At last week’s “Future of Digital Assets” conference produced by the Milken Institute, Rep. French Hill (R, AR), chair of the House Financial Services’ Digital Assets, Financial Technology and Inclusion Subcommittee, spoke at length regarding digital assets legislation prospects in the 118th Congress.

Nicole Valentine, FinTech Director at Milken Institute moderated the discussion.

(Transcript edited for clarity)

On key priorities for the House Digital Assets Subcommittee…

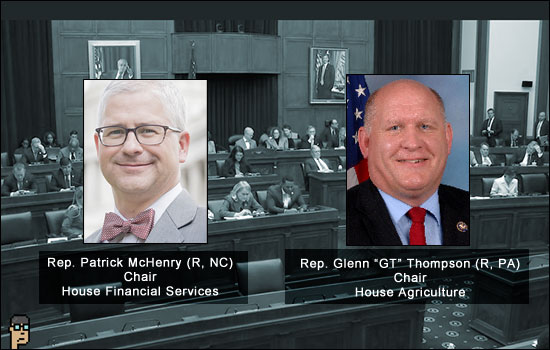

REP. FRENCH HILL: The Digital Assets Subcommittee is a priority for the House Republicans and the House Financial Services Committee because back in 2019, we had two task forces: a task force on artificial intelligence and we had a task force on FinTech, financial technology. Those were bipartisan. It was agreed to and set up by then-Chairwoman Rep.Maxine Waters (D, CA) and then-Ranking Member Rep. Patrick McHenry (R, NC).

And digital assets and financial technology have been a priority for the committee for many years to help solve many of the challenges that the existing financial structure has and lay a framework for innovation for the future. And so it was a “natural” that when Patrick [McHenry] became the chairman of the committee that he would want to have a subcommittee on digital assets. That’s the background – it has the full jurisdictional aspects of all things FinTech, inclusion and the broader picture of digital assets.

In the House and in the Senate, you don’t have clean jurisdiction in some of these key areas. The House Agriculture committee and the Senate Agriculture Committee play a role here as well because under market regulation conditions they might be involved in the futures market or certain aspects of the currency oversight of an exchange.

Our goal is to create a regulatory framework for digital assets. And there’s no doubt in my mind that this country needs that – we’ve seen that through the willy-nilly formation, so far, with no guidance – just pure innovation out there. We’ve seen it in the malfeasance in the industry that we witnessed last year culminating in the collapse of FTX. And we see it in the competition across the globe where other jurisdictions are establishing a legal framework and regulatory framework for digital assets, whether it’s in Europe or Asia. And so that is a critical element to take into account.

And finally, the United States has been at the forefront of financial innovation in the capital markets for certainly the 20th century and into the 21st century. We want to see that continue in a digital format. This is a big agenda for this subcommittee and I look forward to leading it as its initial pioneering chairman, and it’s gonna be a fun ride this year. Continue reading “Rep. French Hill Discusses Digital Assets Legislation Prospects at Milken Institute”