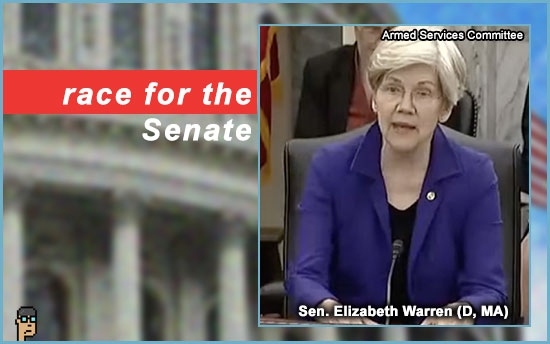

Sen. Warren’s race

Titled “Crypto comes for Elizabeth Warren,” Boston Globe editorial writer Shira Schoenberg provided local readers an overview of the race for Sen. Elizabeth Warren’s (D, MA) seat yesterday.

It’s an even-handed look which includes Sen. Warren and two Republican candidates – John Deaton and Ian Cain – who bring a pro-crypto platform.

Schoenberg notes Warren’s anti-money laundering crusade adding “…But in a state known for its high-tech industries, Warren’s opponents say she is stifling innovation. Cain is the founder of the Quincy-based QUBIC Labs, an incubator for blockchain technology. (…) Cain says the technology has broad uses beyond cryptocurrency. For example, he worked with MassTech Collaborative to explore ways governments can use blockchain, whether to streamline permitting or issue municipal bonds.”

what you should know: The Massachusetts Republican primary is September 3.

stablecoin bill updates

The “Lummis-Gillibrand Payment Stablecoin Act” is now available on Congress.gov.

S.4155, as it is now known, has been referred to Senate Banking. See it here.

what you should know: The Senate stablecoin bill maintains visibility of digital assets legislation in the Senate while the House’s “Clarity for Payment Stablecoins Act” [H.R.4766] will likely be the legislation that gets folded into the law books if/when the bill is successfully attached to a must-pass. Also, the Senate bill’s co-sponsors, Senators Cynthia Lummis (R, WY) and Kirsten Gillibrand (D, NY), remain key advocates for driving any stablecoin legislation and keeping Senate Banking Chair Sherrod Brown (D, OH) on his toes.

hear ye, hear ye

The House Financial Services (HFS) Committee announced a new hearing under the National Security, Illicit Finance, and International Financial Institutions Subcommittee called, “Mission Critical: Restoring National Security as the Focus of Defense Production Act (DPA) Reauthorization, Part II.”

It will take place next Wednesday afterrnoon, May 8. See the landing page.

Any hearing related to illicit finance could have digital assets implications, but, this time, the DPA may have more to do with energy says Politico.

what you should know: And if you’re thinking that if the FAA Reauthorization isn’t the landing strip for stablecoin legislation, perhaps it’s the DPA must-pass… the current DPA authorization expires in September 2025.

three witnesses

Three witnesses have been announced for next Wednesday’s HFS Capital Markets Subcommittee hearing on “SEC Enforcement: Balancing Deterrence with Due Process.” (see Memo) – financialservices.house.gov

crypto and China

A new Congressional Research Service (CRS) piece delves into the topic of the divestment of TikTok and the involvement of the government of the People’s Republic of China (PRC) in the company’s operations.

Though crypto isn’t a focus of the piece, CRS creates a table of the “Key PRC Digital Platforms in the U.S. Market” and it includes one crypto company: Binance and its U.S. subsidiary, Binance.US.

Read: “TikTok and China’s Digital Platforms: Issues for Congress“.

more anti-surveillance

On Monday and Tuesday of this week, 4 new co-sponsors came aboard Majority Whip Tom Emmer’s (R, MN) CBDC Anti-Surveillance State Act [H.R.5403] bringing the total number of Republican co-sponsors to 160. The latest are: Reps. Richard McCormick (R, GA), Mike Carey (R, OH), Robert Wittman (R, VA) and Greg Pence (R,IN).

Drum roll: Will the entire House Republican caucus co-sponsor the bill before an anticipated vote takes place on the House Floor this summer?

Block, compliance questions

Sources tell NBC News that Federal prosecutors are looking at whether financial technology and services firm Block may have allowed cryptocurrency transactions related to illicit finance and countries on sanctions lists. According to NBC, a former Block “employee provided prosecutors from the Southern District of New York documents that they say show that insufficient information is collected from Square and Cash App customers to assess their risks…” Read more.

The stock of Block, a publicly-traded company, dropped 8% on the news yesterday.

Sen. Lummis on DOJ

The Department of Justice’s desire to designate crypto wallet developers and wallet users as money transmitters – which stems from recent proceedings in the Samourai Wallet indictment and the Tornado Cash case – is not sitting well with Sen. Cynthia Lummis (R, WY).

Yesterday on X, she said in a statement: “I am deeply troubled by the Department of Justice’s hyper-aggressive argument that non-custodial software can constitute a money transmission service. This stance contradicts existing Treasury guidance, common sense and violates the rule of law. Arguments against self-custody software threaten the fundamental property rights that are core to being an American. I will do everything I can to fight for your rights to hold your own keys and run your own node.”

more tips:

-

- DOJ’s New Stance on Crypto Wallets is a Threat to Liberty and the Rule of Law (from Monday) – Coin Center

more DOJ news

Justice Department pushes for more firepower in crypto crackdown (subscription) – Politico

Groundhog Day for the Crypto Wars: The DOJ on Bitcoin Prowl – The Reason

states: mining bans

The North Carolina Blockchain Initiative (NCBI) sent a letter yesterday regarding North Carolina Senate Bill 774, “Prohibit Crypto-Mining as Authorized Use” to sponsor and State Senator Tim Moffitt (R) asking him to reconsider a proposed ban of crypto mining in certain North Carolina counties. In a LinkedIn post that includes a copy of the letter, NCBI says they “would welcome an opportunity to aid North Carolina Senate Republicans (and the North Carolina General Assembly at large) in considering alternative solutions to proposed bans and moratoriums against crypto-mining.”

Read the NCBI Linkedin post and letter.

more tips:

-

- New bill would grant regulatory power over crypto mining to three North Carolina counties (April 29) – NC Newsline

new AML solution

Claiming to have a new anti-money laundering solution for cryptocurrency using artifical intelligence (AI), blockchain analytics firm Ellitpic unveiled a new product yesterday using IBM’s AI Lab.

Elliptic’s co-founder and chief scientist Tom Robinson told The Next Web that there are two use cases for the new tech: “The primary application is in anti-money laundering, helping crypto exchanges and other businesses to identify crypto that may have originated from criminal activity (…) It could also be used by law enforcement agencies to identify new illicit services and actors making use of cryptocurrencies.” Read more.

still more tips

BlackRock leads $47 million round for Securitize – Fortune on Yahoo

Stablecoin news: “Tether Releases Q1 2024 Attestation: Reports Record-Breaking $4.52 Billion Profit, Highest Treasury Bill Ownership Percentage Ever, Total Group Equity of $11.37 Billion” – Tether.io

Former L.A. Mayor Antonio Villaraigosa joins cryptocurrency company Coinbase as advisor – LA Times

Ahead of EU Elections, Crypto Industry Pushes Blockchain Merits as Policy Focus Shifts to AI – CoinDesk

Interest-Rate Outlook Hits Bitcoin, Too – The Wall Street Journal