anti-CBDC bill – passage

Yesterday afternoon, The “CBDC Anti-Surveillance State Act” [H.R.5403] from Majority Whip Tom Emmer (R, MN) passed along nearly partisan lines on the House Floor. The bill effectively bans a Central Bank Digital Currency (CBDC) without Congressional authorization.

The bill passed 216-192. 22 members did not vote.

As expected, the bill with 165 Republican co-sponsors, was unanimously approved by House Republicans.

Three Democrats broke from Dem leadership and voted for the bill: Reps. Jared Golden (ME), Mary Sattler Peltola (AK) and Marie Gluesenkamp Perez (WA).

Visit the Clerk’s website for H.R. 5403’s complete tally.

Whip Emmer celebrated the passage in a tweet thread after the vote, “My legislation ensures that the United States’ digital currency policy remains in the hands of the American people so that any development of digital money reflects our values of privacy, individual sovereignty, and free market competitiveness.”

more tips:

-

- View: “Full answer from [Treasury Secretary Janet Yellen] on a digital dollar ahead of this afternoon’s vote on Majority Whip Tom Emmer’s bill to ban the Fed from offering one.” – Brendan Pedersen, Punchbowl News on X

what you should know: This is an important message bill for House Republicans that likely won’t see the Democrat-controlled Senate Floor this Congress (let alone the White House). But, if votes fall the Republicans way in the November election, this bill could make it into law in the next Congress.

ETH ETP – letter

In a bipartisan letter dated Wednesday and announced yesterday morning, House Financial Services Committee Members urged Securities and Exchange Commission (SEC) Chair Gary Gensler to use a “consistent and equitable approach” in reviewing the Ether Exchange-Traded Product (ETP) applications currently pending at Gensler’s commission.

Furthemore, the Members see a “natural progression” on why the SEC should approve an Ether ETP after the Commission had approved a Bitcoin spot market ETP.

Among the letter’s signers was House Majority Whip Tom Emmer (R, MN) was joined by Reps. Josh Gottheimer (D, NJ), French Hill (R, AR), Wiley Nickel (D, NC) and Rep. Mike Flood (R, NE).

more tips:

-

- What Ethereum ETF Approvals Would Mean for US Crypto Policy – Decrypt

ETH ETP – approvals

Congressional letters work.

Late yesterday afternoon, the SEC approved the first leg of the process for a basket of ETH ETF applications.

Bloomberg analyst James Seyffart clarified in a tweet, “This does not mean [the ETFs] will begin trading tomorrow. This is just 19b-4 approval. Also needs to be an approval on the S-1 documents which is going to take time. We’re expecting it to take a couple weeks but could take longer. Should know more within a week or so!” Read Seyffart’s tweet thread.

more tips:

what you should know: This event once again represents a “sea change” in the way Democratic leadership, beginning with the White House, is viewing digital assets. Are stablecoins next?

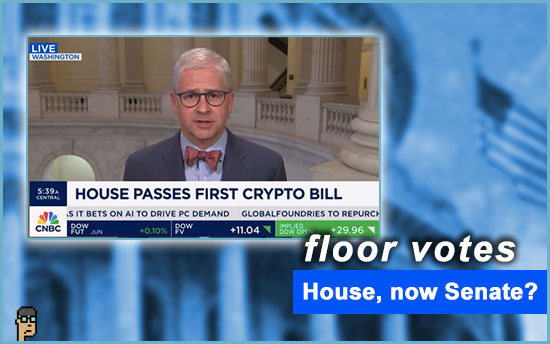

FIT 21 – the Senate

House Financial Services Chair Patrick McHenry (R, NC) appeared on CNBC’s Squawk Box yesterday and commented on next steps for the “Financial Innovation and Technology for the 21st Century Act” [H.R.4763] or “FIT 21”.

McHenry said he believed there was hope for passage in the Senate in the 118th Congress considering the results of the Senate vote on rescinding SAB 121 in the Senate where 11 Democrats and one Independent joined Republicans to pass the resolution.

Chair McHenry said in part:

“Don’t count the Senate out. I think they have a huge opportunity here. I think you a lot of interest with leadership from Sinema and Gillibrand on the Democrat side and Lummis on the Republican side. I think there’s a huge opportunity with the leadership of Chair Stabenow on the [Senate] Ag Committee and Ranking Member Boozman. (…)”

“We’ve gotten much further in an election year on policy than I expected. I’m so focused on just landing deals wherever we can, no matter the political environment. Yesterday was a good statement on that.

more tips:

-

- Crypto market structure bill advances to Senate, Rep. Nickel is optimistic – Blockworks

what you should know: Senate Agriculture Chair Debbie Stabenow (D, MI) voted against the SAB 121 resolution. Like many House Democrats on FIT 21 – and now with McHenry’s mention – it’s highly probable she’d switch to supporting the digital asset market bill, FIT 21.

FIT 21 – shock

Coming out of Wednesday’s House Floor vote, Politico reports that House Financial Services Chair Patrick McHenry (R, NC) was “shocked” by the level of Democratic support for FIT 21.

71 Democrats voted for the bill – 50 more Democrats than voted for the SAB 121 resolution two weeks prior.

Meanwhile, House Democratic leadership appeared equally shocked as Rep. Stephen Lynch (D, MA), a relentless detractor of the bill, told Politico, “I think they misled people, and people don’t really understand the impact that this is going to have.” Read more.

more tips:

-

- FIT21 Bill Progress: Crypto Regulation Moves to the Senate with Congressman French Hill (podcast) – Thinking Crypto on YouTube

what you should know: The general buzz in DC right now seems to be that FIT 21 will stop here in the 118th Congress: i.e. passage in the House. But, if Democratic leadership sees crypto voters as a key place to secure votes for the White House in November, then look out. Also in the mix will be the Lummis-Gillibrand Responsible Financial Innovation Act (S.2281) and perhaps remnants of the 117th Congress’ Digital Commodities Consumer Protection Act (S.4760) assuming Senate Ag Chair Debbie Stabenow’s and Ranking Member John Boozman’s involvement.

Senator Lummis trolling

“We are building a pro-crypto army in Congress.” – Senator Cynthia Lummis (R, WY) on X yesterday

SAB 121 timing

According to industry organization Digital Chamber, the resolution rescinding the Securities and Exchange Commission’s Staff Accounting Bulletin 121 was sent to the White House on Wednesday. The 10-day deadline for President Biden to veto or sign is now extended until June 3.

Read more from Digital Chamber’s Cody Carbone.

Ryan Selkis on offense

With his appearance in early May with former President Donald Trump helping to stirring the presidential politics “pot”, Messari CEO Ryan Selkis hasn’t let up on his fusillade against the Democratic Party. And he made clear that the vote on FIT 21 was not going to change things.

On X yesterday, Selkis said, “If you spend three years defaming us, our teams, and our professional colleagues as terrorist sympathizers, fraudsters, and the most vile of criminals, do not expect to be let off the hook based on a vote we forced you to make for crypto. The offense is just getting warmed up.”

GMAC meeting

Commodity Futures Trading Commission (CFTC) Commissioner Caroline Pham will be holding a public meeting of her Global Markets Advisory Committee (GMAC) on June 4 in New York City.

According to yesterday’s press release for GMAC – which includes a “Digital Asset Markets” subcommittee -, “The upcoming GMAC meeting will build upon the GMAC’s progress toward developing solutions to the most significant challenges in global markets, as outlined in its 2023-2025 work program.” Read more.

opinion

Paradigm responds to The Bank for International Settlements (BIS) recent paper on DeFi lending – Paradigm

Opinion: Bipartisan support of cryptocurrency is resurging in Congress. Here’s why – Coinfund’s Chris Perkins on Fortune (and Yahoo)

Opinion: The SEC Endangers Investors By Approving Spot Ether ETPs – Better Markets

still more tips

Dutch cybercops tracked a crypto theft to one of the world’s worst botnets – The Next Web

McHenry Demands Gruenberg Testify at Hearing on FDIC Toxic Workplace Culture – financialservices.house.gov

President Biden’s campaign team is hiring a master of memes – Cointelegraph