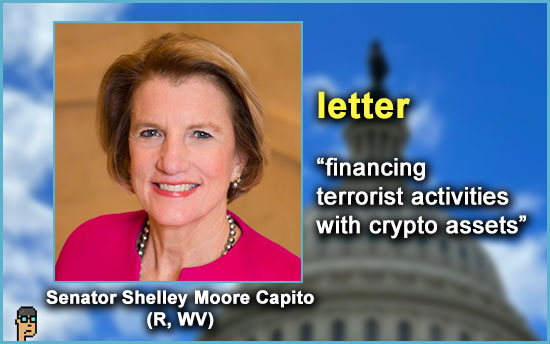

letter – terrorist financing

Senator Shelly Moore Capito (R, WV) sent a letter to the U.S. Treasury’s Under Secretary for Terrorism and Financial Intelligence Brian Nelson last Thursday expressing her concerns and asking a series of questions around terrorist financing via crypto assets and products such as mixers. Read her press release.

Her first question to Nelson is: “Has Treasury begun an independent and comprehensive investigation into the extent FTOs (foreign terrorist organizations) are reportedly avoiding sanctions through the use of digital assets, particularly actors funding Hamas and affiliated organizations?”

The tone of Capito’s letter is reminiscent of the October 26 letter from Senator Cynthia Lummis (R, WY) and Rep. French Hill (R, AR) which also addressed concerns on terrorist financing including the use of crypto exchange Binance and the Tether USD stablecoin. At the time, Lummis was also trying to push through her NDAA amendment – a compromise of sorts – which would have required “federal regulators to enact strong examination standards that will help prevent the utilization of cryptocurrencies in illegal activities” according to an October 23 press release.

more tips:

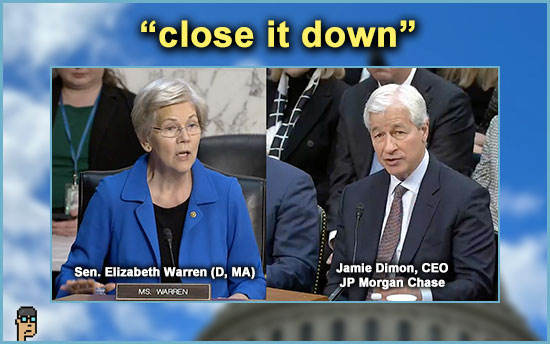

Capito’s in-state colleague/rival – Senator Joe Manchin (D, WV) – is a co-sponsor of Senator Elizabeth Warren’s Digital Asset Anti-Money Laundering Act (S.2669).

what you should know: The public message is clear on both sides of the aisle in Congress: terrorist financing and money laundering concerns need to be rooted out in crypto. Neither party wants to look like they approved of terrorist financing and money laundering via digital assets. But, the pro-crypto forces don’t want draconian regulation to harm U.S. opportunity in digital assets. Whereas, the “anti-crypto army” wants digital assets to be severely restricted if not altogether prevented from accessing the U.S. financial system. Continue reading “Letters From Capito, Warren Intensify Crypto Concerns; PAC Eyes 2024 Election”