Trump on crypto

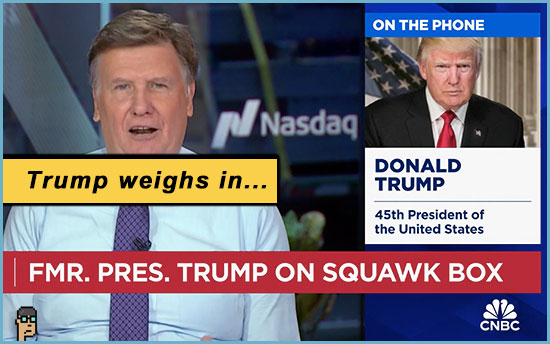

That may have been the most Donald Trump has ever said to the media about cryptocurrency… Yesterday morning, the former President appeared on CNBC with one of the business channel’s anchormen, Joe Kernen, and former SEC Chair Jay Clayton and answered a wide range of questions.

Kernen asked former President Trump about Bitcoin, crypto and regulation. He responded, “Well, it’s taken [on] its own life. I do little things sometimes for fun and make money with it. (…) Sometimes we’ll let people pay through Bitcoin or we’ll let people get involved… If you think of it, it’s an additional form of currency. I used to say I want one currency, I want the dollar, I don’t want people leaving the dollar. And I feel that way. But I will tell you that it has taken on a life.”

“I did a thing that people smile at but.. it was wild. We did a thousand sneakers, a limited edition sneaker run. You could go through our crazy new currencies because that’s what I call them, crazy new – whether it’s Bitcoin or others. So many people were buying these things. Ultimately, the last pair of sneakers sold for approximately, I hear, $450,000. It was a limited edition, a run. They were gold, nice, cute -we thought it was just a very small thing, a branding thing. We had a good time with it. The last pair sold for $450,000. People were going crazy for these sneakers. You probably were, too. Everybody was .. every friend has [asked] me for a pair of sneakers.”

“I noticed that so many of them were paid for with the new currency… it’s a new crypto. Cryptocurrency. I couldn’t believe the amount… other things I do. People are using it. I’m very much a traditionalist. I like staying with the dollar. You know that.. make the dollar the choice. I hate when countries go off the dollar. I would not allow countries to go off the dollar because when we lose that standard that will be like losing a Revolutionary War. That will be a hit to our country just like losing a war. And we can’t let that happen. And too many countries are fighting to get off the dollar.”

During the course of the interview, Trump denied that he has bought Bitcoin but said that he’s “seen there has been a lot of use” for crypto and “and I’m not sure that I’d want to take it away at this point.” It may not have been full-throated support for digital assets but it appeared Trump was carving out a differentiator between himself and current President Joe Biden.

See the crypto part of the interview on CNBC.

what you should know: Overall, though modestly positive, this did not sound like full-throated support of digital assets. Trump openly praised former SEC Chair Jay Clayton in the interview for his tenure at the Securities and Exchange Commission which could presage Clayton’s involvement in a 2025 Trump administration if it were to come to pass.

FDIC Vice Chair on SAB 121

Yesterday, Federal Deposit Insurance Corporation (FDIC) Vice Chair Travis Hill said in a speech that the SEC’s Staff Accounting Bulletin 121 is hurting the banking system.

In a speech at the George Mason University’s Mercatus Center titled, “Banking’s Next Chapter? Remarks on Tokenization and Other Issues,”

Hill didn’t mince words. He began, “In March 2022, the Securities and Exchange Commission (SEC) issued Staff Accounting Bulletin 121 (SAB 121), which provides that an entity that safeguards crypto-assets should recognize such an asset on its balance sheet as both an asset and a liability.”

“This treatment sharply departs from how custodians account for all other assets held in custody, which are generally held off-balance sheet and treated as the property of the customer, not the custodian. On-balance sheet recognition triggers the full panoply of capital, liquidity, and other prudential requirements only for bank custodians, which makes it prohibitively challenging for banks to engage in this activity at any scale. It is worth asking whether it is in the public interest for one crypto exchange to provide custody services for most of the market in approved Bitcoin exchange-traded products, while highly regulated banks are effectively excluded from the market.” The one crypto exchange is Coinbase.

Read the whole speech on FDIC.gov.

Two weeks ago, House Financial Services Committtee approved a joint resolution requiring the SEC to rescind SAB 121. The resolution now awaits a House floor vote. Next steps in the upper house have yet to be revealed by the resolution’s Senate sponsor, Senator Cynthia Lummis (R, WY).

what you should know: Hill is a Republican -one of two required by law in the 5-member leadership of the FDIC. He’s also a former Senate Banking staffer and appointed to his current role at the FDIC by the Biden Administration in 2022.

digital assets hearing

House Financial Services Digital Assets, Financial Technology and Inclusion Subcommittee will hold a hearing tomorrow titled, “Bureaucratic Overreach or Consumer Protection? Examining the CFPB’s Latest Action to Restrict Competition in Payments.” The hearing begins at 10 a.m.

Hearing page is here. And, get the committee memorandum.

The CFPB proposed rule under consideration by HFS Republicans is the “Defining Larger Participants of a Market for General-Use Digital Consumer Payment Applications.” See it on consumerfinance.gov.

The rule would unnecessarily impact crypto asset wallet providers who do not custody crypto as well as have other knock-on effects.

The rule “earned” a congressional letter from HFS Chair Patrick McHenry (R, NC), Digital Assets Chair French Hill (R, AR) and Rep. Mike Flood (R, NE) back in January which read it part: “the proposed rule does not adequately justify the need to substantially expand the Bureau’s regulatory scope into the payments industry.” Read the January letter.

Among the hearing witnesses (click name for available, prepared testimony):

-

- Carl Holshouser, EVP, TechNet

- Brian Johnson, Managing Director, Patomak Global Partners

- James Kim, Partner, Troutman Pepper Hamilton Sanders

- Jack Solowey, Fintech Analyst, CATO Institute

Cato’s Solowey points to the crux of the problem of the new CFPB rule for digital assets in his testimony:

“Even if the Proposed Rule had been properly justified, its proposed coverage of the crypto and decentralized finance (DeFi) ecosystem presents multiple problems. The Bureau proposes to extend its jurisdiction to transfers of ‘digital assets,’ ‘crypto-assets,’ and ‘virtual currency’ made for personal, family, or household purposes. This assertion of authority over crypto and DeFi is based on a thin reed of largely non-pertinent case law and is not supported with a proper cost-benefit or impact analysis. Relatedly, the Proposed Rule risks inappropriately sweeping into its ambit the technology of self-hosted, or non-custodial, crypto wallets.” Read more.

crypto payment card

Payment cards connected to blockchains have moved from exploration to the test phase. CoinDesk reports on new Mastercard marketing material about the test and says, “The MetaMask/Mastercard payment card would be ‘the first ever truly decentralized web3 payment solution,’ allowing users to spend their crypto ‘on everyday purchases, everywhere cards are accepted.'” Read it.

Mastercard’s “Crypto Card Program” website explains a bit more here. But, the MetaMask link up would be new and impactful – it’s one of the biggest crypto wallets in use today according to Money.

what you should know: The news emphasizes the on-chain aspects of the card and the benefit to holders of the card appears to be an easy way to spend one’s crypto. Fees likely help turn this into a moneymaker for the wallet provider and the credit card company – they’re helping convert one currency to another. There is no suggestion that this is about underlying blockchain-enabled infrastructure enabling faster settlement times, for example.

UK – TradFi crypto product

The London Stock Exchange will add cryptoasset-backed Exchange Traded Notes (cETN) denominated in ether and Bitcoin to its ETN product line-up -but for institutional investors only. In a statement, the exchange said, “The [Financial Conduct Authority] continues to believe cETNs and crypto derivatives are ill-suited for retail consumers due to the harm they pose. As a result, the ban on the sale of cETNs (and crypto derivatives) to retail consumers remains in place.” Read the statement.

more tips:

-

- UK regulator to allow crypto-related securities – Financial Times

what you should know: This is another step forward globally even though it targets institutional investors only. It’s also something pro-crypto advocates in the United States can point to and wonder aloud, “Is the United States falling behind?”

no fees for BTC

How important is this early stage of Bitcoin and crypto adoption? For one, ETFs are starting to cut their fees to ZERO. They are making no money.

In a new SEC filing by ETF provider Van Eck, the company said, “During the period commencing on March 12, 2024, and ending on March 31, 2025, the Sponsor will waive the entire Sponsor Fee for the first $1.5 billion of the Trust’s asset.” Laying the foundation for a fund that can compete in the future is the priority. Read more in Decrypt.

what you should know: Back in the day (pre-Bitcoin spot market ETF), exchanges used to make a pretty penny on investors’ cryptocurrency transactions which also encompassed custody services. Now, investors can invest in Bitcoin for free (at least for a while according to Van Eck).

Prometheum

What Is the Biggest Regulatory Hurdle for U.S. Crypto Firms? Prometheum’s Aaron Kaplan Answers Five Questions (Video) – CoinDesk

still more tips

Opinion: America deserves a financial alternative — and it’s crypto – Blockworks

Bitcoin rises to another record, ether breaks through $4,000 – CNBC

Chamber of Digital Commerce Letter To Arizona Governor Katie Hobbs

Supporting SCR 1016: Exploring State Investing Retirement Funds in Bitcoin ETFs – X

SEC Obtains Default Judgment Against Friend of Former Coinbase Manager for Insider Trading in Crypto Asset Securities – SEC.gov

Meeting: The Market Risk Advisory Committee’s Future of Finance and Climate-Related Market Risk Subcommittees – CFTC.gov