letter – no veto, please

WIth the deadline approaching early next week, Senator Cynthia Lummis (R, WY) and a bipartisan group of Congressmen appealed directly to President Joe Biden with a Congressional letter urging him to NOT veto H.J.R.109. The resolution rescinds the SEC’s Staff Accounting Bulletin 121 and was passed by a bipartisan majority in both houses (1, 2) of Congress this month.

Sen. Lummis and the House reps say in a statement, “Given the overwhelming bipartisan votes, we urge you to sign H.J. Res. 109 into law or work with the SEC to rescind the staff guidance…. Rescinding SAB 121 is well within the SEC’s authority and there is ample precedent for revisiting a staff accounting bulletin. In fact, most staff accounting bulletins over the last three decades have been revisions and recessions of prior guidance.” Read the release.

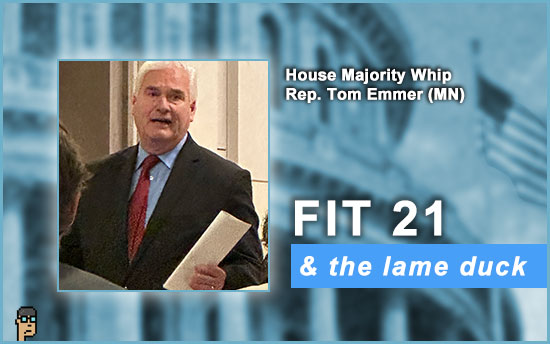

Lummis is joined by House Majority Whip Tom Emmer (R, MN), House Financial Services (HFS) Chair Patrick McHenry (R, NC) and Reps. French Hill (R, AR), Wiley Nickel (D, NC), Ritchie Torres (D, NY), Andy Barr (R, KY), Mike Flood (R, NE) and Dan Meuser (R, PA).

what you should know: If President Biden signs H.J.R.109 into law, would SEC Chair Gary Gensler decide to leave? The President’s signature would be a damning statement on Gensler’s leadership at the agency – even if was just following orders from Dem leaders. It would also follow the ouster of Chair Gensler’s policy director Heather Slavkin Corzo on May 17. The announcement came one day after the SAB 121 resolution vote in the Senate and was one of the first signs that Dem leaders were potentially changing their collective mind on digital assets.

storm for Dem leadership

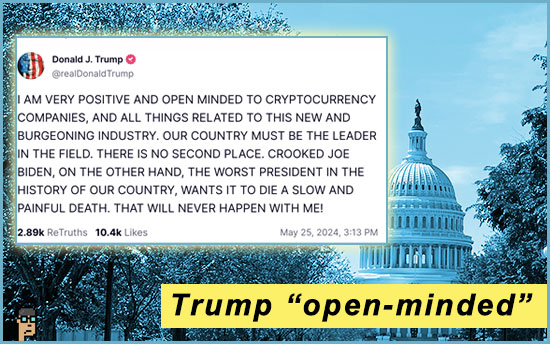

Ohhhhh, the storm continues to brew for Democratic leadership…

According to Bloomberg yesterday, former President Donald Trump and Elon Musk “are discussing cryptocurrency policy as the former president increasingly highlights Bitcoin and other digital assets on the campaign trail as a way to reach new voters,” says an unnamed source. Read it. Continue reading “Congress Urges President To Support SAB 121 Resolution; Storm Swirls For Dem Leadership”