debates and crypto

Axios postulated yesterday about how the presidential debates will play out and where digital assets may make an appearance.

Noting digital assets momentum in the political sphere, Axios’ Brady Dale writes, “Much to everyone’s surprise, both candidates for U.S. president appear to be taking the topic of cryptocurrency seriously as an election issue, but only the challenger has made clear statements about the topic from the stump.” Dale sees President Joe Biden as the one to watch: “If he makes politician-like non-statements about cryptocurrency, then nothing has changed.” Read more.

more tips:

-

- Winklevoss Twins Donate $2 Million in Bitcoin to Trump to Fight Biden’s ‘War on Crypto’ – Decrypt

what you should know: The debates are scheduled for next Thursday, June 27, and then September 10.

votes and accountability

Sarah Brennan, a securities lawyer and general counsel to web3 venture firm Delphi Ventures, is interviewed on crypto[dot]news regarding a range of hot button, digital assets subjects. She’s skeptical of the Biden Administration’s recent overtures to the industry saying, “I personally think the SEC’s SAB 121 is reflective of the Biden admin’s various attempts to cut us off from the broader financial system…. Ultimately, it seems that while the Biden campaign wants our votes, they do not want to be accountable to us on policy.” Read the interview.

more tips:

-

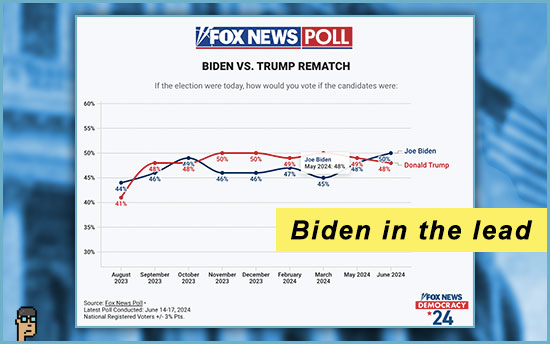

- Fox News Poll: Three-point shift in Biden-Trump matchup since May (June 19) – Fox News

what you should know: The Fox News poll proves the presidential race is a long one. Only a few months ago, President Biden was significantly behind and now he’s moved into the lead. 4.5 months to go….

use case – heat

In search of cheap power and, perhaps, more regulatory certainty, Bitcoin mining company Marathon Digital is spreading its bets and expanding its footprint beyond U.S. borders to Finland’s Satakunta region. The company will not only seek to build more datacenters, but also help heat a town of 11,000 people.

Blockworks explains, “The process Marathon is testing is known as district heating, which involves heating water in a central location before distributing it via underground pipes. Such systems aim to decarbonize heating in urban areas especially.” Read more.

more tips:

Marathon Digital uses crypto mining heat to warm homes in Finland – Data Center Dynamics

Kraken motion-to-dismiss

Oral arguments in cryptocurrency exchange Kraken’s Motion-to-Dismiss (MTD) against the Securities and Exchange Commission (SEC) and its case (started in Nov. 2023) against the company were heard yesterday. The regulator claims that Kraken was operating as an unregistered exchange and broker-dealer and offered a handful of tokens that were securities.

Judge William Orrick said to Kraken’s counsel, “I pretty much agree with what the SEC is arguing at this stage, but see if you can change my mind,” according to Consensys counsel Bill Hughes who was live tweeting the proceedings.

Nevertheless, Kraken counsel pushed forward, and according to Fox Business’ Eleanor Terrett, counsel encouraged Judge “Orrick to look at Judge Analisa Torres’s ruling in the Ripple case for how to think about treating secondary market sales for digital assets.”

Like the Coinbase MTD which ultimately failed except for one key component regarding self-hosted wallets, the Kraken MTD decision will take a couple of months.

Eleanor Terrett tweeted after the hearing yesterday, “Speaking with lawyers who listened to the proceedings today, they say a fair guess would be that Orrick will let this go to discovery. Like with Coinbase, the bar for the SEC to prove they have at least some plausible legal argument to continue with the case against Kraken is super low.”

more tips:

-

- Video: “[Kraken] CEO David Ripley says he’s seen growing support for crypto in Washington over the past several months” – CNBC’s Squawk Box

hear ye, hear ye

House Financial Services Capital Markets Subcommittee Hearing titled, “Solutions in Search of a Problem: Chair Gensler’s Equity Market Structure Reforms” – June 27, 2 p.m. ET – financialservices.house.gov

fentanyl advisory

In an advisory yesterday, U.S. Treasury’s Financial Crimes Enforcement Network (FinCEN) broadly warned how the U.S. financial system is being used for the purchase of the highly addictive drug, fentanyl.

From the advisory regarding how payments are facilitated: “FinCEN has identified the use of shell and front companies; money transfers through banks, money services businesses (MSBs), and online payment processors; and payments in virtual currency…” Read it (PDF).

Reporting on the crypto portion of the advisory, CoinDesk says, “The payments often end up in the Chinese suppliers’ hosted wallets at crypto firms, sometimes through a secondary money transmitter…” Read more in CoinDesk.

This new advisory should like feed into the FEND Off Fentanyl act [S.1271] supported by Senate Banking Chair Sherrod Brown (D, OH) and Ranking Member Tim Scott (R, SC).

what you should know: Senator Elizabeth Warren (D, MA) has made the illicit finance case for fentanyl and cryptocurrency at past Senate Banking hearings including a May 2023 hearing. At the time, she said, “Crypto is helping fund the fentanyl trade, and we have the power to shut that down. It’s time.”

CFTC crypto probe

According to Fortune’s Leo Schwartz, The Commodity Futures Trading Commission (CFTC) is investigating high-frequency trading firm Jump – owners of Jump Crypto – for its “involvement in crypto, including inquiries into its trading and investment activity.” Read more from Fortune on Yahoo.

As Schwartz notes, an investigation doesn’t mean there’s an enforcement action coming necessarily, adding, “Regulatory agencies routinely engage in fact-finding around companies falling under their jurisdiction.”

what you should know: Earlier this week, Jump dropped $10 million into crypto Super PAC coffers.

still more tips

Trump (and Texas) try to decode the crypto voter – Politico’s Digital Future Daily

Martin Shkreli Joins Trump Crypto Game in the Weirdest Way Ever – The New Republic

Italy boosts crypto risk oversight and toughens sanctions, draft shows – Reuters

Crypto ‘Secondaries’ Prices Jump as Expectations of IPOs Climb – Bloomberg