Coinbase – earnings review

Earnings for cryptocurrency platform Coinbase outpaced Wall Street’s expectations for the first quarter of 2024 as the company reported earnings of $4.40 per share last Thursday, more than tripling analysts projections, with total revenue of $1.64 billion which more than doubled the revenue from the same period a year ago.

Nevertheless, Wall Street analysis was a mixed bag. Cannacord said “the quarter underscored the company’s ability to gain market share in hot and cool crypto market environments” while Goldman Sachs said “the risk-reward for Coinbase stock will largely be a reflection of volatility in crypto prices going forward, without a long-term plan in the broader crypto market according to Investor Business Daily. Read more.

Coinbase currently has a market cap of $54 billion.

more tips:

Coinbase – elections, dual banking

On the conference call with analysts, Coinbase CEO Brian Armstrong noted how growing revenue, crypto utility and regulatory clarity were his company’s three big priorities. Fairshake Super PAC, “which already had a great impact in the market primaries in California, Texas, and Alabama” also was mentioned by Armstrong.

Expect more of the same on election contributions leading up to November appeared to be the message.

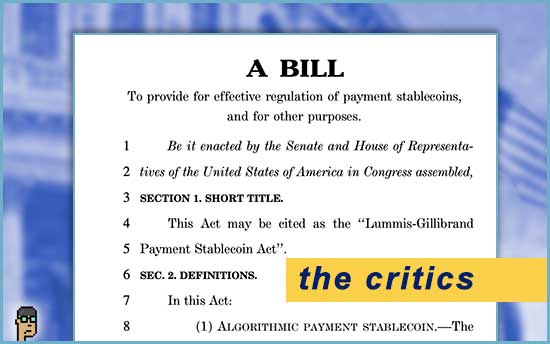

Citi analyst Peter Christiansen asked the Coinbase team about stablecoin legislation during the earnings call. Christiansen claimed “press reports are indicating potentially that Lummis-Gillibrand [Payment Stablecoin Act – S.4155] could hit the floor at some point next week. And part of that Bill, as you likely probably know is the dual banking system debate and whether or not states can issue their own stablecoins independently of the government — the federal government. I’m just curious how you see state-issued stablecoins kind of playing in the market. Is that potentially an opportunity for Coinbase? I’m just curious for your thoughts around that dynamic.” Continue reading “Coinbase Earnings Reviewed With Elections, Regulation In Focus; Russia And Iran Working On CBDC”