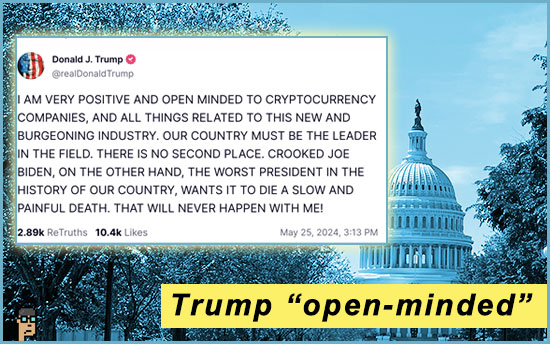

Donald Trump on crypto

With Democratic leadership appearing to turn toward supporting digital assets legislation, former President Donald Trump poured on the gasoline on his Truth Social platform on Saturday saying, “I am very positive and open minded to cryptocurrency companies, and all things related to this new and burgeoning industry.”

Arguably, Trump’s professed interest in crypto – beginning in early May – has helped improve the prospects for bringing digital assets under the umbrella of the U.S. financial system. Read more from Forbes.

more tips:

-

- Trump Vows to Aid Convicted ‘Silk Road’ Founder in Crypto Appeal – Bloomberg

risky stablecoins

Treasury Secretary Janet Yellen speaks to Punchbowl News’ Brenden Pedersen on the latest effort to regulate stablecoin markets. All Yellen sees are risks and advocates for regulation – coming from Congress – sooner than later. She tells Pedersen, “PayPal now has a coin… This could become a widely used payments network. If something is a widely used payments network that involves stablecoins, I think there is serious financial stability risk.” Read more in The Vault (subscription).

what you should know: Given the significant change in tone towards digital assets coming from the White House in the past two weeks, Yellen’s comments do not echo a similar change as of yet. The Biden Administration has seemingly held fast to Federal Reserve pre-emption when it comes to stablecoin issuance versus the dual banking (states/Federal) solution preferred by Republicans.

unvarnished opinion

Capitol Account covered House Financial Services Chair Patrick McHenry’s (R, NC) appearance last Wednesday at the Investment Company Institute’s annual leadership summit in DC.

McHenry did not hold back across a range of subjects including the Securities and Exchange Commission (SEC) and its Chair: “It is the Gensler regime that has made things less certain, more difficult for regulated financials to play substantial roles in this space and provide consumer protection… The SEC has made it worse.” Chair McHenry was none too pleased about Chair Gensler’s statement (see it) on FIT 21 the morning of the bill’s vote, either. Read more from Capitol Account.

soften federal oversight

Crypto lobbying money is helping to create “gentler regulations” according to an article this past Saturday in The Washington Post.

Summarizing the lobbying dollars spent thus far, WaPo’s Tony Romm characterizes last week’s FIT 21 passage in the House saying that the lobbying campaign “culminated [last] week with a House vote to soften federal oversight of the embattled industry.” Read more.

what you should know: The take that Federal oversight is “softening” with digital assets regulation is something pro-crypto forces will likely need to continue to address. Missing from the story is the potentially, valuable voter base at stake which supports digital assets.

DeFi for policymakers

Crypto Council for Innovation (CCI) published a new overview of decentralized finance (DeFi) earlier this month which may be of use to Congress as DeFi gets wrapped into the public policy debate.

Titled, the “Crypto Illicit Finance Risk Management Guide,” the report identifies the different DeFi “stacks,” examples of those stacks, risk management measures currently in play, the key players in the DeFi ecosystem and their available tools.

ETH ETF ripple effects

Securitize CEO Carlos Domingo couldn’t be happier that the SEC appears to be on track to approve Ether Exchange-Traded Products (ETPs). Domingo tells Decrypt, “The most important thing here is not that you can trade an Ethereum ETF… Ethereum, at least from an institutional perspective, is [now] completely safe to use because there’s no risk that the gas token, ETH in this case, is actually a security.” Read more.

what you should know: The SEC still has to approve each application’s S-1. The Ether ETF is not a done deal, yet.

veto, or not, this week

Will the President veto H.J.R.109 – the resolution rescinding the SEC’s Staff Accounting Bulletin (SAB 121) or not?… that is the question this week with a decision deadline early next week.

Following passage in both houses of Congress, Blockchain Association sent encouragement to President Joe Biden last Thursday urging support for H.J.Res. 109: “Our industry has long expressed concerns that SAB 121 fails to align with GAAP standards, and would harm consumers and other market participants by limiting the availability of safe custody options.”

more tokens and ETFs

Crypto analysts at JP Morgan attempt to look beyond the still nascent Ether ETP approval process currently being managed by the SEC and considers whether still more tokens are possible under an ETF “umbrella.” The Block quotes the JPM analysis, “We don’t think the SEC would go even further by approving Solana or other token ETFs given the SEC has stronger (relative to Ethereum) opinion that tokens outside bitcoin and Ethereum should be classified as securities…” Read more.

still more tips

“Crypto just became a political football, and ether is the early winner” (May 22) – Yahoo Finance

SEC completes abrupt U-turn to approve Ethereum ETFs in ‘politically driven’ move (May 23) – Fortune on Yahoo

Libertarian Party has US presidential candidate – What’s his crypto platform? – Cointelegraph

Whistleblowers, Yachts and Lawyers: FTX Examiner’s Key Takeaways – The Wall Street Journal

Crypto’s ‘huge moment’ scrambling US politics (May 23) – Politico