approps amendments

As negotiations continue on the Hill regarding appropriations, at least two digital asset-related amendments were introduced by Republicans in the House of Representatives yesterday. Reigning in the SEC and CBDCs was the focus.

Majority Whip Tom Emmer (R, MN) said, “[Gary Gensler] is as ineffective as he is incompetent. Fortunately, my nonpartisan appropriations amendment to reign in SEC enforcement abuses against the digital asset industry passed the House today with no opposition. Congress will hold unelected bureaucrats accountable.” Incidents involving Coinbase and Grayscale and the agency’s SAB 121 bulletin are all identified as examples of SEC overreach. See Emmer’s 5-minute statement on the House floor on X.

Rep. Warren Davidson (R, OH) took the opportunity to target CBDCs, a House Republican bugaboo, as an approps amendment. He said, “Central Bank Digital Currencies (CBDCs) should never be designed, developed, or established. It’s like building the Death Star and saying you won’t turn it on. Today I offered an amendment to stop the creation of [CBDCs]…” On X, see Rep. Davidson’s speech on the House floor.

Emmer’s (here) and Davidson’s (here) amendments were adopted by voice vote in the House.

more tips:

You Can’t Regulate What You Don’t Understand (2.0) – Alex Grieve, Paradigm

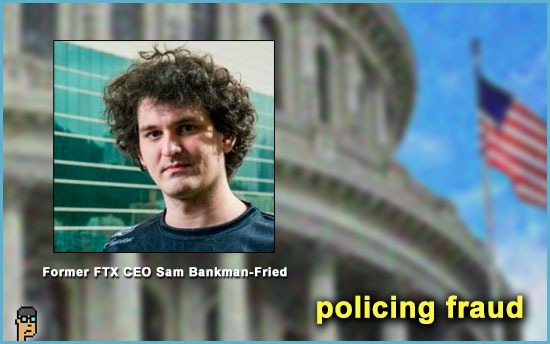

cop on the beat

Showing Congress that it’s the “cop on the beat,” the Commodity Futures Trading Commission (CFTC) tallied up its fiscal year 2023 enforcement actions ending September 30, 2023 in a press release yesterday. It’s lead category was “digital assets” in which the regulator “brought 47 actions involving conduct related to digital asset commodities, representing more than 49% of all actions filed during that period.” Overall (digital assets plus everything else), the CFTC said it had “over $4.3 billion in penalties, restitution and disgorgement” in the fiscal year. Read the release.

CFTC Chair Rostin Behnam has long advocated that his agency is the appropriate “cop on the beat” for digital assets cash markets since pre-FTX-implosion and the consideration of the Digital Commodities Consumer Protection Act (DCCPA) in the last Congress. Continue reading “Appropriations Amendments Address SEC, CBDCs; McHenry Sees Crypto Legislative Window”