevention

Punchbowl News’ Brendan Pedersen reported yesterday that Senator Mark Warner (D, VA) is introducing a new piece of legislation aimed at sanctioning any firm that is facilitating payments to “Foreign Terrorist Organizations” rather than the current limits of the law which focuses on Hezbollah. Read more.

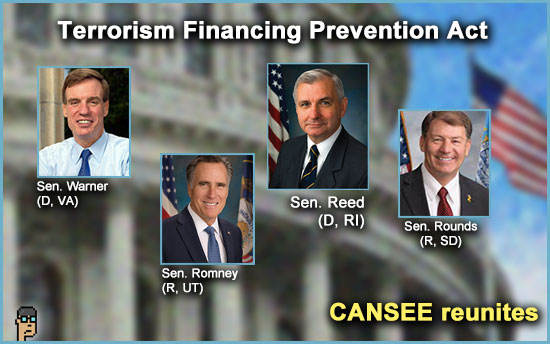

Known as the “Terrorism Financing Prevention Act,” co-sponsors include the CANSEE Act [S.2355] team of Senators: Mike Rounds (R, SD), Jack Reed (D, RI) and Mitt Romney (R, UT). CANSEE takes aim at money laundering within decentralized finance or DeFi.

Pedersen provides a copy of the bill here.

Later in the day, a press release from Sen. Warner’s office was issued with more details… “The bill also contains a key provision from the Crypto-Asset National Security Enhancement and Enforcement (CANSEE) Act the senators previously introduced, giving FinCEN authority to restrict transactions with ‘primary money laundering concerns’ that do not involve a U.S. correspondent bank account. This provision will provide FinCEN with appropriate tools to address threats involving digital assets and non-traditional finance networks, just as they currently can where correspondent accounts are involved.” Read the release.

what you should know: Since the terrorist attacks in Israel on October 7, anti-money laundering and terrorist financing legislation related to crypto has reached a new level of urgency. Whether a bill such as Senator Warner’s can pass both houses while digital assets remains a key part of the House Financial Services’ agenda remains a question.

updating BSA

Senator Elizabeth Warren (D, MA) continued her media campaign in support of her Digital Assets Anti-Money Laundering Act [S.2669] and appeared on CNBC’s Squawk Box. CNBC’s Andrew Ross Sorkin asked Warren if she supported approval of a Bitcoin Spot market ETF by the SEC and its implications for Americans who would invest. She demurred but wanted to focus on the law enforcement aspects of crypto and the Bank Secrecy Act (BSA), specifically, which hasn’t been amended since the 70s according to the Senator. She added, “What we need to do is we need to update [the BSA] again.” See the clip on X.

For the anti-crypto camp, The Bank Secrecy Act needs to be updated, which includes Sen. Warren’s Digital Asset Anti-Money Laundering Act, and Securities laws do not.

what you should know: Riot Platforms policy executive Sam Lyman notes that Senator Warren did NOT reference the data originally used in the October 10 Wall Street Journal article about crypto and terrorist financing at Wednesday’s Senate Banking hearing. Lyman said on X, “Sen. Warren has quietly abandoned the debunked claim that Hamas raised $130 million in crypto. She keeps it vague here by simply saying ‘millions.’ A small but important victory…” See that clip.

Sen. Hagerty – TradFi

Yesterday, Senator Bill Hagerty (R, TN) disputed JP Morgan CEO Jamie Dimon’s rejection of crypto during a Senate Banking hearing this week. Hagerty sees innovation and opportunity with digital assets and repeated on X , “I can understand why large banks are opposed to cryptocurrencies – the technology has the potential to disrupt much of the traditional banking model. This is not a fight for DC to pick sides on. We need to regulate with a light touch that doesn’t kill innovation in the US.” See a video clip of the interview.

offshore – stablecoins

Imagine a bank issued stablecoin in the U.S.? It’s not happening yet, but it is in the European Union. Axios’ Crystal Kim takes a look at Societe Generale’s Euro-backed Stablecoin – EURCV a.k.a. EUR Convertible. Kim writes, “Enterprise blockchain projects from the world of traditional finance usually go nowhere, but one European bank’s stablecoin could flourish outside the confines of its walled garden…” Read more. US Dollar hegemony threat? It’s still early, but…

more tips:

Societe Generale-Backed Euro Stablecoin EURCV Starts Trading on Bitstamp – CoinDesk

new co-sponsors

Sen. Laphonza Butler (D, CA) and Sen. Chris Van Hollen (D, MD) signed on a co-sponsor of Senator Elizabeth Warren’s (D, MA) “Digital Asset Anti-Money Laundering Act” [S.2669]. There are now 19 co-sponsors according to Congress.gov.

what you should know: More Senate Democrats come aboard. It’s curious that no one from the bipartisan CANSEE – and now Terrorism Financing Prevention Act – team of Senators has come aboard. Is that the next “shoe” to drop in the Senate? Or do Reed, Romney, Rounds and Warner want KYC/AML legislation for digital assets their way?

still more tips

Exclusive: Montenegro Plans to Extradite Fallen Crypto Tycoon Do Kwon to U.S. – The Wall Street Journal

Robinhood Launches Commission Free Crypto Trading in the European Union with Customers Earning Bitcoin Back on Every Trade – Robinhood

Block announces preorders for Bitkey bitcoin wallet – Blockworks