Spinning out of the Labor Day holiday, U.S. Securities and Exchange Commission (SEC) Chair Gary Gensler unleashed a public relations blitz about cryptocurrency and its regulation.

His position mostly reinforced what the Chair has said before: crypto companies should “come in” and connect with the SEC to ensure regulatory compliance, the Howey Test is the unquestionable arbiter of all things securities-related and Bitcoin is a commodity.

Putting his many appearances together such as SEC Speaks 2022, The Wall Street Journal and CoinDesk, Chair Gensler appears either increasingly defiant or defensive in relation to the crypto hordes depending on your point-of-view.

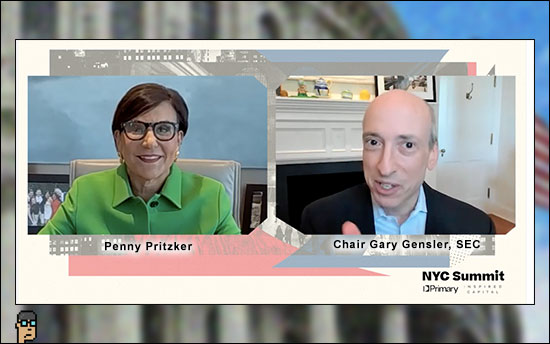

The least publicized of his media appearances on Wednesday was his 10-minute taped interview (see the video) with former Commerce Secretary Penny Pritzker for NYC Summit. Ms. Pritzker’s firm Inspired Capital co-hosted the New York City entrepreneurial ecosystem event along with Primary Capital.

Gensler’s role as head of the CFTC (2009-2014) overlapped six months with Pritzker’s Commerce Secretary role (2013-2017) during the Obama administration.

Interview highlights

Among the questions, Ms. Pritzker inquired about “Bitcoin or other cryptocurrencies” and how the Chair saw them evolving from a regulatory standpoint. Chair Gensler avoided mentioning any cryptocurrency by name other than Bitcoin:

(lightly edited for clarity)

“This is a bit of innovation that came along, whomever Satoshi Nakamoto, whoever she was, or he, this innovation. And the investing public got interested – certainly by five, six years ago – got pretty interested. I think that it’s similar to what I said earlier. I think the investing public benefits from disclosures, understanding what a group of entrepreneurs might be doing, and, frankly, that most of the tokens and there’s five or 10,000 tokens to buy most of the tokens have a group of entrepreneurs and the public is trying to invest in those projects and get a better future. Well, those are the attributes of a security. And those are things that the SEC does well. I’ve said come in, talk to us, help get the the intermediaries registered, the crypto exchanges, the crypto lending platforms, the crypto broker dealers, registered we can use exemptive authority to to where we can to tailor this but also the disclosures around the tokens.”

“Now, Bitcoin you mentioned. My fellow regulator at a great agency that I once was honored to chair, the Commodity Futures Trading Commission -but we can work together as we work together on so many other issues between our financial regulators and to get investor protection for the public.”

“And I will close on this. Without that investor protection, there won’t be trust in these markets. So I say this to any of the VC or founders in the room that are involved in crypto – just like you might have said he had a point about the auto industry that Detroit would not have taken off without some traffic lights and cops on the beat, this field crypto is neither going to take off if you think it will, unless you’ve got some trust that the public can have in this field.”

Pritzker also inquired about the role that regulation plays as it relates to new innovations and technologies.

Chair Gensler, who was speaking to a room of entrepreneurs and venture capitalists, did not hesitate: “I think that most innovation happens out in the public sector and the great scientists and academics and tinkerers in the garages and so forth. But, I do think government plays a role and I think that it plays a role in finance critically about instilling trust…”

In closing, Pritzker asked Chair Gensler if there was anything else he would like to share on the future of technology. Gensler tried to give his entrepreneurial audience hope:

“Well, look, I think that it’s really at the core of this great nation of ours – its innovative, productive side, and that I don’t know what technology will come in the future, [but] it’s changing the face of finance [with] predictive data analytics, robo-advising and in brokerage apps, and of course, how it’s being used in day-to-day investing by the most sophisticated or just somebody starting out. And so that’s makes it exciting for [the SEC]. But I think that we in the official sector who have this privilege to serve should constantly update our roles for those new technologies. And so that’s what we’re trying to do. That’s what we’re trying to do across our markets -to keep them the most efficient here in the face of changing technologies. And if we don’t, some other nation will, so I’d rather be that party to do it.”