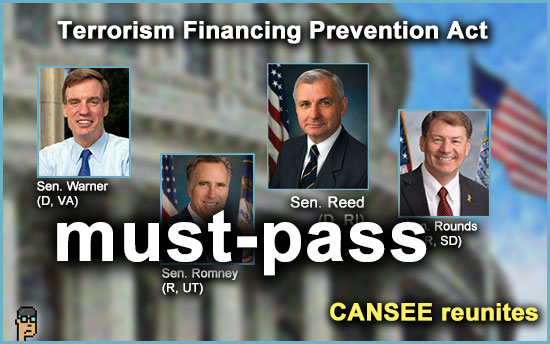

must-pass amendment

Sen. Mark Warner (D, VA) and his co-sponsors Sens. Mike Rounds (R, MT), Jack Reed (D, RI) and Mitt Romney (R, UT) appear to be trying to add at least a part of their “Terrorism Financing Prevention Act” (S.3441) to a “must-pass” bill [H.R.815] “RELIEVE Act” which supports the Veterans Community Care program and is sponsored by Rep. Cathy McMorris Rodgers (R, WA), Chair of the House Energy and Commerce Committee,

Warner first introduced his bill in December which aims at sanctioning any firm that is facilitating payments to “Foreign Terrorist Organizations” rather than the current limits of the law which focuses on Hezbollah. The legislation also includes a piece of Sen. Reed’s CANSEE Act which gives “FinCEN authority to restrict transactions with ‘primary money laundering concerns’ that do not involve a U.S. correspondent bank account.” Senator Warner’s December press release explains, “This provision will provide FinCEN with appropriate tools to address threats involving digital assets and non-traditional finance networks, just as they currently can where correspondent accounts are involved.”

Congress.gov notes that the amendment was submitted this past Friday and currently includes nearly all of the original text of S.3441. Warner is trying to attach his amendment to the Senate amendment [S.Amdt.1388].

what you should know: Warner’s bill received a lukewarm reception from Secretary Yellen during a Q&A with the Senator at last week’s FSOC hearing.

Commissioner criticizes SEC

Republican Securities and Exchange Commission (SEC) Commissioner Mark Uyeda didn’t hesitate when asked by financial policy publication Capitol Account about how the Commission has handled crypto. Uyeda said:

“I think we made a lot of mistakes…We’ve been going on for a number of years, with still no real answer in sight…We have a lack of clarity and ambiguity of what makes crypto a security and what makes Bitcoin, for instance, not…We could have addressed it head on. I’m sure some people might’ve been unhappy, but it would’ve been reviewed by the judicial system. We probably would’ve, by now, had answers on this – and a path forward. Instead, we have extensive ongoing litigations in various forums….And what is this uncertainty doing to potential innovation? It’s driving it offshore.” Read the interview.

what you should know: The three majority Democrats, which includes Chair Gary Gensler, would undoubtedly disagree with Uyeda.

stablecoin headlines

Just in time for negotiations over [H.R.4766] “Clarity for Payment Stablecoins Act,” an article appeared in Bloomberg on Saturday titled, “Why Crypto Stablecoins Still Worry the Fed.”

In presenting an unnerving outlook for stablecoins, Bloomberg makes the case (without saying it explicitly) for why a “Federal floor” – or pre-emptive rights on issuance – is a key part of Democratic leadership’s positioning in negotiations with House Financial Services (HFS) Chair Patrick McHenry (R, NC) and others.

Bloomberg recounts Circle’s stablecoin USDC during the banking crisis in March of last year: “With about 8% of USDC’s reserves stuck in a failing bank, the stablecoin experienced its own panic. Traders raced to get out, dragging its price well below $1 over the dramatic weekend when regulators were figuring out what to do about SVB. After the government stepped in to make all of the bank’s depositors whole, USDC’s price recovered.” In response, Circle said it was the safest and most transparent digital dollar around. Read more.

what you should know: This type of “stablecoins aren’t stable” story isn’t new, but the fact that it’s running again may indicate “Where there’s smoke there’s fire” – a compromise bill may be imminent. HFS Ranking Member Waters (D, CA) suggested a stablecoin bill compromise which would Dem leadership would support was “very, very close” last week. On the other hand, the media “fog” may be a desperate last attempt by Dem leadership to get what it wants in the 118th Congress. It’s hard to imagine the stablecoin bill going forward in the current Congress (i.e. through the Democrat-controlled Senate) without the “federal floor” change.

expanding the suit

If there were any regrets at Digital Currency Group (DCG) and its Genesis crypto trading platform for running afoul of investors, they surely are regretting their alleged misstatements now as Democratic New York State Attorney General Laetitia James is broadening the scope of the fraud to $3 billion (was $1 billion) in a lawsuit against the holding company and its subsidiary.

According to Reuters, “The attorney general said it had become clear as more investors came forward that ‘the scam perpetrated by DCG through Genesis’ also ensnared investors who sent money directly to Genesis and were falsely assured their money was safe.” Read more.

more tips:

Attorney General James Expands Lawsuit Against Cryptocurrency Company Digital Currency Group For Defrauding Investors – ag.ny.gov

what you should know: AG James is, arguably, in the “anti-crypto army” camp and will likely not pull any punches with DCG. The lawsuit may help her consolidate her power in competition with New York Department of Financial Services (NYDFS) and Superintendent Adrienne Harris (D) (Harris is supported by NY Governor Kathy Hochul (D). James was in the 2022 governor’s race with Hochul until polling numbers showed James losing by double-digits).

Last May, James’ introduced her CRPTO Act – currently in limbo in the New York State legislature – which was an attempt to wrest some oversight of the cryptocurrency industry from NYDFS. The Attorney General did not consult NYDFS, the state’s de facto digital assets regulator, in the legislative process.

Bitcoin hits “$48,000”

It’s never a good idea to report on the price of a cryptocurrency, given its volatility – you could be wrong an hour later. But, given its rebound from a “sell the news” decline after the launch of Bitcoin spot market ETFs, Bitcoin seems to be *back* at over $48,000 as of Sunday afternoon. A melt-up in the stock market and speculation, is no doubt helping.

Whether one is in the pro- or anti-crypto camp, a continuing rise in the price of Bitcoin will only serve to make it a part of the political discussion and the 2024 general election.

The all-time high for Bitcoin was over $65,000 in November of 2021 – the peak lasted for all of a week. Nevertheless, the higher it goes, the more likely Bitcoin returns to the same dinner table conversation at which politics currently resides.

lobbying

Punchbowl News’ The Vault newsletter reports that “real estate blockchain company Balcony Technology Group Inc. hired Holland & Knight…[which] will lobby on legislation related to digital assets and blockchain technologies and ‘monitoring government contracting opportunities to tokenize public/private real estate on blockchain.'”

still more tips

Loyalty Points Are Crypto’s New Bait – Bloomberg

UK’s Planned Stablecoin Rules Need Reworking, Crypto Advocates Say – CoinDesk

Crypto absent again from Super Bowl ads – Fox Business