Senator Warner – illicit finance

Senator Mark Warner (D, VA) has inserted his Terrorist Financing Prevention Act [S.3441] into a must-pass: The “Intelligence Authorization Act for Fiscal Year 2025” [S.4443].

From the bill:

“… Sanctions With Respect To Foreign Financial Institutions And Foreign Digital Asset Transaction Facilitators That Engage In Certain Transactions.” –

“(1) MANDATORY IDENTIFICATION.—Not later than 60 days after the date of enactment of this Act, and periodically thereafter, the Secretary shall identify and submit to the President a report identifying any foreign financial institution or foreign digital asset transaction facilitator that has knowingly…” See the text.

Senator Warner chairs the Senate Intelligence Committee.

DeFi Education Fund CEO Miller Whitehouse-Levine tweeted last night about the addition, “Massive expansion of sanctions designation authorities (and mandatory imposition?) including ‘foreign digital asset transaction facilitators’ put into [Sen.Mark Warner’s] intel bill, which passed out of committee unanimously yesterday. Very concerning.”

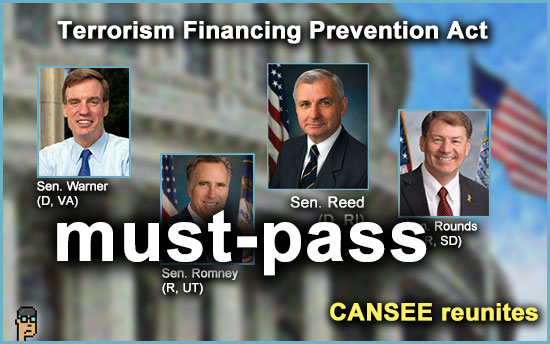

what you should know: Senator Warner has previously partnered with Sens. Jack Reed (D, RI), Mitt Romney (R, UT) and Mike Rounds (R, SD) on the CANSEE or “Crypto-Asset National Security Enhancement and Enforcement Act” [S.2355] which has given industry pause in its treatment decentralized finance among other issues.

Senators Ron Wyden (D, OR) and Kirsten Gillibrand (D, NY) are also members of the Senate Intelligence Committee and are presumably aware of Sen. Warner’s legislative maneuvers. Wyden and Gillibrand have been openly supportive of digital asset interests.

tokenization hearing – 2 things

Two things were clear from yesterday’s hearing on tokenization from House Financial Services (HFS) Subcommittee on Digital Assets, Financial Technology and Inclusion led by Chair French Hill (R, AR)…

First, real-world asset (RWA) tokenization is an exciting and potentially huge financial frontier enabled by distributed ledger technology and Congress will need to weigh in. Continue reading “Politics Mixes Heavily With Tokenization Hearing; Sen. Warner’s Illicit Finance Bill”