digital assets taxation

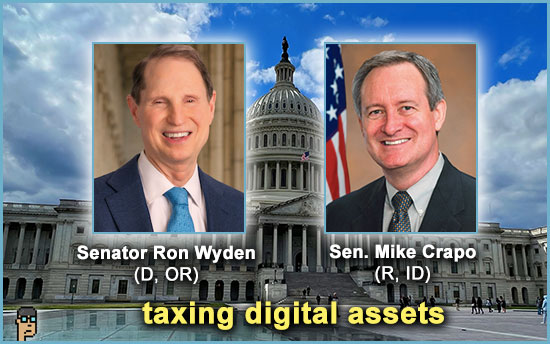

“In Letter to Stakeholders and Experts, Finance Leaders Seek Input to Address Uncertain Tax Treatment of Digital Assets” … so begins a press release from Senate Finance Committee Chairman Sen. Ron Wyden (D, OR) and Ranking Member Sen. Mike Crapo, (R, ID), who are attempting to address the need for proper taxation of digital assets beginning with feedback from the digital assets community and anyone else who cares to share. As evidenced by the detail of the release, this will be no small undertaking – just like most things in digital assets. Read it.

To breakdown where digital assets tax stands today, the Committee’s leaders asked the Joint Committee on Taxation (JCT) to compile a report on the taxation of digital assets – get the 24-page PDF here.

Jason Schwartz, a tax partner & digital assets co-head at law firm Fried-Frank, who also calls himself “Crypto Tax Guy,” quickly offered an analysis via a tweet thread examining each section of the Senators’ outline.

On wash sales, for example, Schwartz opined, “If you sell stock or bonds at a loss and buy back within 30 days, the tax loss is disallowed. The same rule doesn’t generally apply to crypto. Sound tax policy probably dictates that the wash sales apply to crypto in the same way they apply to stock & bonds.” Read the thread.

decentralized fraud

The U.S. District Attorney’s Office for the Southern District of New York (SDNY) announced the arrest yesterday of a security engineer who used “an attack on a smart contract” in a decentralized exchange (DEX) to steal crypto and defraud its customers.

U.S. Attorney Damian Williams said in a press release: “As alleged in the indictment, Shakeeb Ahmed, who was a senior security engineer at an international technology company, used his expertise to defraud the exchange and its users and steal approximately $9 million in cryptocurrency. We also allege that he then laundered the stolen funds through a series of complex transfers on the blockchain…” See the video of Williams announcement on Twitter.

Noting the DEX fraud case is a first-of-its-kind, Decrypt adds, “Though the DEX hasn’t been named in the indictment, it may be related to the Solana-based liquidity protocol Crema Finance hack that happened at that time last year, when a thief made away with $9 million in digital assets in a flash loan attack but then returned most of the cash.” Read more.

Also, on Monday, the SDNY announced charges against an individual who allegedly stole crypto and non-fungible tokens (NFTs). Read that release.

more tips:

What are smart contracts? – Santander

What is a decentralized exchange (DEX)? – Coinbase

EU metaverse plan

The European Commission announced its plan for the metaverse yesterday and calling it the “EU strategy to lead on Web 4.0 and virtual worlds.” See the high-level plan.

Politico reports, “That makes the European Union the first major global player to propose such an ambitious roadmap for our online future, or at least the online future that tech giants like Meta and Apple are promising.” Read that one.

Could future CODELs to the EU only require a VR headset?

bipartisan – Dodd-Frank

In a Wall Street Journal op-ed on Monday, former Massachusetts Senator Barney Frank (D) sees bipartisan, financial reform opportunity ahead despite what happened in March to crypto rails provider Signature Bank, a bank for which he was a board member.

Building on the WSJ editorial board’s opinion that built on Frank’s – that during March’s banking crisis, the closure of Signature Bank by the Federal Deposit Insurance Corporation (FDIC) was a “message to crypto” – Frank argued on Monday that the example of the eponymous Dodd-Frank Act and its bipartisan approach on consumer protection and Wall Street reform rigor is a lesson on a host of issues which need to be addressed today.

Speaking about the drama which occurred at the cusp of Congressional approval of Dodd-Frank post the Great Financial Crisis of 2008, Frank writes, “The Democrats’ and [Majority Whip Rep. Paul Ryan’s (R, WI)] decision to adopt specific fixes for obvious problems—rather than reopen a broad philosophical debate – has served us well. It should, moreover, be our model today as we deliberate the way forward on crypto regulation, monetary policy’s effect on financial stability, and deposit insurance. That isn’t succumbing to the banking industry’s deep pockets – it’s applying fact-based analysis to decide how to strengthen the financial system.” Read Frank’s editorial.

bipartisan – bicameral

Ron Hammond at Blockchain Association rallied the crypto troops yesterday in a Tweet thread as next week’s House Financial Services Committee Markup on July 19 approaches with the futures of the stablecoin and market structure bills hanging in the balance.

Appearing to address the stablecoin bill’s prospects, Hammond sees bipartisanship continuing to heat up in the House but warns, “To reiterate, there is still no bipartisan agreed upon text…yet. However most signs point to collaboration and it is possible in the next week or two there will be an update. This has been a years long process, but usually good bipartisan legislation takes time to craft.”

Pro-crypto forces are hoping that House bipartisanship can translate into Senate bipartisanship as digital assets legislation attempts to make its way into law.

bipartisan – partisan

Meanwhile, Blockworks also covered the bipartisan digital assets swirl in Washington yesterday. Clyde Group VP John Rizzo tells Blockworks’ Casey Wagner, “It has become partisan, and it’s dangerous for the industry, because if you’re a partisan issue, the livelihood…of your industry is subject to the whims of an election.” Read that one.

code of conduct

GBBC Digital Finance (GDF) announced its new Global Cryptoasset Standards, calling it “a code of conduct for financial institutions engaging in intermediation activities such as brokerage, custody, and settlement of cryptoassets like bitcoin and Ethereum.” See the 58-page code here (PDF).

GDF is a trade organization and a member of The International Organization of Securities Commissions (IOSCO). The press release notes that the new standards “have also been in purview of global regulators, including the Financial Conduct Authority (FCA), the U.S. Securities and Exchange Commission (SEC) and the Hong Kong Monetary Authority (HKMA). The Standards offer the best global practices for regulated firms handling cryptoassets, aimed at giving assurance to clients, regulators, employees, and shareholders.”

Is GDF carving out a global self-regulatory organization (SRO) future for itself?

use case – car sharing

A new trend in the tokenization of assets is sharing revenue across a network of asset owners according to TechCrunch. An Austrian company is telling its story: “ELOOP is a token-based car-sharing blockchain project that allows community members to share the revenue of its electric car fleet in Vienna. The cars are Teslas powered on the Polkadot blockchain via Peaq network, which builds applications for vehicles, robots and devices.” Read more.

see more tips

Former FTX Executive Linked to Campaign-Finance Probe of New York GOP Race – The Wall Street Journal

Blockchain and IoT for Drinking Water in G20 Countries: A Game-Changing Opportunity – India’s Observer Research Foundation

Coinbase Reaches Cboe Surveillance Sharing Agreement for 5 Bitcoin ETF Applications – CoinDesk

Policy Readout – CryptoUK blog

If you would like this delivered as a newsletter, please sign up here.